By Lawrence G. McMillan

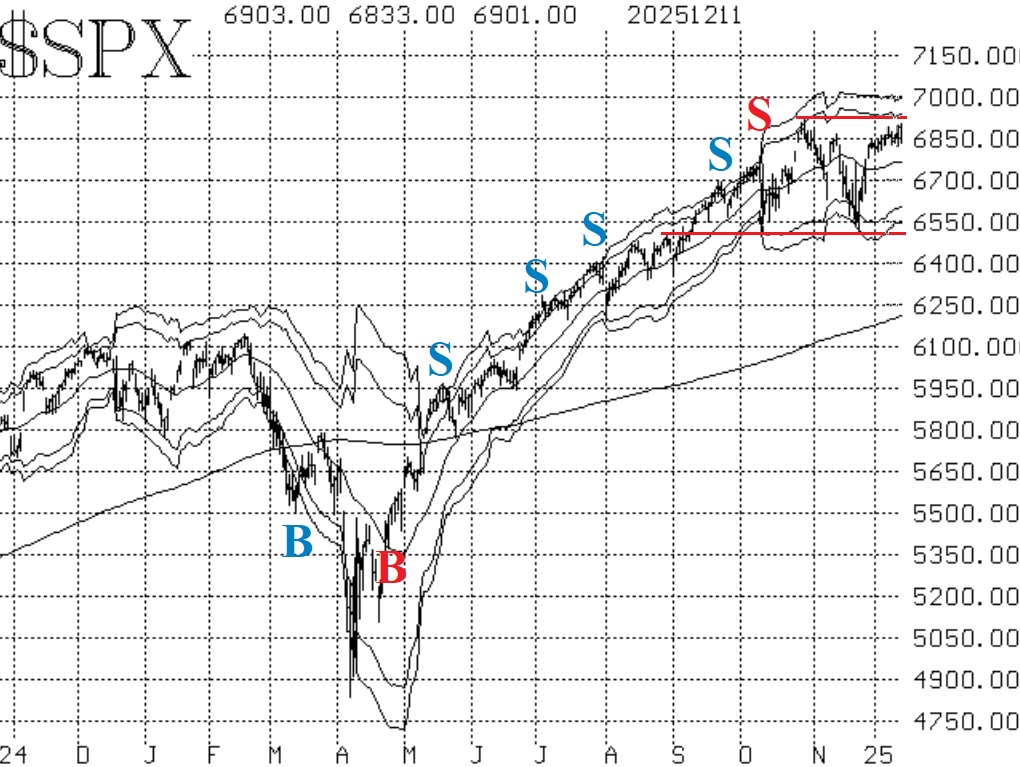

It seems that everything is quite bullish, and we are merely awaiting confirmation from the $SPX chart. That is, we need to see $SPX trade solidly at a new all-time high in order to be in agreement with what is a very bullish set of indicators otherwise.

Specifically, the number we're expecting to see exceeded is the previous $SPX all-time intraday high at 6920. $SPX closed at a new all-time closing high of 6901 yesterday. A two-day close above 6920 would be a clear bullish signal, confirming what you will see is a bullish set of indicators.

A failure here would potentially find support at 6800, but that would be a disappointment and such a failure might even be a reason to retest the major support at 6500, which has held eight times since September.

Equity-only put-call ratios have curled over and begun to decline over the past week. The computer analysis programs have confirmed that the weighted ratio is thus on a new buy signal.

Market breadth has improved again, and both breadth oscillators are on buy signals, and they are in modestly overbought territory.

The implied volatility complex is bullish on the stock market. $VIX has continued lower, and so the trend of $VIX buy signal was confirmed on December 9th (pink "B" on the chart in Figure 4). Moreover, the "spike peak" buy signal of November 21st remains in place as well (green "B" in Figure 4).

So, the indicators are bullish, but $SPX is having trouble breaking out? The reason seems to be tied to some poor earnings reports by recently-favored stocks, such as Oracle (ORCL) or Broadcom (AVGO). It is probably exacerbated by desire to not let profits slip away as year-end approaches. Even so, we will follow our indicators and trade new signals accordingly. Meanwhile, continue to roll deeply in-the-money options.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation