By Lawrence G. McMillan

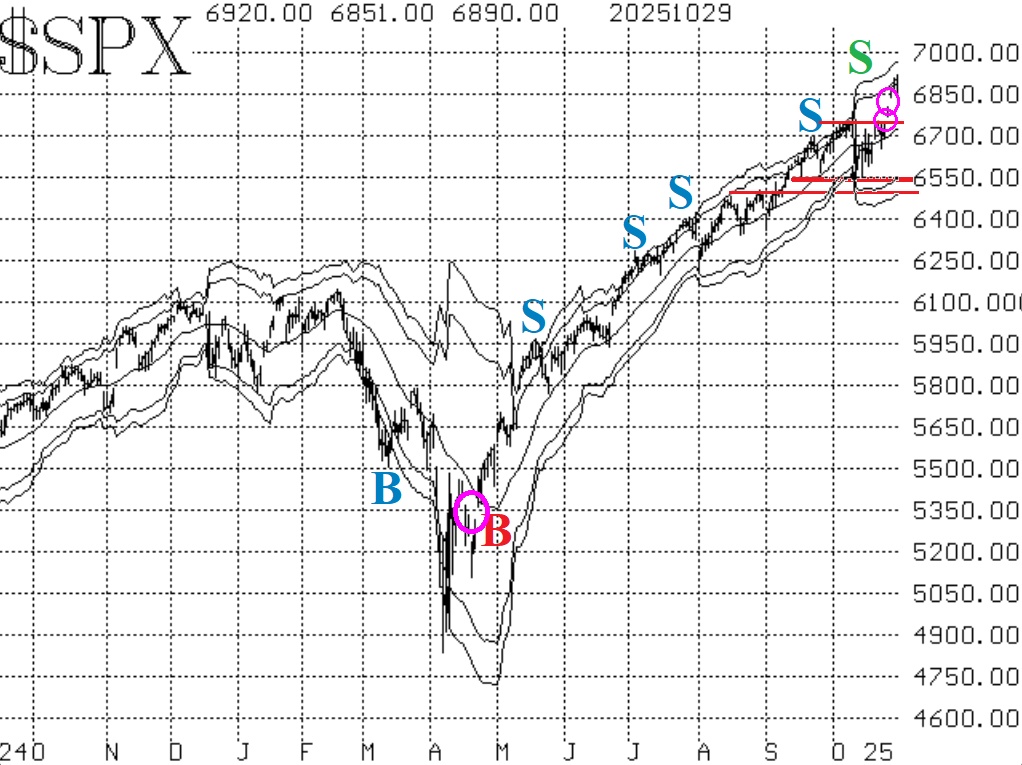

The market eventually shrugged off the most recent "tariff tantrum" and moved to new all-time highs. The breakout came on two gap days to the upside -- very strong action. That created support at the old highs, near 6750. There is also the major support below there at 6500-6550.

The equity-only put-call ratios remain on sell signals however, since they made a bottom and began to rise over a week ago. There has been some back-and-forth action in the ratios over the past couple of days, which might bring these sell signals into question. However, the computer analysis programs continue to grade them as "sell."

Market breadth has deteriorated badly over the past two days, and now both breadth oscillators are back on sell signals again. Breadth has continued to have trouble even with $SPX making new all-time highs.

$VIX has fallen, but is not back to its mid-summer lows. Even so, the "spike peak" and trend of $VIX buy signals are still in place. They would be stopped out if $VIX were to close above its 200-day Moving Average for two consecutive days. That MA is just above 19.

For now, we are maintaining a general bullish outlook because of the positive nature of the $SPX chart and the $VIX-related indicators. However, we will take all signals as they occur. Continue to roll positions that become deeply in-the-money, as was the case with two of our SPY call bull spreads this past week.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation