By Lawrence G. McMillan

This seasonal trade first came to my attention last year, but when I heard about it, the system had already been entered. So, I wrote it on my calendar for this year, and the time has arrived. As it turns out, it is one of the few confirmed bearish signals out there right now (no, I don’t count the myriad of overbought conditions as “confirmed bearish signals;” they would have to generate actual sell signals to be confirmed). In last week’s Hotline, we made a decision to hold onto our SPY puts (which were originally bought via the “modified Bollinger Band” – mBB – sell signal), because of this seasonally bearish signal. The current status of the mBB signals is discussed in this issue as well.

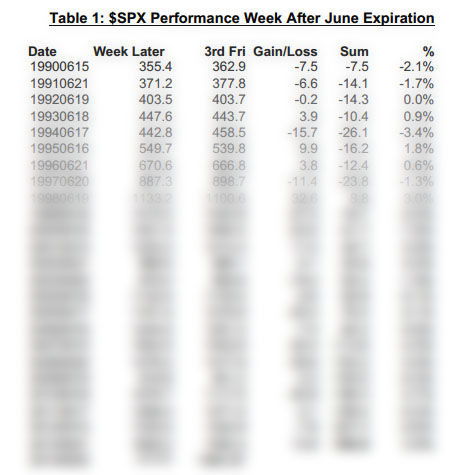

The Week After June Expiration Is Bearish

The system is quite simple. It relies on historic data which shows that the week after June option and futures expiration is a bearish time period for the broad stock market – i.e., $SPX. Last Friday was June expiration. I suppose there are several ways that this can be measured, but the way that I did it...

Read the full article (published on 6/27/14) by subscribing to The Option Strategist Newsletter today. Introductory 3 month trial subscriptions are available for only $29.

© 2023 The Option Strategist | McMillan Analysis Corporation