By Lawrence G. McMillan

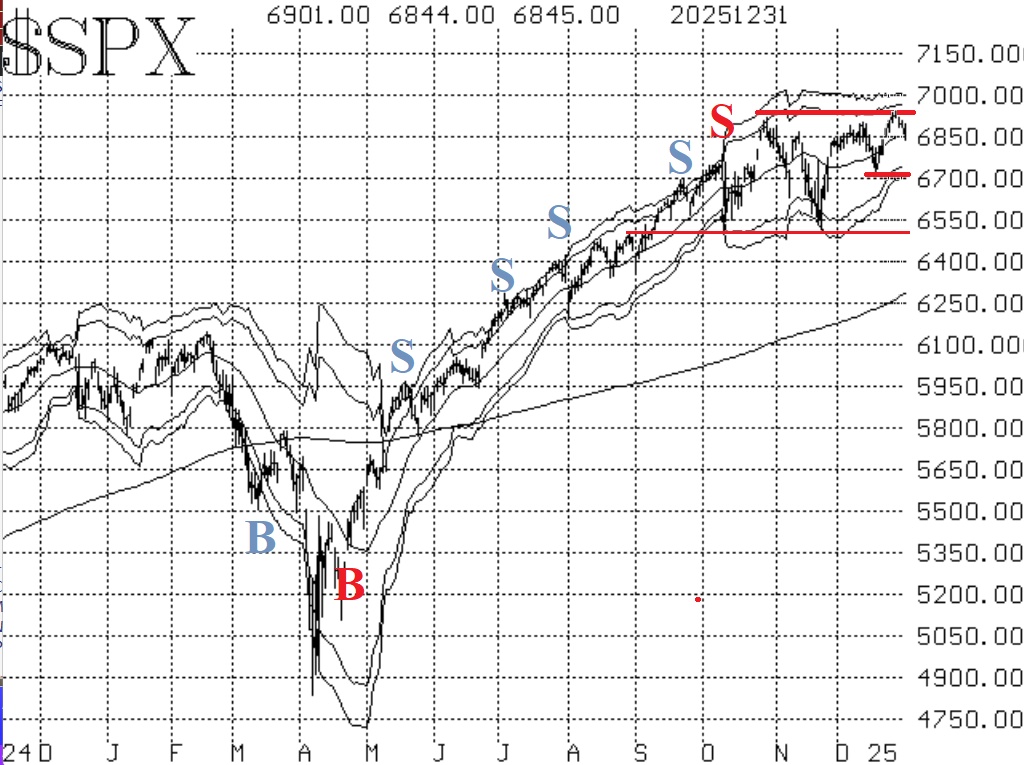

The $SPX Index broke out to all-time highs just before Christmas, although the Dow ($DJX) and NASDAQ-100 ($NDX) did not. There hasn't been any follow-through to the upside by any of them. In fact, $SPX has been down for four straight days since then. The decline is still modest, but it is somewhat unusual and unsettling to falter like that just as new highs are being made.

For the record, there is support on the $SPX chart at 6840 and then stronger support at 6720 (the December lows). As for resistance, that exists at the highs of 6945.

This decline over the past four days has taken a toll on two of our internal indicators breadth and the equity-only put-call ratios.

Equity-only put-call ratios started to edge higher about a week ago, and now both put-call ratios are on sell signals. That is, the ratios are rising. As long as that is the case, it is bearish for the stock market.

Breadth has been pretty negative over these last few days as well, especially on the last day of 2025. It seems that a lot of people wanted to sell (for tax purposes, one would assume) and waited until the last day to do it. As a result, both of our breadth oscillators are on sell signals.

So far, $VIX has been fairly complacent, and that is generally bullish for stocks. Yes, $VIX is low, and that is an overbought condition. But there isn't anything to worry about until $VIX starts to rise. The trend of $VIX buy signal (for stocks) remains intact.

Seasonality is also supposedly bullish. We are in the Santa Claus rally period, which encompasses the last five trading days of one year and the first two of the next.

In summary, the $SPX chart is positive, but the failure to rise after new highs were made is a bit of a disappointment. The selling at year-end shows just how many people are holding stocks at losses (which they are electing to take for 2025). So, even though the major indices were higher for the year, that was accomplished with a relatively small number of stocks. The remainder of the stock universe has plenty of stocks which are at losses.

Regardless, we will see if the bulls can get their act back together in the first two trading days. The volatility complex is still quite bullish.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation