By Lawrence G. McMillan

Beginning on October 6th, there will be a change to the way that $VIX is calculated. In this article, we’ll details the new methodology and make some analytical comments about how this might affect $VIX.

Currently, $VIX is computed by using two series of $SPX options – the two closest “regular” expirations. For example, by next week, the calculation will use “regular” October $SPX options expiring on 10/18/2014 and “regular” November $SPX options expiring on 11/22/14.

The two entire “strips” of options are used in this calculation, and the strips are weighted to create a 30-day volatility ($VIX is, by definition, a 30-day volatility estimate). The weight changes each day, with the nearer-term strip getting less weight as time passes and the longer-term strip getting more weight.

A similar methodology is used to calculate $VXST (9-day volatility, using strips of $SPX weekly options), $VXV (using strips of $SPX monthly options with intermediate-term expirations), and $VXMT (using strips of $SPX monthly expirations with 6-to-9 months of life remaining).

Returning to $VIX, occasionally both strips of options have more than 30 days of life remaining. In these case, it is necessary to use a negative adjustment in the weighting process. That has occasionally caused some movements in $VIX that seem illogical when compared with what $SPX is doing on the same day.

The new methodology erases that problem, and may provide other benefits. The new methodology is this:

Beginning on October 6th, the two strips of options that are closest to a 30-day expiration will be used in the $VIX calculation.

These would include weekly options, “regular” monthly options, and potentially even $SPX end-of-month or end-of-quarter options, providing that they expire on a Friday. With this new methodology, there would always be one strip expiring before 30 days and one strip expiring after 30 days. The CBOE says that the near-term strip will always have at least 23 days until expiration, while the longer-term strip will never have more than 37 days to expiration.

$VIX derivatives will not change at all, in any way. They will still be “attached” to the $SPX options that expire 30 days after the $VIX expiration. So the behavior of $VIX derivatives will not change at all.

One wonders, though, if the behavior of $VIX will change. We know that in extreme bearish markets, the near-term $SPX options explode in volatility much more than longer-term $SPX options do. This has resulted in some large discounts by $VIX futures in the past. For example, on August 8, 2011, $VIX shot up to 48 on the day that S&P Corp. downgraded U.S. debt – causing $SPX to drop 80 points in one day. However, the near-term (at the time) August $VIX futures only rose to 36.55. Those futures were based on the August $SPX options (expiring on August 19th) and September options (expiring on September 16th).

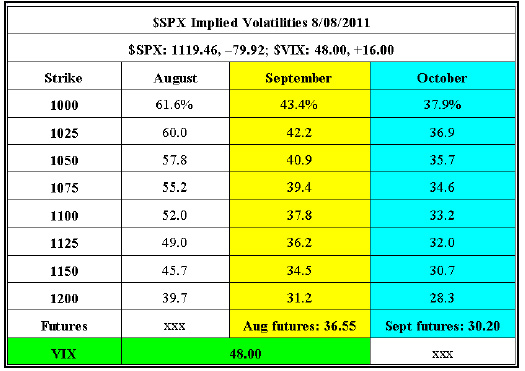

The following chart is used in many of my seminars on volatility trading, as an illustration of how the term structure behaves. It shows representative implied volatilities at the close of trading on August 8, 2011.

You can see how the discrepancy between $VIX and the $VIX futures occurred. The $VIX calculation was based on the August strip (which roughly has implieds averaging above 55%) and the September strip (which roughly has implieds averaging slightly below about 40%). So, $VIX was 48.

But August $VIX futures are based only on the September options (something slightly below 40%), so 36.55 was a reasonable price for them as well.

Hence this huge discount was “normal.” There wasn’t anything untoward going on, either from market manipulation, speculation, or adverse supply and demand. Rather, it accurately reflected the implied volatilities of the options in question. It’s just that $VIX is based on a different set of options than the $VIX futures are – up until expiration day of the $VIX futures.

Will the new $VIX methodology change this? The new method would use $SPX weekly options expiring just before and just after September 7th (30 calendar days after August 8th) – the September 2nd options and the September 9th options. I would think that both of those would have much lower implieds than the August options in the above table. Hence, $VIX itself would be lower, and the $VIX futures discount would be smaller.

That’s the way it looks to me.

This article was featured in The Option Strategist Newsletter Volume 23, No. 17. Get all the articles and trading recommendations by subscribing today.

1A “strip” of $SPX options, for the purpose of computing $VIX, consists of all strikes that fit the following criteria. The low strike is the lowest one which has a bid for the puts, and all higher strikes also have a bid for the puts; the high strike is the highest one in which there is a bid for the calls, and all lower strikes have bids for the calls. That is, if there is no bid, that strike isn’t used; moreover, the resulting strip must be continuous as well, so that every put and call has a non-zero bid.

© 2023 The Option Strategist | McMillan Analysis Corporation