By Lawrence G. McMillan

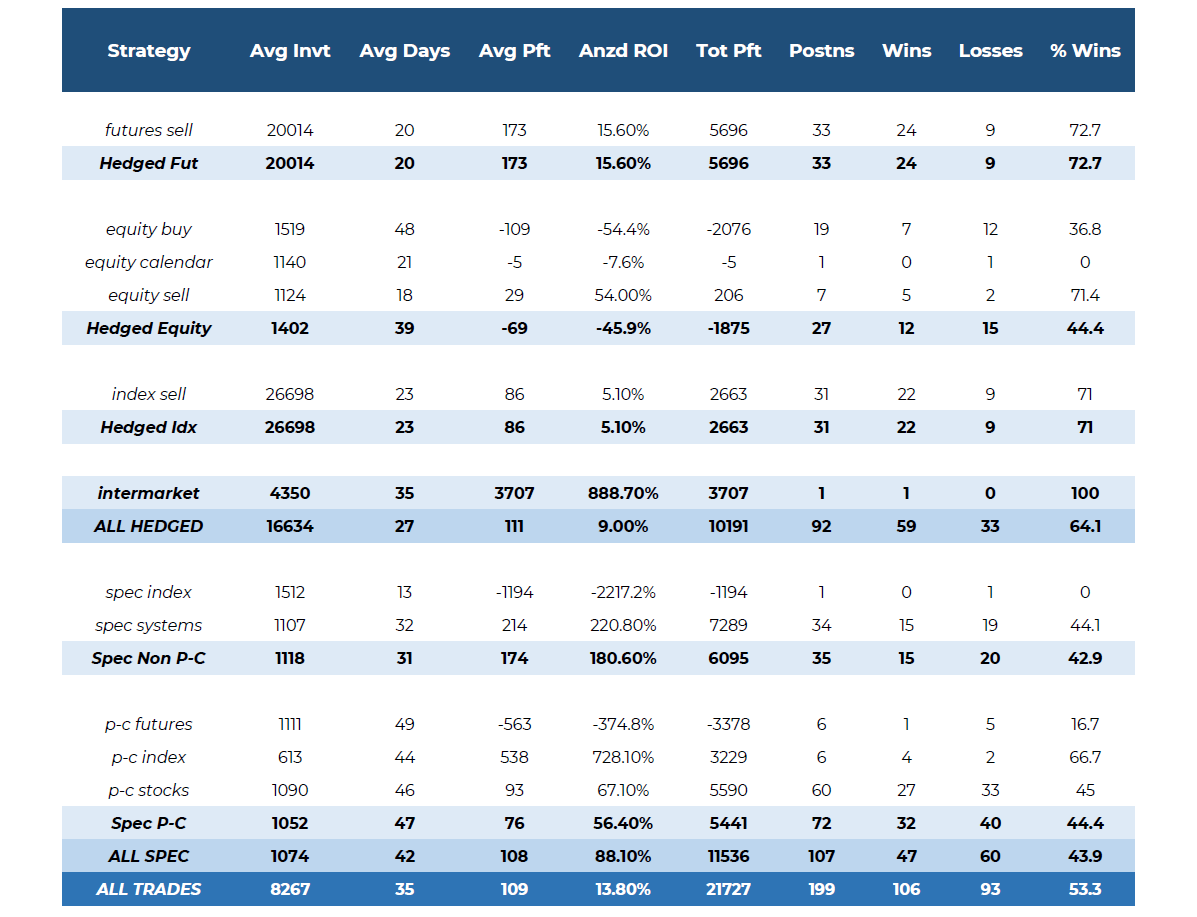

The full track record, including 2023, is now available on our website. The information for 2023 is going to be presented in this article. 2023 was a profitable year for our recommendations, with an average gain at an annual rate of 13.8% – slightly above our 32-year average rate of 12.2%.

2023 Performance

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.

Put Ratio Spread Strategy

Normally, the leading strategy is “Hedged Futures Trading,” followed by “Hedged Index Trading.” That’s because those two categories are primarily the put ratio spreads that we utilize all year. While those made money in 2023, they did not make as much as in past years. That was partially due to the cost of protection, since we buy “Protective Put Spreads” to hedge the downside risk. It was also the result of cutting back on position size as volatility plummeted late in the year. Specifically, every one of the put ratio spreads made money, but all but one of the protective spreads lost money. Perhaps we were being a little too cautious – owning too much protection – although that is not obvious. In any case, Hedged Futures returned 15.6% (including protection), while Hedged Index returned only 5.1%...

Read the full article by subscribing to The Option Strategist Newsletter now. Existing subscribers can access the article here.

© 2023 The Option Strategist | McMillan Analysis Corporation