By Lawrence G. McMillan

This article was originally published in The Option Strategist Newsletter Volume 3, No. 23 on December 8, 1994.

Traders sometimes use bull spreads instead of actually buying calls when they want to hedge their bets somewhat. In this article, we'll take a look at how the bull spread works, and perhaps shed some light on the somewhat unusual characteristics of its profit potential as time passes.

A bull spread is a hedged strategy, designed to profit if the price of the underlying security moves higher. The strategy has both limited profit potential and limited loss potential, although the loss is equal to 100% of the amount invested, much as with the purchase of call or put options. The bull spread can be constructed with either puts or calls. In either case, it is established by buying the option at a lower strike and selling the option at a higher strike, both options usually having the same expiration date.

Example: With XYZ stock at 85, one can construct a call bull spread by buying the Feb 80 call and selling the Feb 90 call. The call spread requires the debit, equal to the net difference in the price of the options, to be paid in full.

Alternatively, a spread with similar profit characteristics can be constructed with puts: Buy the Feb 80 put and sell the Feb 90 put. This spread brings a credit into the account. The margin required is the difference in the striking prices, and one may apply the initial credit against that requirement.

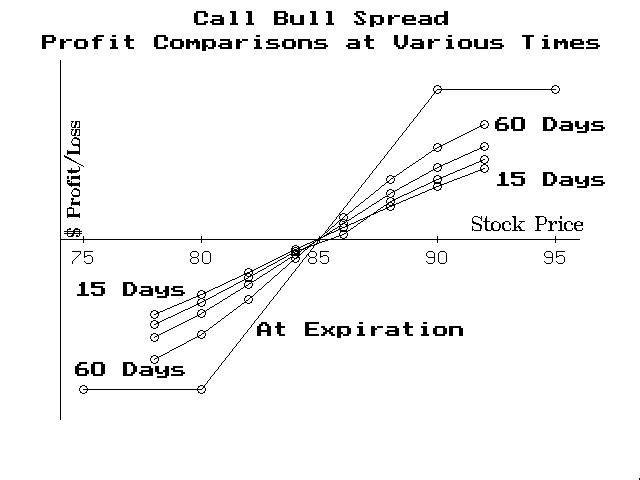

The general shape of the profit potential of a bull spread is shown in the graph above. If the underlying is near or below the lower strike when the spread is established, the profit potential can be several times the loss potential. If the underlying is initially midway between the two strikes, then the profit and loss potential will be approximately equal. One does not generally establish bull spreads with the underlying at or above the higher strike, because the risk is too great in comparison to the potential

Experienced traders will often turn to bull spreads when options are expensive. The sale of the option at the higher strike partially mitigates the cost of buying an expensive option at the lower strike. I prefer to use the bull spread if the options are expensive (i.e., have a high implied volatility) in comparison to the historical volatility of the underlying.

However, one should not always use the bull spread approach just because the options have a lot of time value premium, for he is giving up a lot of upside profit potential in order to have a hedged position. If the underlying is volatile, then one should not be queasy about having to pay for time value premium on an in-the-money option — it is probably worth it, as the implied and historical volatilities most likely are closely in line.

Once the bull spread is established, it might not perform exactly as you might expect. The graph at the top shows a typical bull spread using the 80 and 90 striking prices, bought when the underlying was 85 — mid-way between the two strikes. The profit potential at several intermediate points in time is shown: at 15 days from inception, 30 days, 45 days, and 60 days. Notice that there is very little difference in the results as time passes (until you get very close to expiration, when the profit potential approaches the final shape of the bull spread). This phenomenon can be frustrating in some cases: if the underlying has a nice upward move shortly after you establish the spread, you probably will disappointed in your profits at that time. This fact often causes bull spread holders to "overstay their welcome" as they figure they will continue to hold on for better results closer to expiration, only to see the underlying slip back and their profits dissipate.

Thus the bull spread is a low-risk and low-profit potential strategy, which is not what many traders intend when they establish it. To get a larger profit potential, one must establish the spread with the underlying close to the lower strike.

This article was originally published in The Option Strategist Newsletter Volume 3, No. 23 on December 8, 1994.

© 2023 The Option Strategist | McMillan Analysis Corporation