By Lawrence G. McMillan

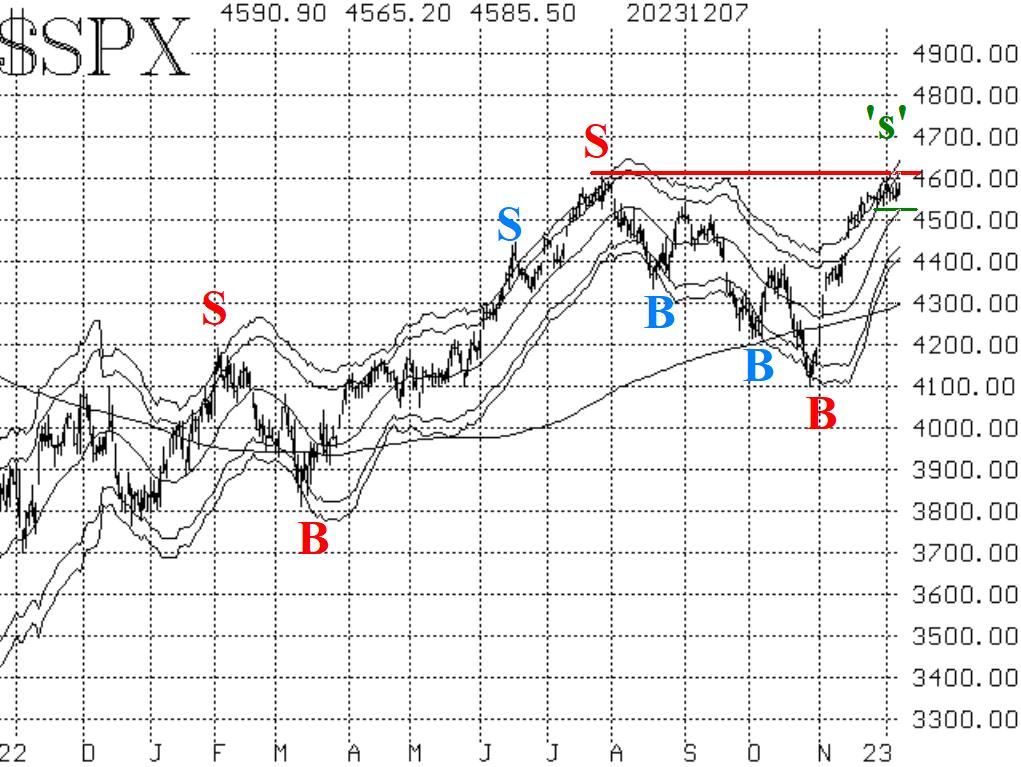

The broad market is not giving up on the monster rally that occurred in November. While there has been resistance at the 2023 highs, there has not been much of a pullback from there. That is the 4600 level roughly, and if it is decisively broken through on the upside, the next target will be the all-time highs at 4800.

Meanwhile, if that resistance does hold and a more meaningful pullback occurs, it is not necessarily a bad thing. Filling the gap down to 4420 on the $SPX chart would be "healthy," as long as support holds at 4400 (which was the major breakout level that launched this latest phase of the $SPX rally). A close below 4400, however, would be a bearish game-changer.

Equity-only put-call ratios continue to fall, and thus they remain on buy signals for the broad stock market. These buy signals will persist until the ratios bottom out and begin to trend higher.

Breadth has managed to hold together well enough so that the breadth oscillators remain on buy signals. They are in modestly overbought territory, as are many other indicators, but "overbought does not mean sell." So, the breadth oscillators remain in the bullish camp.

$VIX has been languishing at low levels near 13 for a couple of weeks now. This can be considered another overbought indicator, but it is not a problem until $VIX begins to rise. In fact, the trend of $VIX buy signal remains in place. That buy signal was generated in mid-November (the circle on the chart in Figure 4), when the 20-day Moving Average of $VIX crossed below the 200-day MA.

In summary, we continue to maintain a "core" bullish position in line with the positive nature of the $SPX chart. We will trade other confirmed signals around that core position. Ordinarily one might have suspected that any new confirmed signals would be sell signals, but those have not yet materialized while in fact a new buy signal appeared ("New Highs vs. New Lows"). This is why we have system rules and don't make guesses about what we think might happen.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation