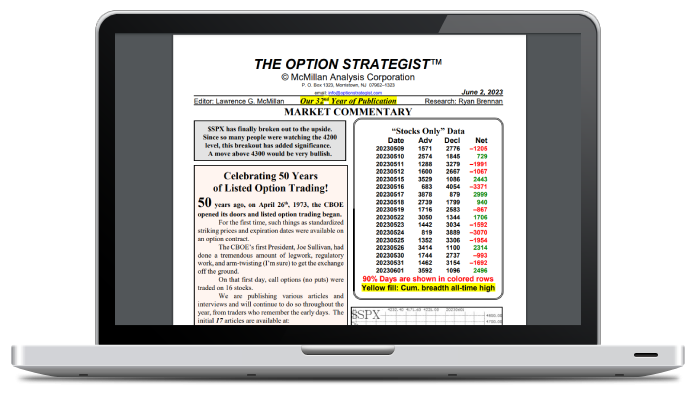

The Option Strategist Newsletter

Analysis, Commentary, Education, and Specific Trading Recommendations on a weekly basis

With over 30 years+ of publication, The Option Strategist newsletter remains one of the industry's most respected stock options newsletters. Written by renowned analyst and best selling author Larry McMillan, The Option Strategist continues to be an essential investing tool for novices and experts alike. Inside every edition of this weekly newsletter, you'll find market commentary, opinion and recommendations on option trading and the stock market. From index, to stock and futures options, including general and specific recommendations, The Option Strategist covers it all. The newsletter is delivered either by email or US Mail. Subscriptions also include access to the weekly research article, periodically posted during the week.

An Option Strategist subscription includes:

- A Newsletter Every Friday:

The Option Strategist Newsletter is published each Friday, and is generally delivered in the morning. - Feature Articles:

Research articles covering relevant topics, historical studies, and new strategies are published throughout the week and delivered to subscribers immediately. Click Here to view an index of past Feature Article topics. - Specific Trading Recommendations:

Including follow-up action, trading stops and position analysis. Recommendations are made in the following strategies:

- Option Buying (puts & calls) based on put-call ratios, speculation, momentum, etc

- Ratio Spreads, Calendar Spreads, Bull & Bear spreads, Back Spreads, etc

- Inter-market Spreads

- Condors / Iron Condors

- Straddles & Strangles

- Covered Call Writing & Naked Put Selling

- Volatility Trading

- Seasonal Trading

- and much more

- Current Market Analysis:

Larry's weekly stock market analysis based on various technical indicators including put-call ratios, breadth, sentiment, price action, momentum, volatility and volatility derivatives. - The Basics:

Review and explanation of key option concepts. - Charts, Graphs, & Tables

Pertinent charts and graphs illustrating important positions, studies, and ideas (put-call ratio signals, price action, support & resistance, term structure, McMillan Oscillator, volatility & variance futures, etc). Tables detailing lists of valuable data ("stocks only" advances & declines, covered call write candidates, volatility skews, expensive and cheap options, implied volatility of $VIX options, etc). - Volatility & Variance Futures and Options Update

In-depth analysis and commentary on the current volatility and variance derivatives markets and what they're saying about the stock market. This important information is found only here.

Subscribe today and start trading with one of the most trusted names in the options industry.

Click here to view The Option Strategist Newsletter's impressive 32+year track record.

Click here to view The Option Strategist Newsletter's impressive 32+year track record.

Back Issues

Each Option Strategist Newsletter subscriber is granted access to the full last year of back issues. Older back issues are available to purchase for $4 each. Visit The Option Strategist Newsletter Back Issue page to view the feature article topics and to purchase older back issues.

Each Option Strategist Newsletter subscriber is granted access to the full last year of back issues. Older back issues are available to purchase for $4 each. Visit The Option Strategist Newsletter Back Issue page to view the feature article topics and to purchase older back issues.

Satisfaction Guaranteed

If you are not completely satisfied with your subscription, you may cancel at any time and a prorated refund will be issued based on the remaining unused portion of the subscription.

If you are not completely satisfied with your subscription, you may cancel at any time and a prorated refund will be issued based on the remaining unused portion of the subscription.

Free Trial Subscriptions are not renewed automatically. Paid Trial Subscriptions will renew at the shortest subscription length offered (e.g. monthly / quarterly). Paid auto-renew subscriptions are set to automatically renew monthly, quarterly, or annually for your convenience and to avoid any interruption of service.

© 2025 The Option Strategist | McMillan Analysis Corporation