By Lawrence G. McMillan

This article was originally published in The Option Strategist Newsletter Volume 21, No. 12 on June 29, 2012.

A"call stupid" is a rather arcane and little-known term, which is used to describe a position in which a trader is long two calls at two different strikes (probably with the same expiration date). It is often offset by a short position in the underlying security.

This term was apparently coined on the trading floor. Over the years, floor traders have contributed to the option jargon with some colorful terms (“jelly roll,” for example), and this appears to be another one of them.

Frankly, I had never heard of it until last week. The term has come to light lately after it was used by a trader in the $VIX pit on a recording posted on Youtube. The video described the position as a "call stupid tied up with the futures" – which I assume means that there was a short position in the $VIX futures partially offsetting the long calls. Later, the term was mentioned on CNBC, although on CNBC there was no mention of the hedge.

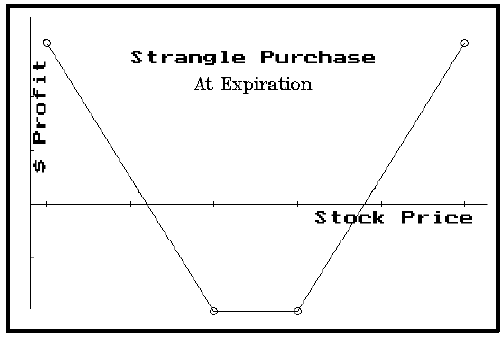

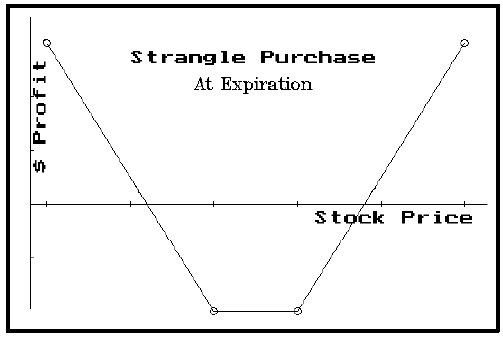

It is unusual that the trader would want to establish the position in this way, since it can usually be done more efficiently with puts. It almost brings to mind the days before puts were listed (pre-1976). In those days, if you wanted a position that behaved like what we know now as a long strangle, you had to use something like what these traders are now terming a "call stupid." Today, a strangle is usually established as both a long call with a striking price higher than today's stock price and a long put with a striking price below today's stock price.

If puts don't exist, the equivalent position can be established by a) buying that same long call with a striking price higher than today's stock price, b) buying another long call with the lower striking price, and c) shorting 100 shares of the underlying stock. That position is exactly the equivalent of a long strangle. Both positions have a profit graph as shown below.

In the recent vernacular, I suppose, that would be a "call stupid" with 100 shares of short stock – which is close to what I suspect the $VIX trader was establishing. It just seems odd that he wouldn't use puts. Perhaps it was a liquidity issue, since $VIX call volume is typically much greater than $VIX put volume on any given trading day.

Clearly, the term can be used with puts (“put stupid”) as well. Furthermore, in a scan of internet postings, at least one site says that the “Call stupid” can involve two expiration dates as well. So, in a general sense, a “stupid” doubles up a directional bet, as opposed to spreading.

This article was originally published in The Option Strategist Newsletter Volume 21, No. 12 on June 29, 2012.

© 2023 The Option Strategist | McMillan Analysis Corporation