By Lawrence G. McMillan

This past week has seen volatile moves in both directions. First, $SPX failed to capitalize on the move to new highs a week ago, and then over last (3-day) weekend, President Trump once again announced a tariff threat. That resulted in the market throwing another "tariff tantrum" on January 20th, the first trading day after the Martin Luther King holiday. But just as that was unfolding, an agreement of sorts was reached on the Greenland issue, and the market exploded upwards.

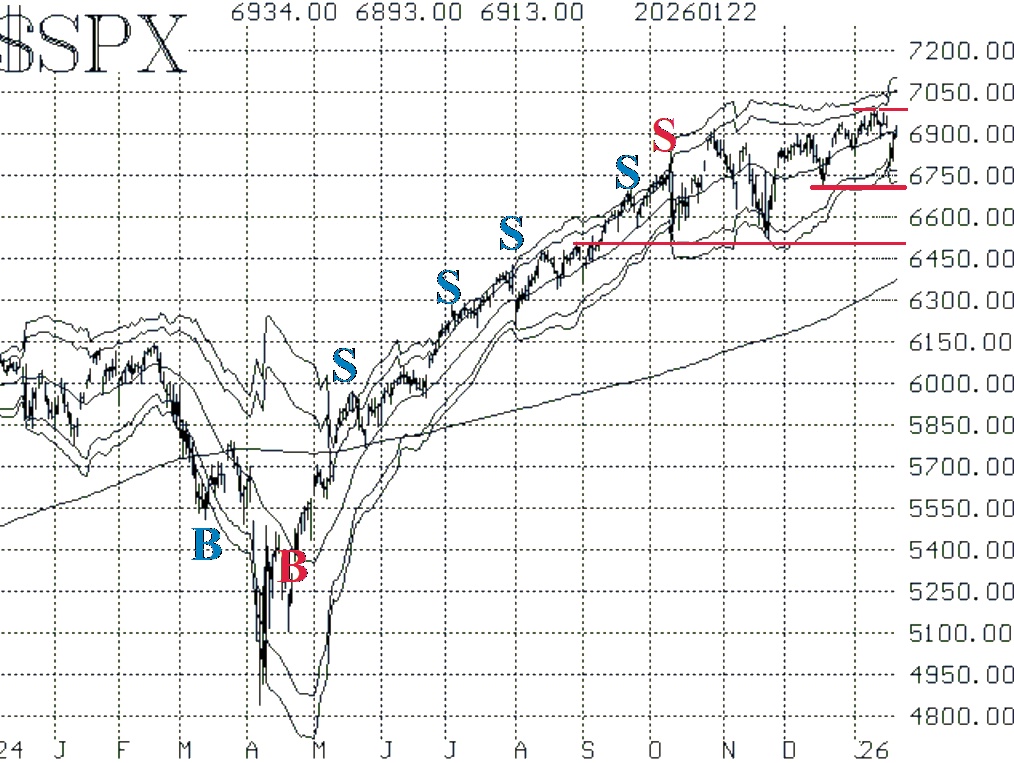

There are several facts to the technical picture that have emerged as a result of all of this. First, the support at 6840 was wiped out, leaving the December lows at 6720 as the next major support area. There is minor support just above there, near 6800, which was the low of this week's trading. As for resistance, it is at the all-time highs of 6945. Once again, $SPX was unable to follow through after trading at a new all-time high, on January 13th and then unsuccessfully trying to break through on the upside on the next two trading days.

Equity-only put-call ratios have rolled over and begun to decline again, and that places both of them on a tentative buy signal. Those are marked with green "b's" in Figures 2 and 3. The computer analysis programs confirm these buy signals. So, for now, these ratios are declining once again, and that is bullish for stocks.

Breadth has been quite strong. Yes, there was a very negative day on January 20th, when the broad market took a beating, but otherwise breadth has been strong. Both breadth oscillators remain on buy signals.

There were some nervous, almost bearish, fluctuations in $VIX and its associated indicators this week, but in the end everything has come out on the bullish side. There is a new $VIX "spike peak" buy signal (for stocks) and the trend of $VIX buy signal remains in effect.

So, once again, tariff news was just a temporary inconvenience. However, the massive selling that took place because of it shows that there are some large institutions ready to jettison stocks if they see a reason. The December lows at 6720 are very important. We will continue to take new signals as they occur. Also, continue to roll deeply in-the-money options.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation