By Lawrence G. McMillan

It’s a bit hard to realize, because it’s happened so quietly, but $SPX has fallen more than 60 points from its highs of two weeks ago. It’s done this without causing panic, although some negativity has certainly arisen in our indicators. $SPX has still not taken out the important support level at 2040. If it does that, a more severe correction will unfold. And there is still the chance that 2016 is trading in a manner similar to 2008 – where prices topped in May after a two-month rally and broke through January’s lows by July (2008).In the short term, we are actually beginning to see some oversold conditions materialize – as we’ll detail below.

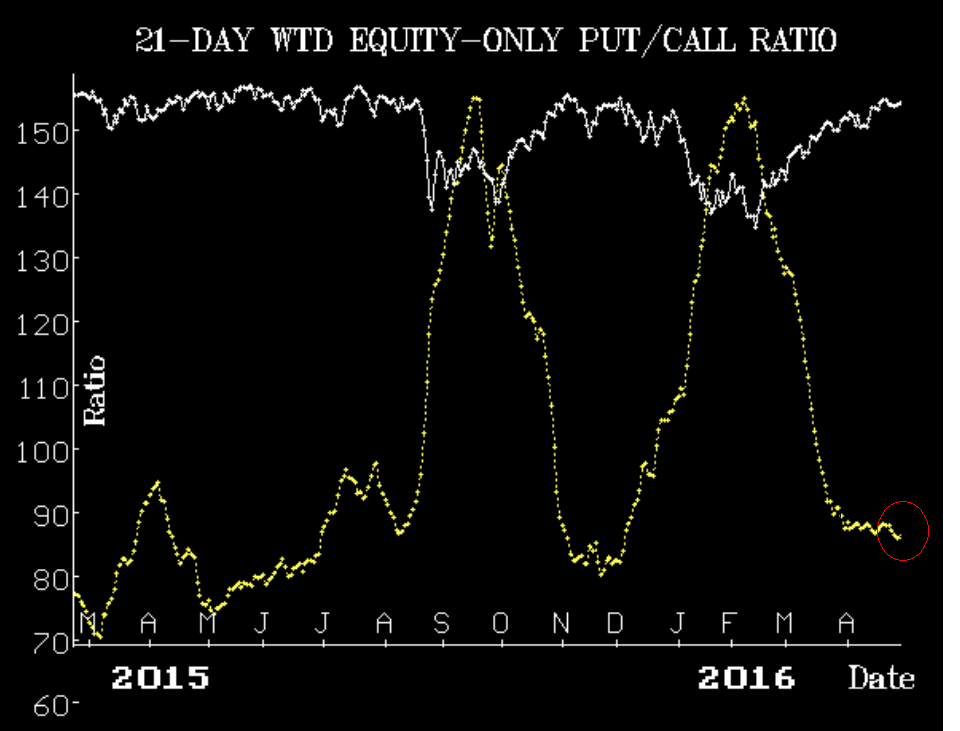

Put buying was extremely heavy yesterday, and the equity-only putcall ratios jumped sharply higher. This is enough to officially change them to sell signals. So, in this case, the “naked eye” interpretation that we have been talking about for the last couple of days trumped the computer analysis. That doesn’t happen often, but it is the case this time...

This excerpt was part of the market commentary featured in this morning's edition of The Daily Strategist. Sign up for a free 7-day trial today.

© 2023 The Option Strategist | McMillan Analysis Corporation