Nov, 14, 2025

By Lawrence G. McMillanFor over a week now, strong selloffs have been followed fairly quickly by strong rallies. This is the type of action that occurs in a trading range environment, and we might...

Nov, 10, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on November 10, 2025.

Nov, 07, 2025

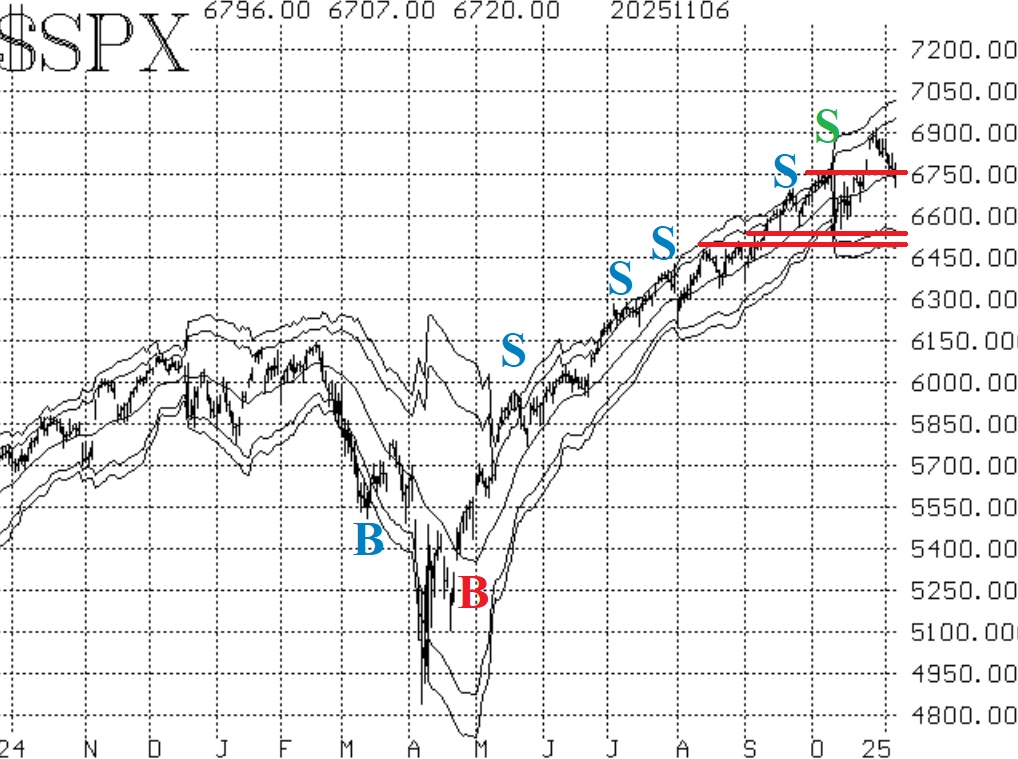

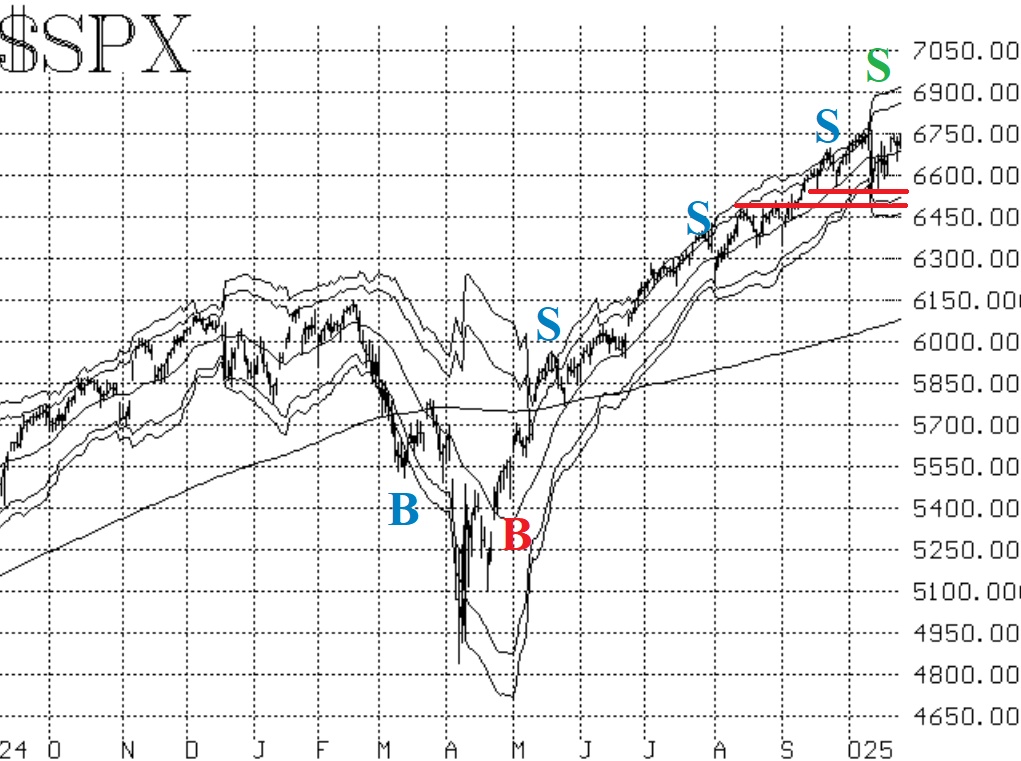

By Lawrence G. McMillanAfter having gapped to new all-time highs a little more than a week ago, the broad stock market has gone into a modest (so far) corrective mode. $SPX has now closed both of the...

Nov, 03, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on November 3, 2025.

Oct, 31, 2025

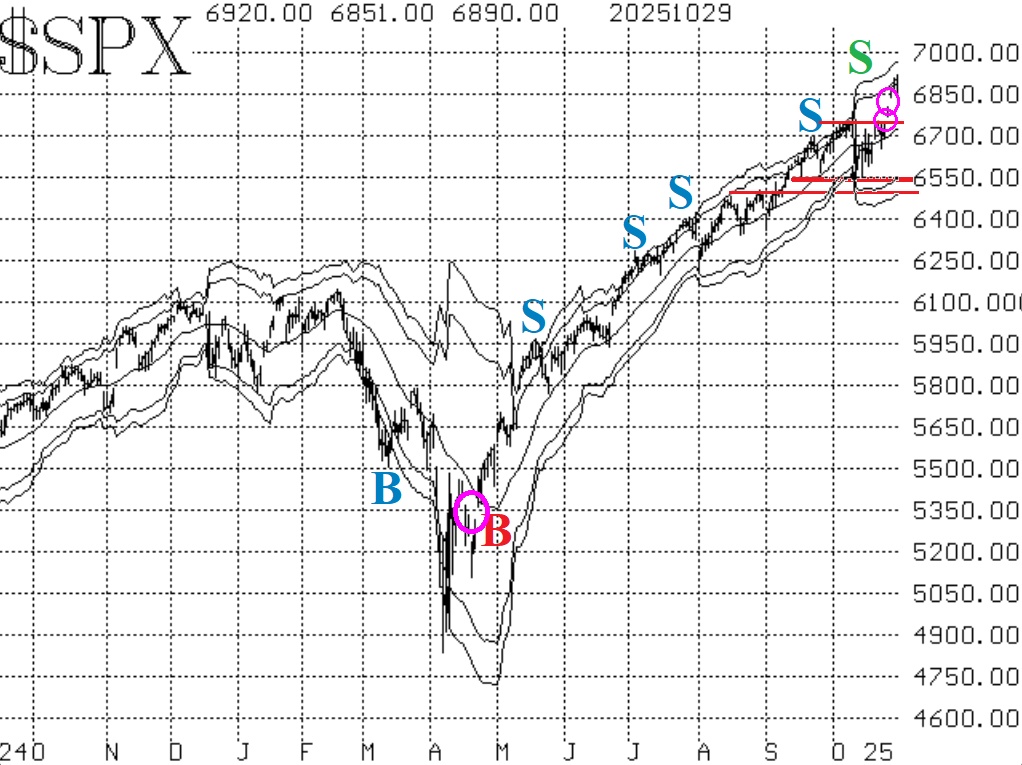

By Lawrence G. McMillanThe market eventually shrugged off the most recent "tariff tantrum" and moved to new all-time highs. The breakout came on two gap days to the upside -- very strong action. That...

Oct, 31, 2025

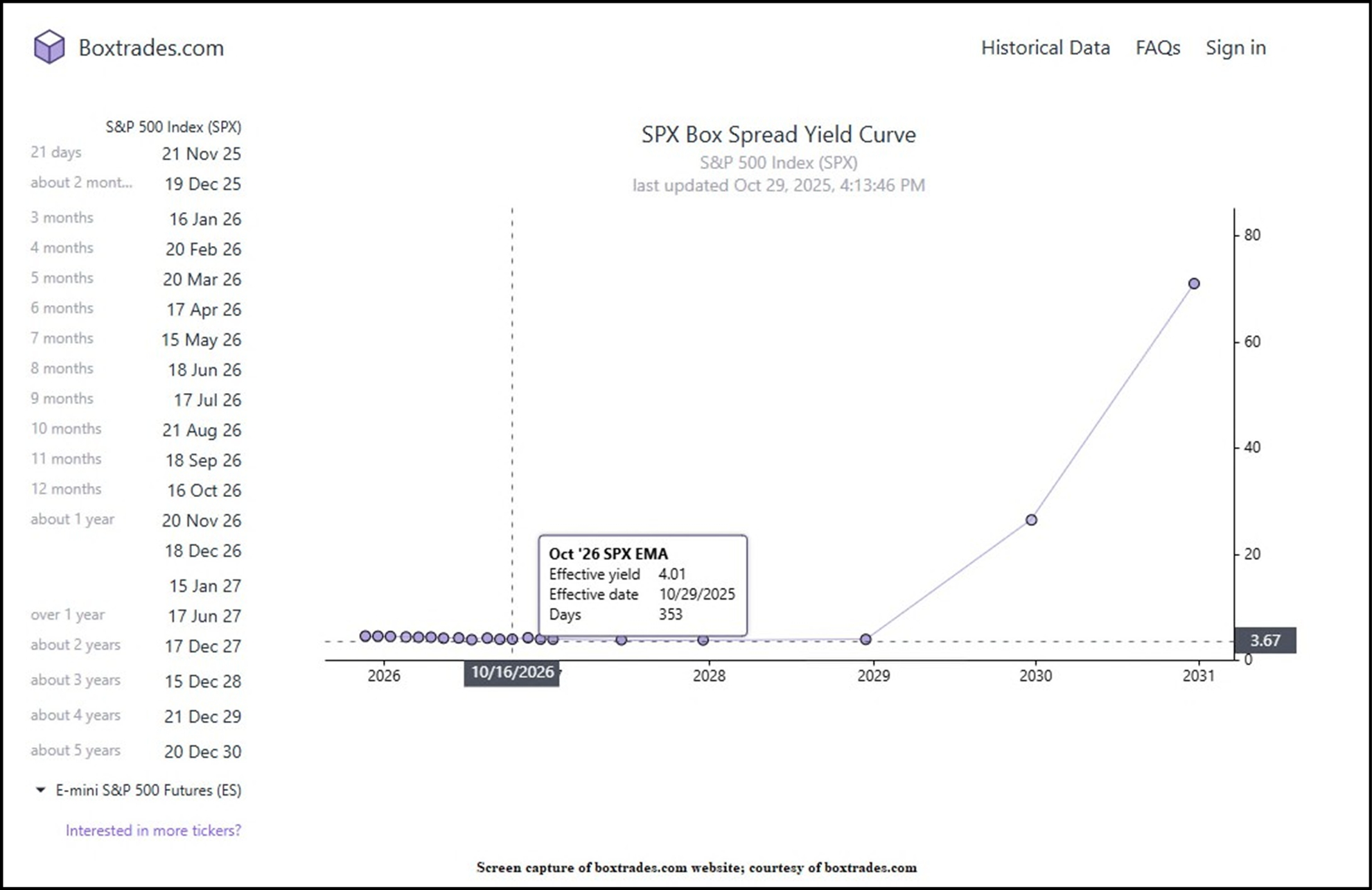

By Lawrence G. McMillanRecently, there have been some articles in the media – both print and social – about box spreads and how people are using them to get reduced-cost loans. Some of these articles...

