By Lawrence G. McMillan

Stocks have continued to plow ahead, with $SPX making repeated new all-time highs this week. For the most part, these new highs have been accompanied by strong internal indicators, too.

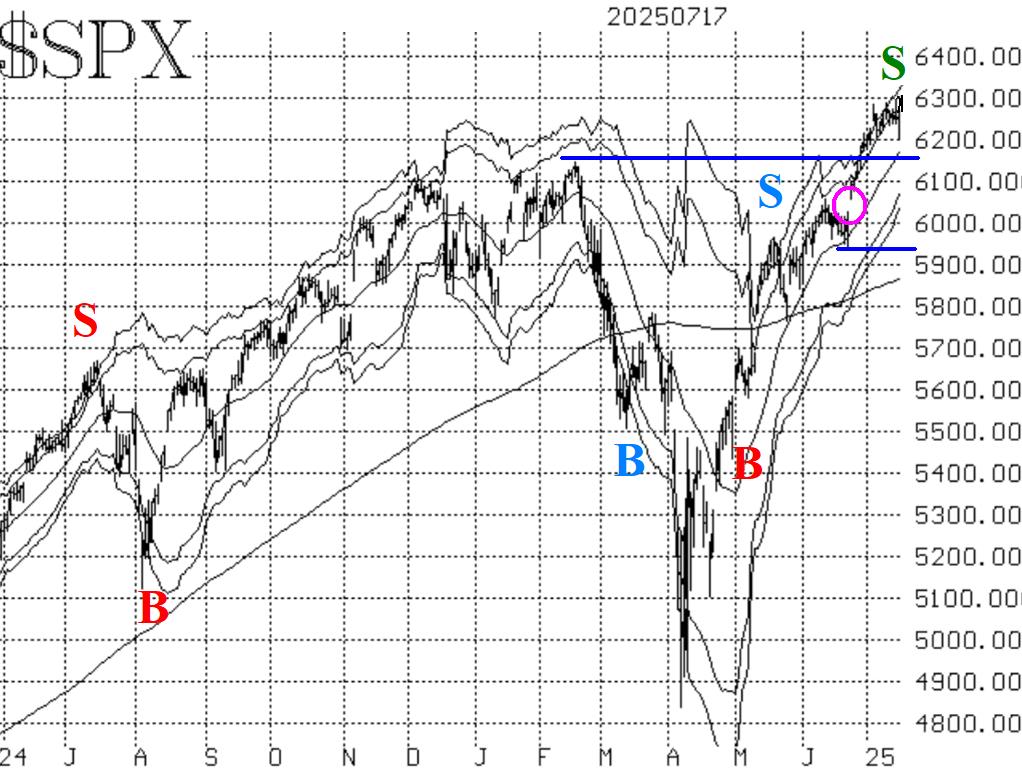

There is no formal resistance with $SPX at an all-time high. There is now support at 6200 (this week's low, reached on a mini- selling spree when it was rumored that Fed Chair Powell would be replaced), 6150 (the previous highs), 6020-6060 (the gap on the chart, circled in Figure 1), and 5920. Any move below 5920 would be very bearish, but I don't expect to see that.

Equity-only put-call ratios remain on buy signals. That's because they are continuing to decline. They have reached the lower regions of their charts, indicating that they are overbought, but they won't generate sell signals until they begin to rise.

Breadth was a little shaky on a couple of days this week, but the breadth oscillators are still both on buy signals. The NYSE- based oscillator dropped below +200 one day, but that is not a confirmed sell signal. Now, both of them are back above +200 after two days of strong breadth on July 16th and 17th.

Implied volatility, as measured by $VIX, has remained low. It briefly rose above 19 on that mid-week selloff, but has returned to sub-17 levels. As long as $VIX remains low, the two $VIX-related buy signals are intact: the "spike peak" and the trend of $VIX. $VIX would have to return to "spiking mode" in order to stop out those buy signals.

So, we remain bullish. If more indicators generate confirmed sell signals we would implement those. Meanwhile, continue to roll long calls upward.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation