By Lawrence G. McMillan

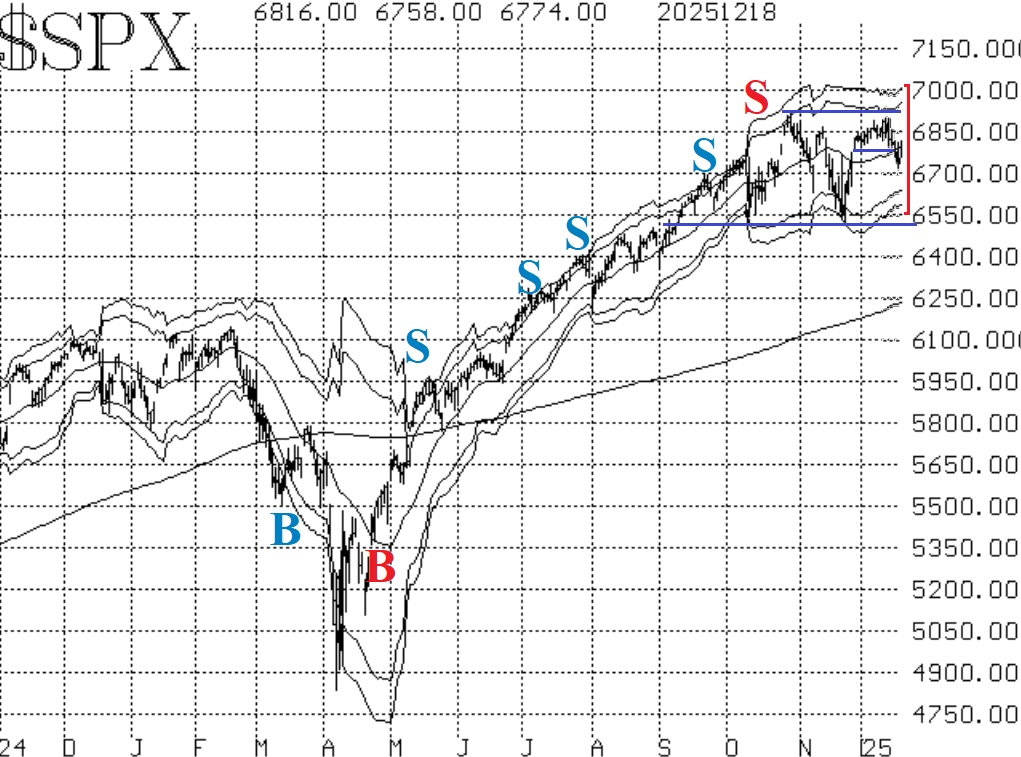

$SPX couldn't break out on the upside, so then it decided to test the downside, breaking down below support at 6800 for two days. But that move had no follow-through either. Thus, $SPX remains in a trading range, and the frustration with this market continues to grow.

The indicators lean slightly to the bullish side, but the real arbiter of price is, of course, $SPX and that remains in a neutral state.

Equity-only put-call ratios have continued to decline from their peaks of about two weeks ago. That means that they are on buy signals for the stock market.

Breadth has continued to struggle all month. Both breadth oscillators are now back to sell signals, after what seemed like a promising buy signal just after Thanksgiving. This has been the case with breadth all year it just can't get traction.

$VIX and its associated indicators are all bullish on stocks at the moment. There is a "spike peak" buy signal in place from November 21st. In addition, the trend of $VIX buy signal, from December 9th, remains in place as well.

Seasonality is also bullish, in theory. We are in the "January effect," part of the seasonal and Following that, the "Santa Claus rally" kicks in.

In summary, only breadth is actually bearish at this time, although that can change quickly. So, the weight of the indicator evidence is bullish, but the price action of $SPX is still "trading range."

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation