Jan, 26, 2026

By Lawrence G. McMillanThe put-call ratio is one of the most widely followed indicators in options trading — and one of the most misunderstood. When used correctly, it can provide powerful, contrary...

Jan, 23, 2026

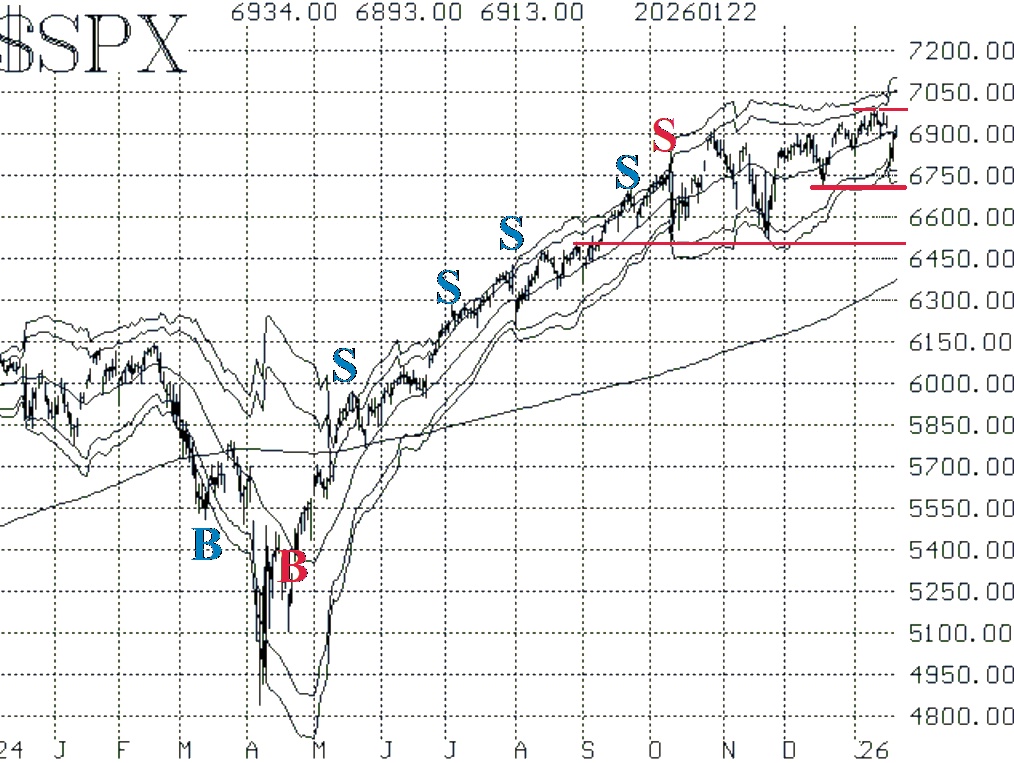

By Lawrence G. McMillanThis past week has seen volatile moves in both directions. First, $SPX failed to capitalize on the move to new highs a week ago, and then over last (3-day) weekend, President...

Jan, 23, 2026

By Lawrence G. McMillanThe impetus for this column came from the fact that the S&P futures took a beating last Monday (January 19th, 2026) on the holiday celebrating Martin Luther King. Of course...

Jan, 20, 2026

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on January 20, 2026.

Jan, 16, 2026

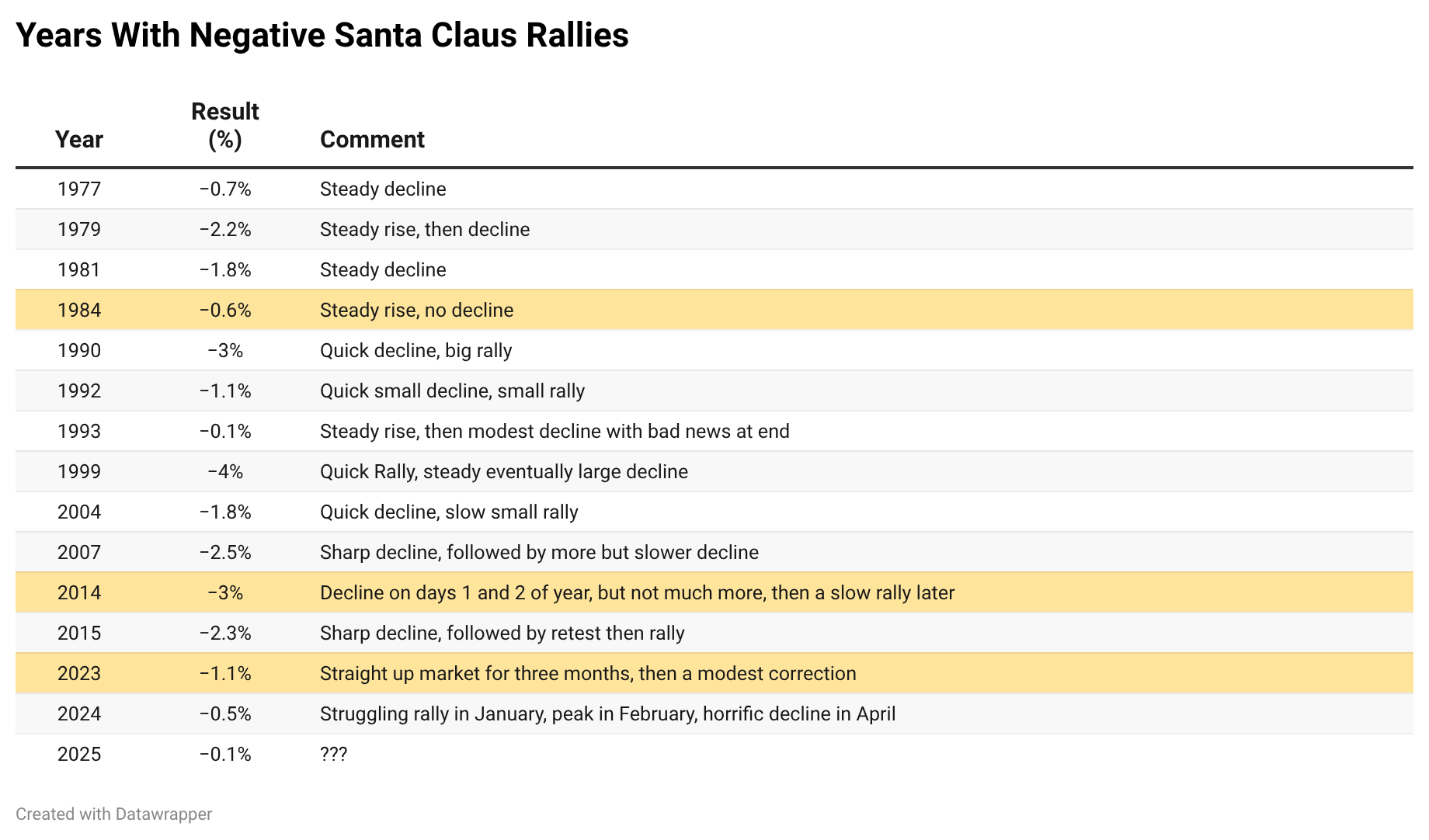

By Lawrence G. McMillanNow that January is here, the first of two “classic” January indicators is in place. That is the result of the first five trading days of January. Here are the...

Jan, 16, 2026

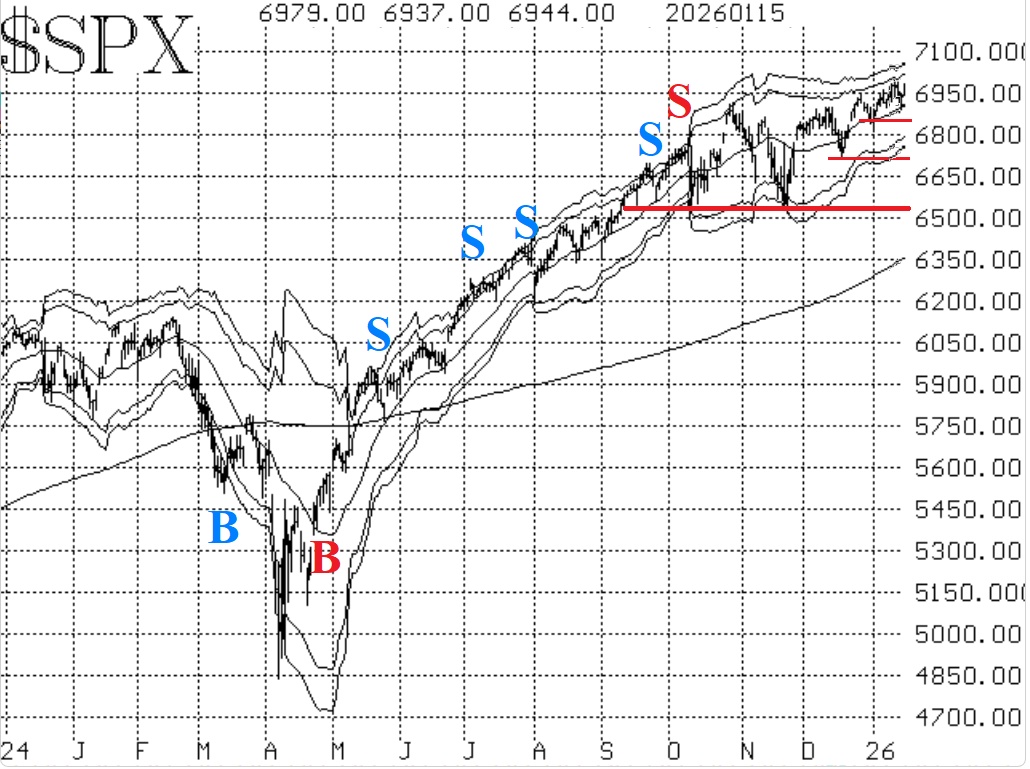

By Lawrence G. McMillan$SPX made another new all-time high on both January 9th and 12th -- the first time it's made new all-time highs on back-to-back days since last October. That would indicate a...

Jan, 13, 2026

By Lawrence G. McMillanEarnings announcements, biotech news, and corporate events often create sharp price gaps and extreme option pricing distortions. In our latest write-up, we outline a practical...

Jan, 13, 2026

By Lawrence G. McMillanThe post-Thanksgiving series of three seasonal trading periods has ended, and we are nearing the beginning of what is called the “January Defect,” when the market – and NASDAQ-...

Jan, 12, 2026

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on January 12, 2026.

Jan, 12, 2026

By Lawrence G. McMillanMany option traders have read about the disaster that befell traders involved in selling condors recommended by David Chau, the self-named “Captain Condor.” To quickly...

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation