Jan, 12, 2026

By Lawrence G. McMillanMany option traders have read about the disaster that befell traders involved in selling condors recommended by David Chau, the self-named “Captain Condor.” To quickly...

Jan, 09, 2026

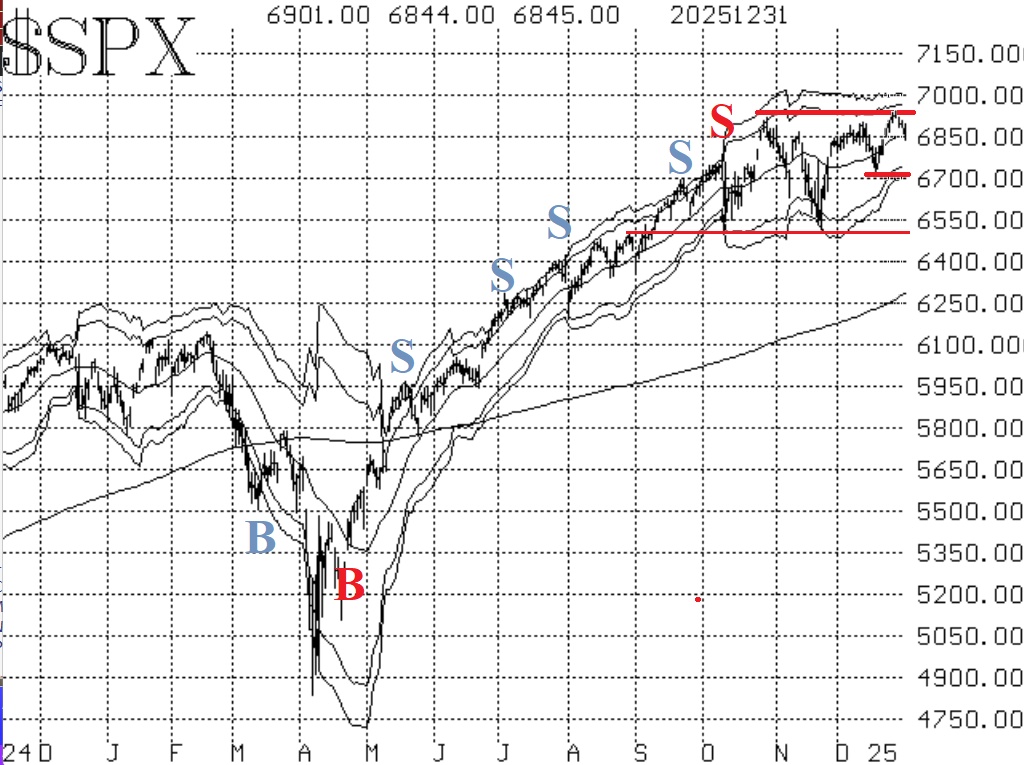

By Lawrence G. McMillanThis week, $SPX traded at a new all-time high, just as it did last week. Then, it dropped -- in both cases. Normally, we'd like to see new highs confirmed by strongly positive...

Jan, 09, 2026

By Lawrence G. McMillanThis session dives deep into LEAPS — how they behave differently from short-term options, where they shine, and where traders often make costly mistakes.LEAPS (Long-Term Equity...

Jan, 05, 2026

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on January 5, 2026.

Jan, 05, 2026

By Lawrence G. McMillanWe’re extending our holiday special for a short time.Due to a technical issue, the holiday coupon expired earlier than intended at the end of December. That has now been...

Jan, 02, 2026

By Lawrence G. McMillanThe $SPX Index broke out to all-time highs just before Christmas, although the Dow ($DJX) and NASDAQ-100 ($NDX) did not. There hasn't been any follow-through to the upside by...

Dec, 29, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on December 29, 2025.

Dec, 29, 2025

By Lawrence G. McMillanOption spreads are often introduced as “defined-risk” strategies — but that description barely scratches the surface. In practice, the success or failure of a spread depends on...

Dec, 26, 2025

By Lawrence G. McMillan$SPX broke out to new all-time closing and intraday highs this week. This comes as a quick turnaround after some heavy selling just a week ago. A clear breakout would...

Dec, 23, 2025

By Lawrence G. McMillanMany traders are drawn to buying calls and puts because of the leverage options provide. Unfortunately, that same leverage is the reason so many option buyers struggle, even...

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation