Dec, 12, 2025

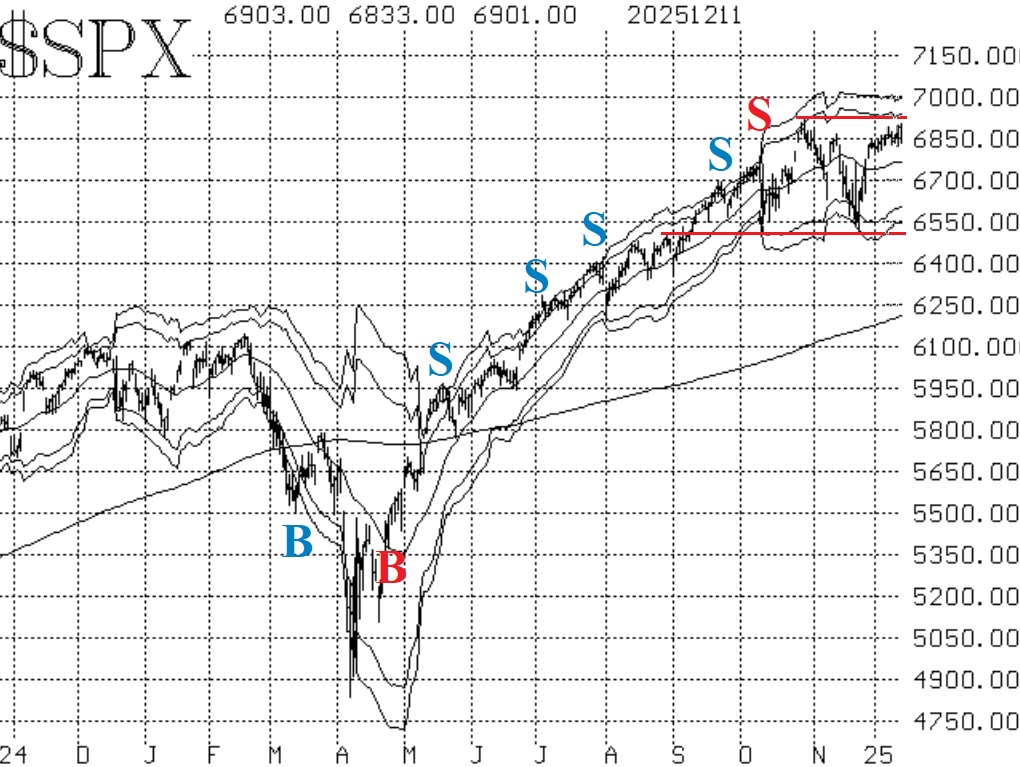

By Lawrence G. McMillanIt seems that everything is quite bullish, and we are merely awaiting confirmation from the $SPX chart. That is, we need to see $SPX trade solidly at a new all-time high in...

Dec, 11, 2025

By Lawrence G. McMillanWe recently upgraded our Free Probability Calculator, making it an even more useful tool for traders who want a deeper understanding of market expectations. The calculator...

Dec, 11, 2025

By Lawrence G. McMillanWe’ve just published a detailed Substack post walking through the core principles of covered call writing—a strategy many traders use for income, but one that carries important...

Dec, 08, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on December 8, 2025.

Dec, 08, 2025

By Lawrence G. McMillanLast week, I didn’t get all the statistics into the newsletter regarding the post-Thanksgiving trading, plus other related T-day trades. So, here’s a quick summary...

Dec, 08, 2025

By Lawrence G. McMillanRecently, I have been seeing some references to the “wheel” strategy. Of course, they come with all kinds of accolades about how you can’t lose, etc. I thought it might be a...

Dec, 05, 2025

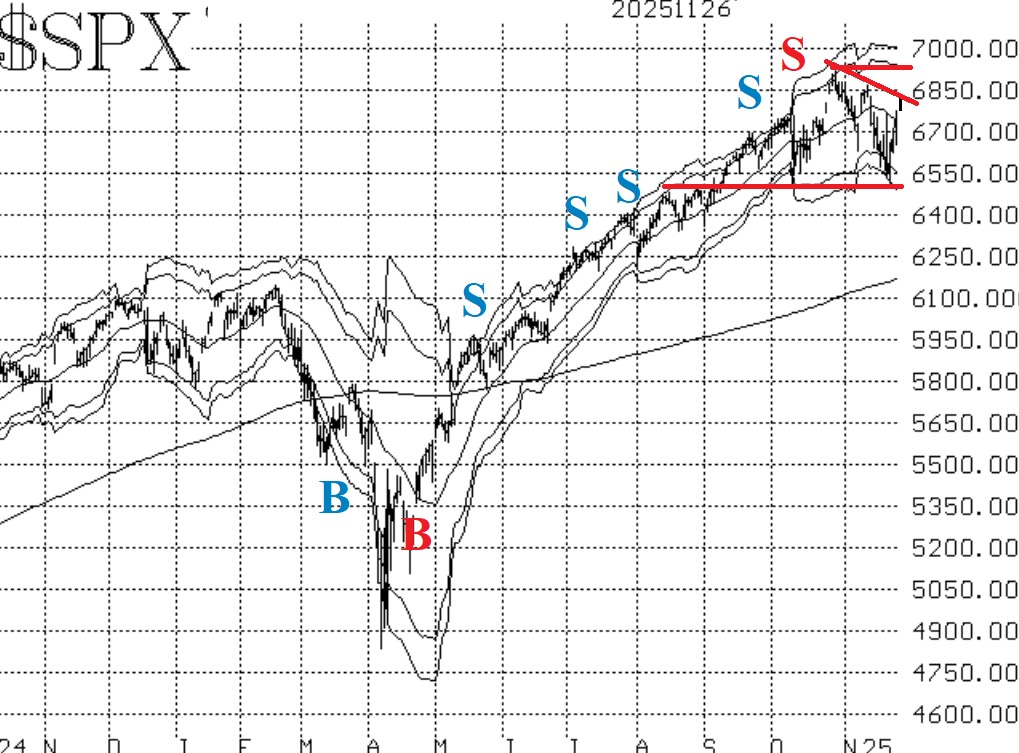

By Lawrence G. McMillanThe market has stalled near the top of the 6500-6900 trading range. This comes after a strong rally the week of Thanksgiving. But unless there is a clear breakout to new all-...

Dec, 03, 2025

If you’re looking to strengthen your trading discipline, I’ve just posted a new Substack article and video on what I consider the most important part of trading: risk management. In it, I walk...

Dec, 01, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on December 1, 2025.

Nov, 28, 2025

By Lawrence G. McMillanThe stock market sold off fairy heavily into the 6500-6550 support zone for $SPX on November 14, but then it rallied strongly off of that support area. That support has been...

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation