By Lawrence G. McMillan

One of the strongest underpinnings of this bull market has been low volatility and – to an even greater extent – a very positive construct in the $VIX futures. Quietly, $VIX has been increasing since late August, and now it’s becoming much “noisier.”

In this article, we’ll go over the current state of several volatility indicators and indices. Moreover, we’ll refresh the status of the signals that these volatility indices and derivatives can generate regarding broad market movement.

In addition, we’ll look at some of the subsidiary volatility indices to see what they are saying about potential movement in sectors, such as Emerging Markets (and others).

Now that volatility is shooting higher, we want to be especially aware of the possibilities for volatility spike peak buy signals – not just in $VIX (which we know is a powerful signal), but in other volatility indices as well, for others have good track records for spike peak buy signals, just as the broad market does with $VIX signals.

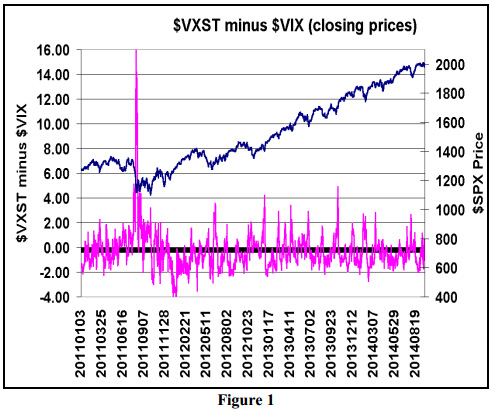

The harbinger of increased volatility

Figure 1 shows, in pink (lower graph on chart), the difference between the Short-term Volatility Index ($VXST) and $VIX. When that difference is positive (i.e., when $VXST closes above $VIX), that is a signal that actual volatility is about to increase.

We wrote about this phenomenon in detail in Volume 23, No. 4. The gist of that article was...

Read the full article (published on 9/25/14) and get all of the trading recommendations by subscribing to The Option Strategist Newsletter today. Introductory 3 month trial subscriptions are available for only $29.

© 2023 The Option Strategist | McMillan Analysis Corporation