Oct, 27, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on October 27, 2025.

Oct, 24, 2025

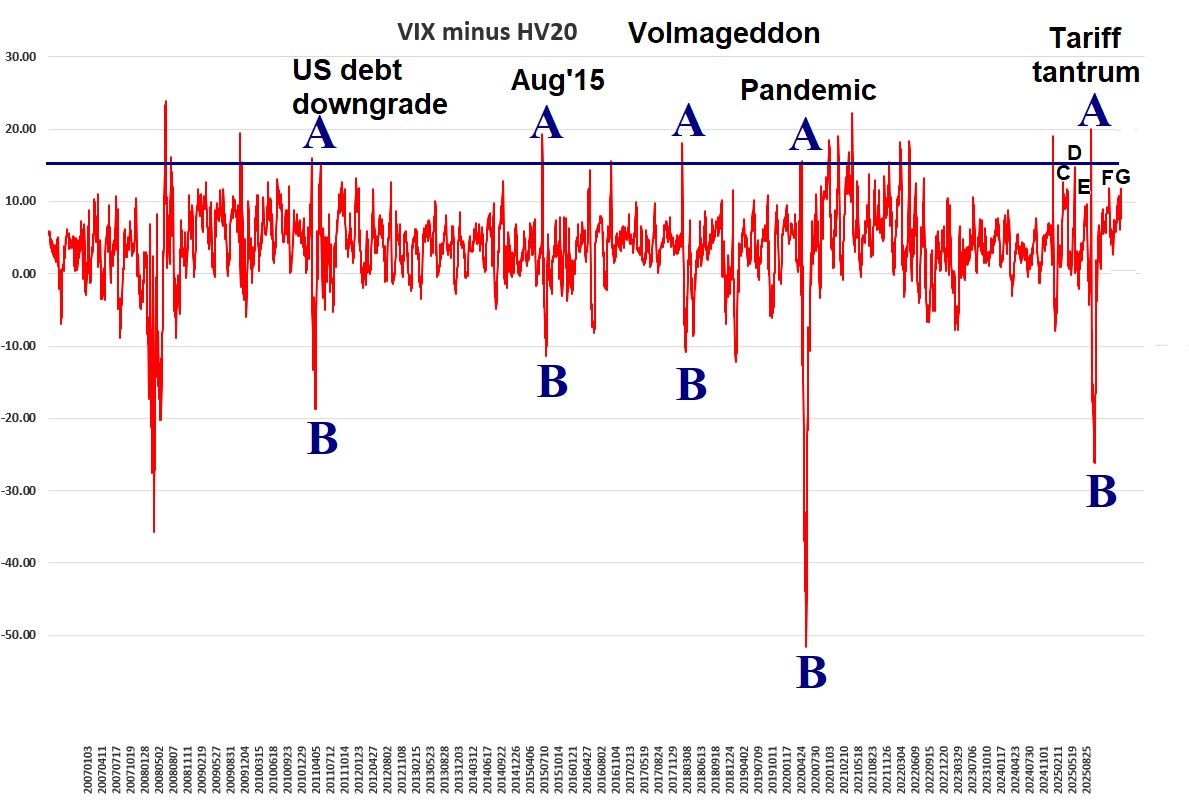

By Lawrence G. McMillanEver since $SPX dropped over 200 points on Friday, October 10th, (including after-market trading on the NYSE), there has been a difference in the volatility market. ...

Oct, 24, 2025

By Lawrence G. McMillanVolatility exploded between October 10th and October 17th, but in the end, it didn't have its usual bearish effect. Rather, $SPX found support in the 6500-6550 area multiple...

Oct, 21, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on October 20, 2025.

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation