By Lawrence G. McMillan

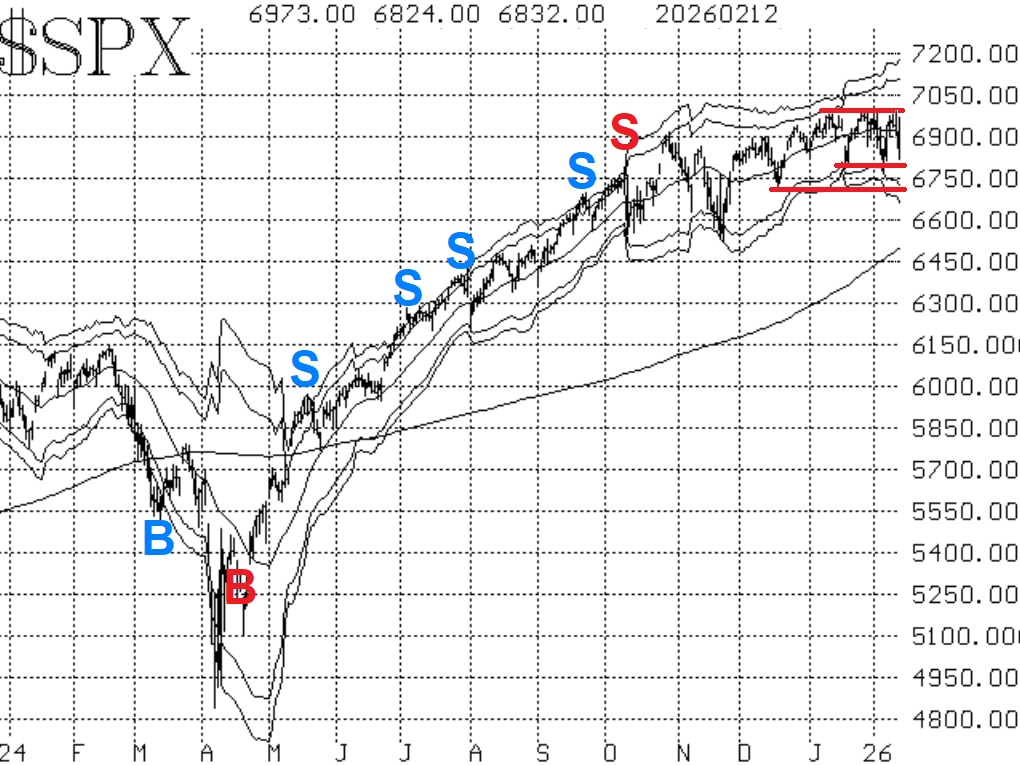

The schizophrenia of this market is really something else. On bad days, it looks like the world is imploding, but then it bounces right back. Meanwhile, it has been unable to break out over 7000 in any meaningful fashion. So that is a major resistance area. There is support at 6800 and 6720.

Equity-only put-call ratios have risen over the past week, and they have risen rather sharply. So, whether traders are buying or selling stocks, they seem to be buying puts at all times. Both ratios are rising, and as long as that is the case, that is bearish for stocks in general.

Breadth was very positive earlier this week, and that was enough to generate new buy signals from the breadth oscillators. Unfortunately, things deteriorated badly on February 12th, and now those same oscillator buy signals are in danger of being canceled out.

$VIX has seen some wild action also. A week ago, $VIX had spiked up to 23.10 and then backed off, generating a new "spike peak" buy signal for the stock market.

This week, when prices began to drop on February 12th, $VIX started to shoot higher again. It has now made a second peak, topping at 22.40 (so far) this morning February 13th.

In summary, there is rather volatile trading range action. $SPX has not been able to confirm a direction. Moreover, the market internals are somewhat mixed as well. For now, we are taking new signals as they are confirmed, but we are adhering to the stops for any trading system that is employed. Meanwhile, continue to roll deeply in-the-money options.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation