Jul, 25, 2025

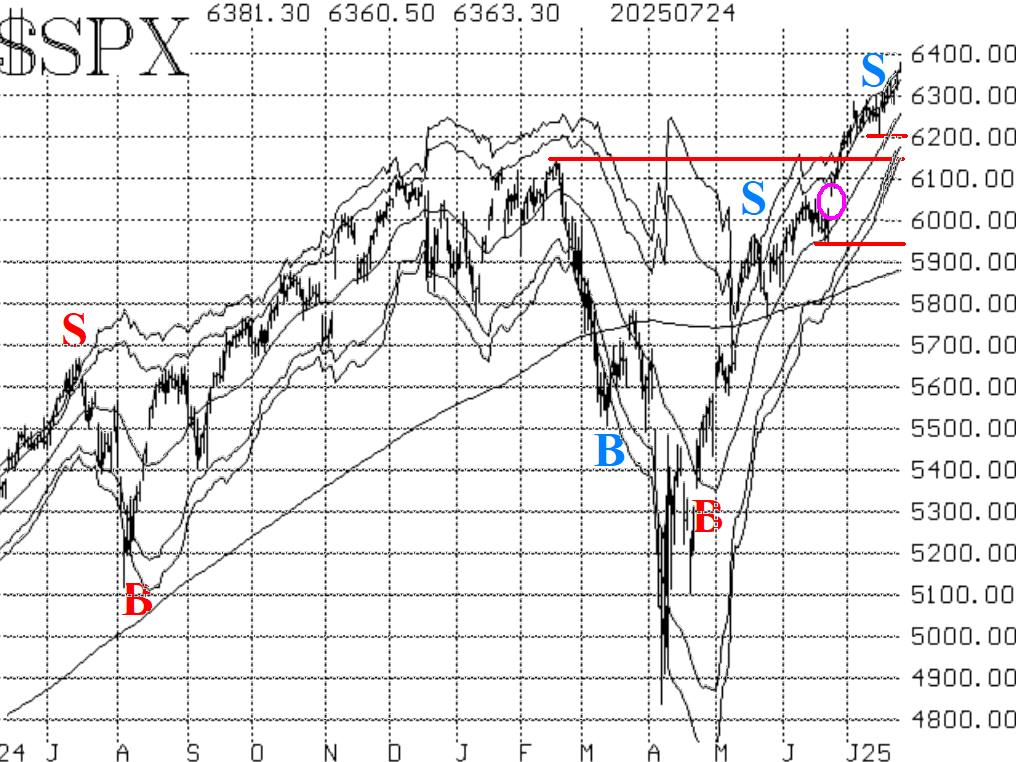

By Lawrence G. McMillanThe rally that began in early April continues to drive higher into new all-time territory. There hasn't been much of a correction, and so far the internals have held up very...

Jul, 22, 2025

By Lawrence G. McMillanThis article was originally published in The Option Strategist Newsletter Volume 7, No. 12 on June 25, 1998.With the frequent number of 100-plus point moves in the...

Jul, 21, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on July 21, 2025.

Jul, 18, 2025

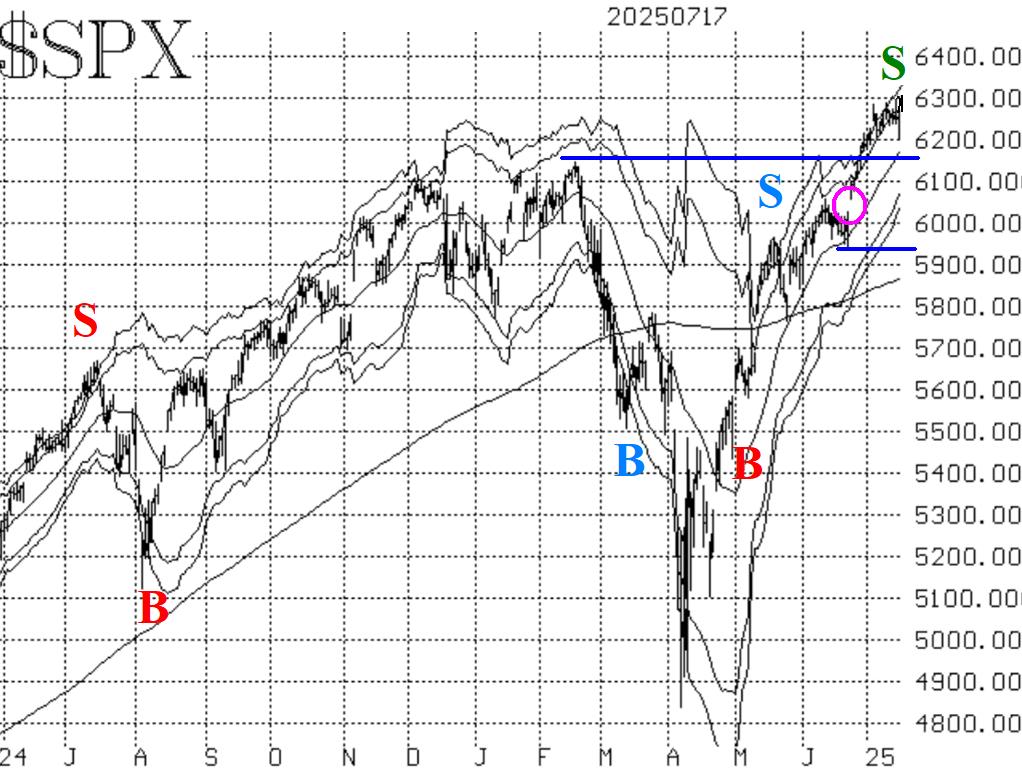

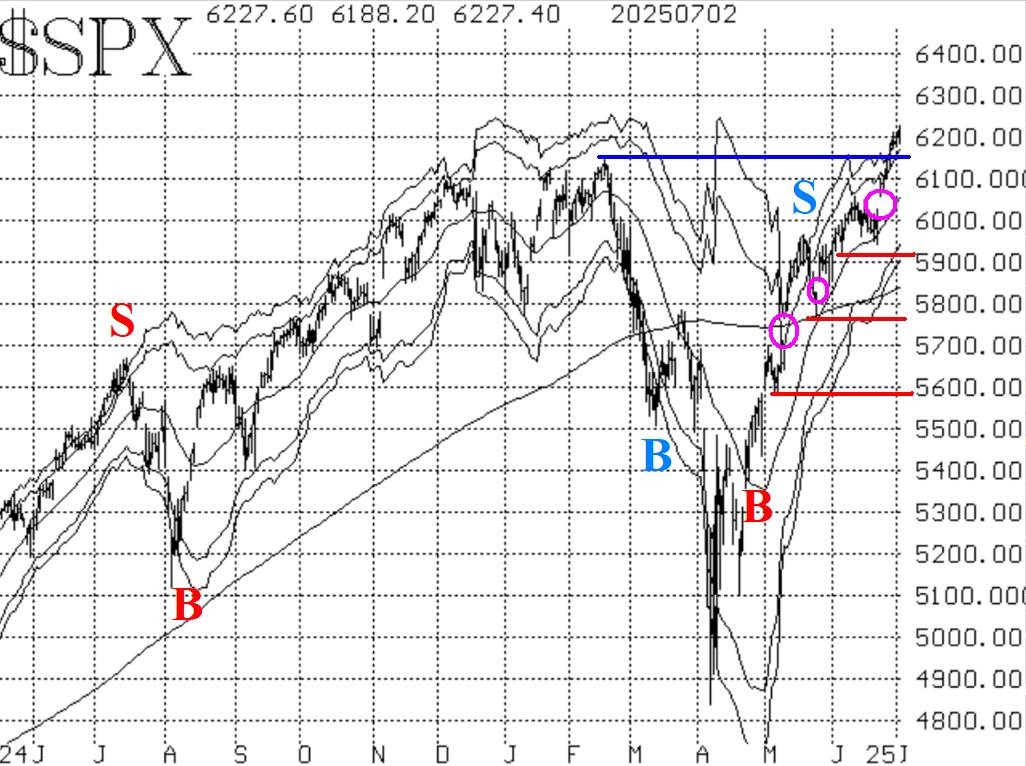

By Lawrence G. McMillanStocks have continued to plow ahead, with $SPX making repeated new all-time highs this week. For the most part, these new highs have been accompanied by strong internal...

Jul, 17, 2025

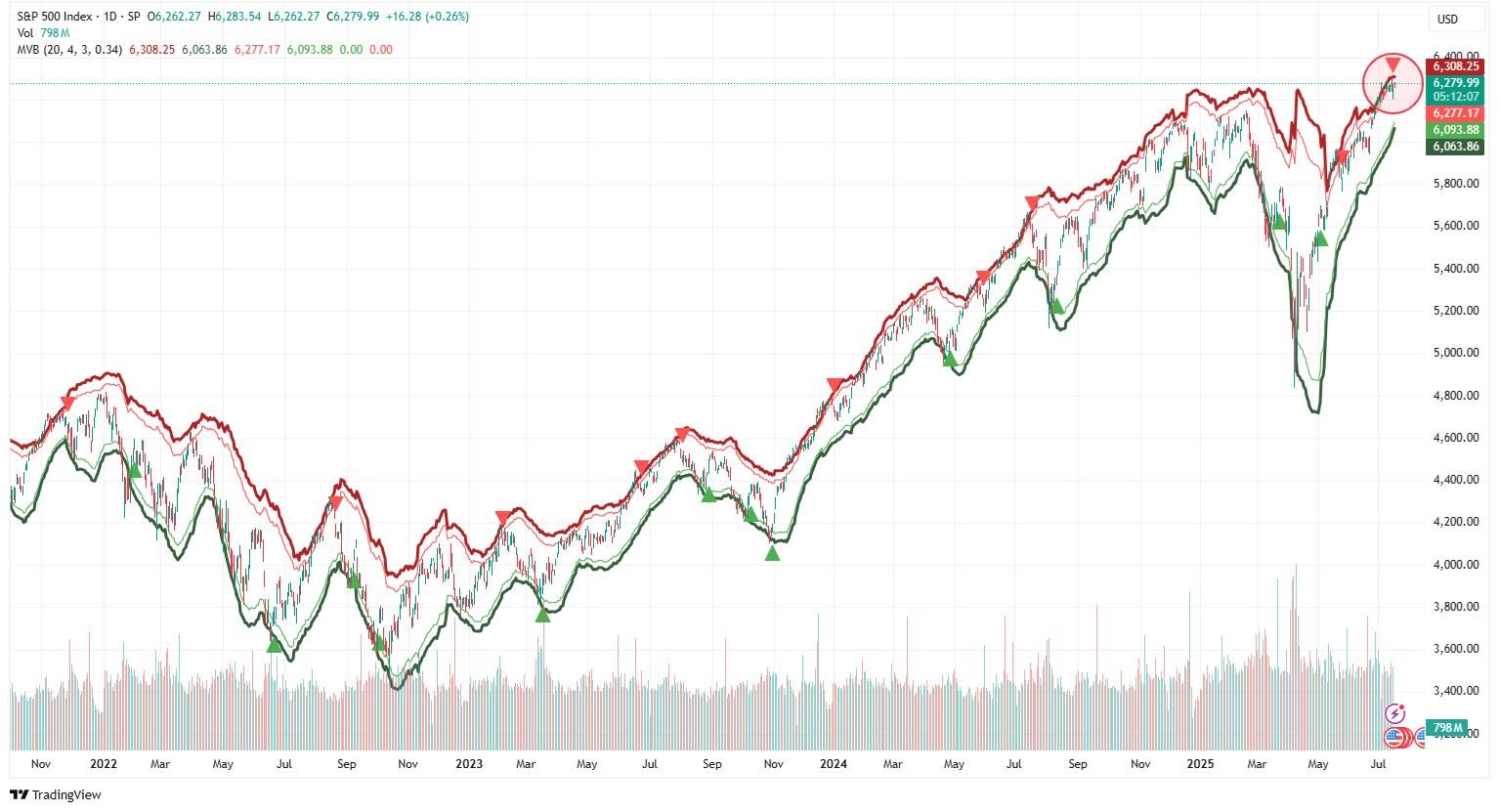

By Lawrence G. McMillanThe S&P 500 ($SPX) remains in a solid uptrend, but yesterday marked a notable shift: a confirmed McMillan Volatility Band (MVB) sell signal was triggered. This is the first...

Jul, 14, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on July 14, 2025.

Jul, 11, 2025

By Lawrence G. McMillanWe rarely buy out-of-the-money calls, because when you do, there is a chance that you could be right about the direction of the underlying stock (up), but still lose money....

Jul, 11, 2025

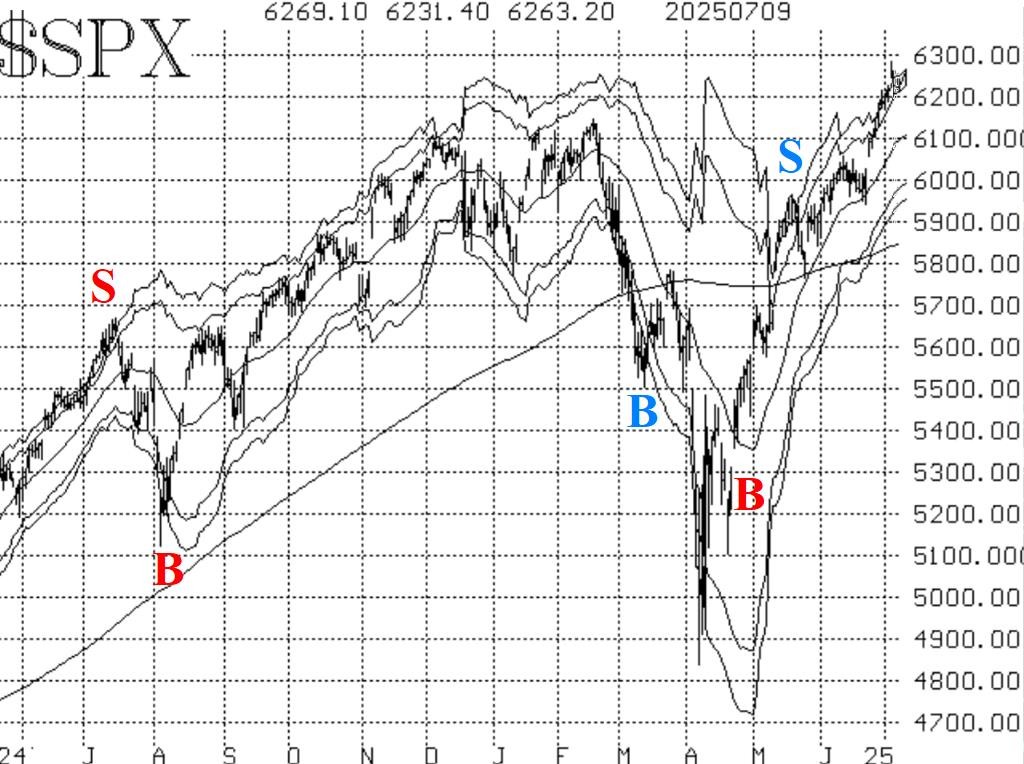

By Lawrence G. McMillanThe stock market has continued to make new all-time highs, accompanied by strong internal indicators. Eventually, overbought conditions may become confirmed sell signals, but...

Jul, 07, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on July 7, 2025.

Jul, 03, 2025

The stock market, has continued to rise, registering new all-time highs repeatedly. It appears that the current breakout to new all-time highs is stronger than the failed one of last February. There...

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation