By Lawrence G. McMillan

The rally that began in early April continues to drive higher into new all-time territory. There hasn't been much of a correction, and so far the internals have held up very well. However, overbought conditions are building, so we need to avoid complacency and pay attention to the indicators.

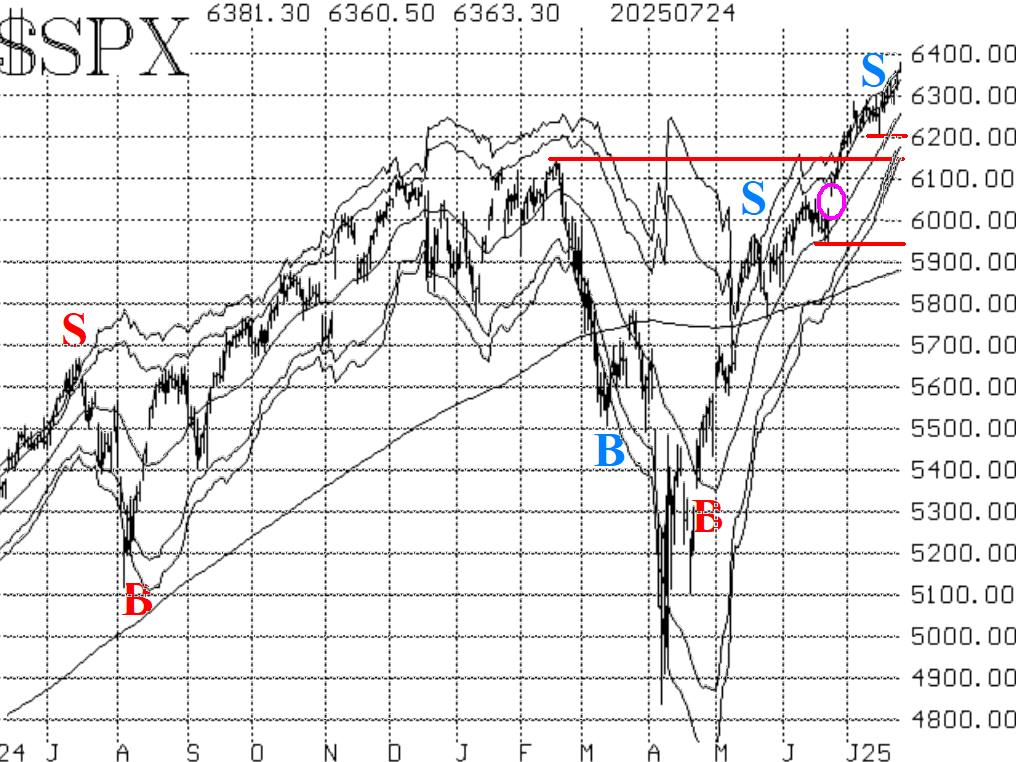

The $SPX chart is bullish, with support at 6200 (last week's low), 6150 (the previous highs), 6020-6060 (the gap on the chart), and 5920. These are all marked on the $SPX chart in Figure 1.

Equity-only put-call ratios have reached very low levels on their charts, thus reflecting the optimism that is naturally associated with $SPX plowing ahead to new all-time highs almost daily. The standard ratio is now below its lows of 2024 and is at levels last seen in November 2021.

The weighted ratio has fallen to a new 2025 low, but has not fallen below the 2024 lows. However, the weighted ratio curled upward yesterday, and the computer analysis programs are calling this a sell signal, but we need confirmation from both ratios.

Breadth has been reasonably strong, with only the occasionally negative day here and there. Thus, both breadth oscillators remain on buy signals at this time.

Meanwhile, implied volatility has declined. Figure 4 shows that $VIX is down to 15 for the first time since last February. But a low $VIX is not a sell signal, in and of itself. It is merely another overbought condition. What would be a negative for the market would be a rising $VIX (from a low level).

Regardless, at the current time, there are two $VIX-related stock market buy signals that are sill in effect. The first is the "spike peak" buy signal and the second is the trend of $VIX. That signal was launched in early June (see the circle on the lower right of the $VIX chart in Figure 4).

To summarize, we remain bullish but vigilant. In particular, it is important to keep rolling deeply in-the-money calls to higher strikes -- or at least to tighten trailing stops. Eventually, sell signals will be confirmed, and we will act on them. Overbought conditions can persist for far longer than one envisions, and thus we prefer to wait for the confirmed sell signals before taking bearish action.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation