May, 09, 2023

By Lawrence G. McMillanI have known Paul Stevens since the 1970’s. He has had a long a successful career in the options arena. Paul (an English major in college) was kind enough to write up some...

May, 08, 2023

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on May 8, 2023.

May, 08, 2023

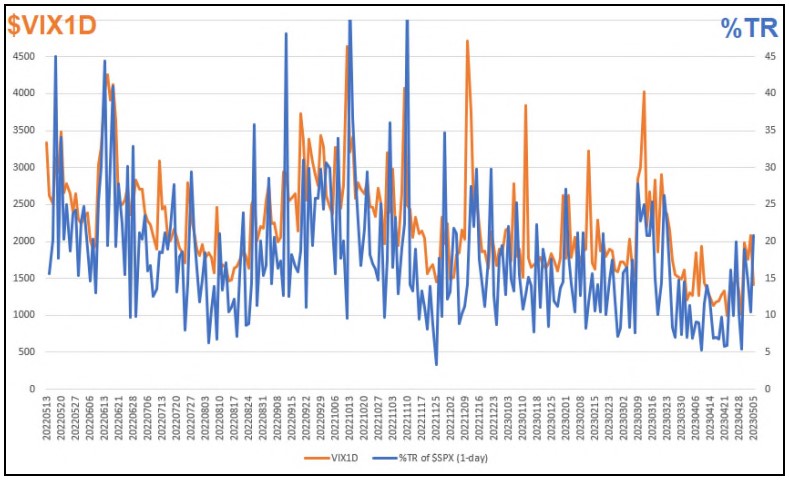

By Lawrence G. McMillanEveryone seems enamored with zero day to expiration (0DTE) options. Trading volume has been huge, and no one exactly seems to know why. The conventional wisdom is that market...

May, 05, 2023

By Lawrence G. McMillanStocks are still stuck in a trading range. The wider range has its lows in the 3760-3850 area (the lows of both December and March). The narrower, more recent range has its...

May, 05, 2023

By Lawrence G. McMillanShelly Natenberg is best-known as author of the book, Option Volatility and Pricing. He is respected as both a trader and an educator in the option business.Q: As I’ve...

May, 01, 2023

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on May 1, 2023.Click here to view this week's charts »This Market Commentary is an abbreviated version...

Apr, 28, 2023

By Lawrence G. McMillanBill Brodsky was the CEO and Chairman of the CBOE from 1997 to 2013 and continued on as Chairman until 2017. Bill was involved in the listed option markets from the beginning...

Apr, 28, 2023

By Lawrence G. McMillanStocks had been drifting in a tightening range, causing realized volatility to shrink, and boring the heck out of traders -- even though intraday swings were still present....

Apr, 24, 2023

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on April 24, 2023.Click here to view this week's charts »This Market Commentary is an abbreviated...

Apr, 21, 2023

By Lawrence G. McMillan Ed Tilly is the current Chairman and Chief Executive Officer of CBOE Global Markets, after having taken over from Bill Brodsky as CEO in 2013 and Chairman in 2017. Ed began...

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation