By Lawrence G. McMillan

This article was originally published in The Option Strategist Newsletter Volume 15, No. 14 on July 27, 2006.

As our marketplaces evolve, so do the products available. Electronic trading is prevalent in nearly all types of markets now – stocks, futures, and options. Multiple listing in options is commonplace – so much so, in fact, that one is almost reluctant to trade options that are not multiply listed. Along with this increase in electronic trading and deeper liquidity in stocks, options, and futures, have come some new products that have proven to be quite popular. One such vehicle is the ETF (exchange traded fund), which has been embraced by institutional traders as a quick way to diversify. Derivatives traders, too, have some new products that exist or that are on the horizon. We’re going to take a look at these in this article. Not all will appeal to every trader, but there are certainly some that you should find interesting.

Mini Futures Contracts

As the commodity bull market has unfolded, with an increase in volatility, the futures exchanges realized that many small traders – and even medium-sized ones in “wild” market such as Copper or Silver – couldn’t viably participate due to increased margin requirements and volatility. Thus a series of minicontracts has been introduced over the years. More continue to be added each year.

This “trend” started with the Chicago Merc’s S&P 500 e-mini contract, introduced in 1997. The “big” S&P 500 futures are worth $250 per point of movement. Those contracts trade in the pits during the daytime and on the electronic Globex market at night. The S&P e-mini is one-fifth the size of the “big” S&P contract – worth $50 per point of movement, and having a margin requirement 20% of the size of the “big” S&P (currently, the exchange minimum margin for the “big” contract is just under $20,000, so the margin for the e-mini is just under $4,000). These e-mini’s trade on Globex at all times.

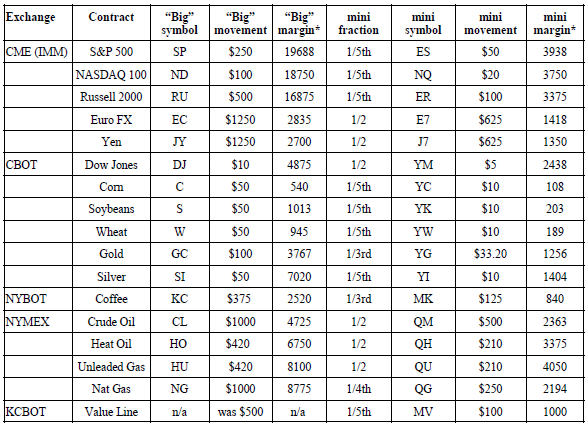

Nearly all traders are aware of the S&P 500 emini, but might not be aware of how many other “mini” contracts there are. The following list shows the major ones that currently exist.

Depending on the quote system you are using, the mini symbols might be different than shown in the above table. For example, the mini-Yen has a symbol of “J7" according to the CME web site. But many vendors can’t accommodate a number in the symbol portion of a futures contract, so the symbol is ZJ on eSignal, for example.

If there is any question, you should go to the exchange web site and look up the “contract specifications” for any contract before actually trading it.

Not every contract is listed in the above table. In particular, the CME (IMM) has several others listed, although I don’t know how liquid they are. They include NASDAQ Composite (the NASDAQ listed above is the NASDAQ 100), NASDAQ Biotech sector, S&P Midcap 400, S&P Asia, MSCI EAFE (Europe, Australia, and Far East stocks), and Russell 1000. There is a mini-Eurodollar contract on the CBOT. There is a Brent Crude mini on the NYMEX. There may be more soon, but I believe this is the complete list at the current time.

The only mini contract with listed options is the original one, the S&P 500 e-mini (ES).

It is interesting to note that the Value Line e-mini is the surviving contract for Value Line, as the “big” Value Line contract ceased to be listed a couple of years ago.

As noted above, these mini-contracts can be useful if you want to cut your risk in markets that have become quite volatile and/or increased their margin requirements. Also, they allow one to be able to take partial profits whereas the big contract might not allow that luxury. Suppose, for example, that you wanted to trade Nat Gas, but felt you could only afford the risk of one contract. Buying 4 mini contracts would be the same risk, but would give you the opportunity of taking a partial profit if prices moved in your desired direction.

Other "Exchanges"

There are some new electronic “exchanges” that have sprung up in the last couple of years. These offer various contracts, and in light of our discussion, they offer certain financial contracts. However, these contracts may be a bit different than you’re used to seeing.

One is Hedgestreet, now Nadex. Another is Intrade, http://www.intrade.com, and the third is IG Index, http://www.igindex.com. Hedgestreet is a fully registered U.S. futures exchange; Intrade was recently approved as an “exempt board of trade”1 by the CFTC for certain transactions. IG Index is not approved as a US exchange, to my knowledge, but certain portions of it are registered in England.

Futures On Hedgestreet

The only one of the three that actually lists a semblance of futures contracts is Hedgestreet. However, even there, the contracts are slightly different than actual futures contracts. Hedgestreet does not set margin requirements, as the CME or CBOT might do. Rather the CFTC requires Hedgestreet retail clients to be 100% collateralized for any transaction they might make.

As a result, their futures contracts all have a “cap” and a “floor” on them. That is, the contract price can’t go above the stated cap, nor fall below the stated floor. If the price of the underlying commodity moves farther than that, there is no further gain nor exposure to the Hedgestreet futures trader.

Example: Suppose Sept Silver futures on the COMEX are trading at 1110. There is a Hedgestreet futures contract on Silver, expiring this Friday, July 28th. The floor is 1100 and the cap is 1120. The Hedgestreet contract movements is worth $5 per point, rather than the $50 per point of Silver futures on the COMEX. Furthermore, since there are 20 points between the cap and the floor, there is a maximum value of $100 to the Hedgestreet contract.

Suppose one sells this Hedgestreet contract at a price of 1108. He has 8 potential points of profit, and 12 potential points of risk. At $5 per point, his risk is $60. That is what he must advance, or have available in his trading account. Hedgestreet will “reserve” the $60 potential loss while the contract is in place. That is why the Hedgestreet contracts have caps and floors – so that the risk is fixed and that risk can be set aside when the trade is initially entered.

Option traders will also recognize the above structure as a call vertical spread. If you buy it, you are buying a bull spread; if you sell it you are selling a call credit spread, or the equivalent thereof.

At any given time, there are several of these caps and floors available. For example, in Silver, this week there was a contract with 1060 & 1080 as the cap and floor, and then another with 1070/1090, etc., all the way up to 1100/1120. If you wanted to have a short position with larger profit potential, you could sell the entire series which would, in effect, mean you’d be selling a call credit spread with the lower strike (floor) at 1060 and the upper strike (cap) at 1120. Of course, with Sept Silver currently at 1108, you’d get a pretty healthy credit for all of those sales combined.

Hedgestreet offers these types of contracts on Gold, Silver, Crude Oil, Unleaded Gasoline, Euro FX, and the Japanese Yen. Unfortunately, the exchange has not yet quite caught on with a large segment of traders, and there is not a whole lot of liquidity currently.

Binary Options

All three of these exchanges offer binary options on a variety of situations. The largest in terms of volume is Intrade, where tens of thousands of contracts trade daily in the various markets (IG Index does not make its volume and open interest figures readily available).

A binary option is one where – at settlement – the contract is worth either 0 or 1 (hence, that’s where it gets its “binary” nature). Or it could be worth 0 or 100, or any other type of “all-or-nothing” structure like that.

Binary options will soon be listed on many exchanges, not just these three. The CME has already listed one for the Fed Funds rate.

Intrade made a big splash a couple of years ago when they traded millions of contracts on the U.S. Presidential election. The binary option was “Will George Bush win the 2004 Election?” (There was an accompanying “Kerry” contract as well, although that is somewhat superfluous, since shorting the “Bush” contract offers exactly the same risk/reward as buying the “Kerry” contract).

Binary options usually settle at 1) 0 or 10, or 2) 0 or 100. In that way, one can easily look at the current price and see the probability that the market assesses of the event occurring. In the “Bush” contract, the expiration values were 0 and 100. So, when the contract was trading at 52 prior to the actual election day, one could easily see that the traders were assessing the probability of Bush winning (by even one electoral vote) as 52%.

The binary option contracts trade right up until the event is decided. In the case of the “Bush” contract, you may recall that early exit polls showed “Kerry” with a big edge. The “Bush” contracts fell below 30 on election night, before rebounding and eventually settling at 100 when President Bush was re-elected.

On Intrade, the contracts – even though they are quoted on a scale from 0 to 100 – are worth $10 at payout. So your cost is 10 cents times the price you pay for the option (or times the price you sell it for).

Of course, you don’t have to hold a binary option all the way to expiration (settlement). You can sell it out at any point along the way. For example, if you had been short the “Bush” contract, at 52 say, going into election night, you might have decided to cover at 30 when the contract plunged. In that case your profit would have been 22 points per contract (or $2.20 per contract).

Intrade offers binary options on a wide range of events – some financial (where will the Dow close today? or at any hour of the day?), some political (as in the “Bush” contract, or who will win his party’s Presidential Nomination in 2008? – McCain leads the Republicans at 38, while Hillary leads the Democrats at 42), some on entertainment (who will win the Oscars?), some on weather (various probabilities of hurricanes making landfall in the U.S., or – in the winter – the amount of snowfall in certain cities), current events (whether or not the Avian Flu will be confirmed in the U.S. before a certain date), and others on a wide range of subjects.

Intrade shows charts of where the contracts have traded during their life, and time & sales data is available for downloading as well.

In the financial area, Intrade binary options are available on the Dow, S&P 500, NASDAQ, FTSE, the Nikkei, and DAX. Contracts extend through the end of this year, the end of the month, the end of the week, or each day. There are also binary options on a wide range of Foreign Currency contracts. As for “regular” commodities, only Gold and Crude Oil have binary contracts on Intrade. Finally, binary options exist on many of the major economic numbers that are reported each month (Housing Starts, Unemployment, etc.).

Hedgestreet has binary options, too. They offer more commodities: Gold, Silver, Copper (note: this is the only “mini” contract on Copper that exists anywhere today – somewhat surprising, considering how much Copper has risen in price in the last couple of years), Corn, Soybeans, Euro FX, British Pound, Swiss Franc, Canadian Dollar, and Japanese Yen. Also, Crude Oil, Heating Oil, Unleaded Gas, and Natural Gas. Furthermore, Hedgestreet offers binary options on a few economic numbers (CPI, Fed Funds Rate, Mortgage Rates, and Nonfarm Payrolls). Finally, there are (illiquid) contracts on Housing Values in various locations in the U.S.

Some Comments On Binary Option Strategy

It will behoove option traders to understand binary options, for they are growing in popularity and will likely be a sizeable portion of the derivatives market within a few years.

Traditional concepts, such as linear spreads, do not mean the same thing with binary options as they might with regular options. Let’s look at an example using the Dow Jones Industrials.

Example: with the Dow at 11,000, the following two binary option contracts are trading at the indicated prices:

Dow to close above 11025 today: 50 Dow to close above 11050 today: 25

Suppose you buy the first binary contract at 50 and sell the second at 25. Your debit is 25 points. If the Dow closes below 11025, both will expire worthless and you will lose your debit – much as you would in a typical call bull (debit) spread.

However, if the Dow closes above 11050, how would you do? Both contracts would settle at 100. You’d make 50 on the first contract (it settles at 100 and you paid 50), but you’d lose 75 on the second contract (it settles at 100 and you sold it for 25). So you’d lose 25 points if the Dow rises by more than 50 on the day.

If the Dow finishes between 11025 and 11050, you’d do best – making 75 points (50 on the contract you bought plus 25 on the contract you sold). The point is, though, that this is not the same as regular option call debit spread, so you need to be careful if you decide to spread binary options.

There are other developments in the works. Right now, a new concept called Longitude is about to be expanded – allowing a Dutch auction on various economic numbers right before they’re reported.

All of these contracts – binary options and so forth – fall under the general umbrella of “Prediction Markets.” That is, the participants predict the percent chance of an event occurring before it happens. Academic studies are already being done on these predictions, and it appears that they are really quite accurate in most cases.

The serious derivatives trader should learn about these and avail himself of them, for they will only become more important as the financial markets evolve

This article was originally published in The Option Strategist Newsletter Volume 15, No. 14 on July 27, 2006.

© 2023 The Option Strategist | McMillan Analysis Corporation