By Lawrence G. McMillan

Stocks sold off early in the week, but traders were sort of waiting around for the NVDA earnings, which were released after the close on Wednesday, November 19th. When those earnings were positive and guidance was positive, a monster rally took place. NVDA itself was up 10 points, but $SPX really took the news in a very positive way, and it rose 110 points on Thursday morning. Then, a harsh dose of reality set in, and $SPX experienced one of the sharpest drops in recent months losing nearly 240 points from its highs, to finish near the lows of the day. Not only that, but signs of panic in the volatility space accompanied that massive price reversal.

This has produced some oversold conditions, but "oversold does not mean buy," as we've said hundreds of times before. So, let's review what we have:

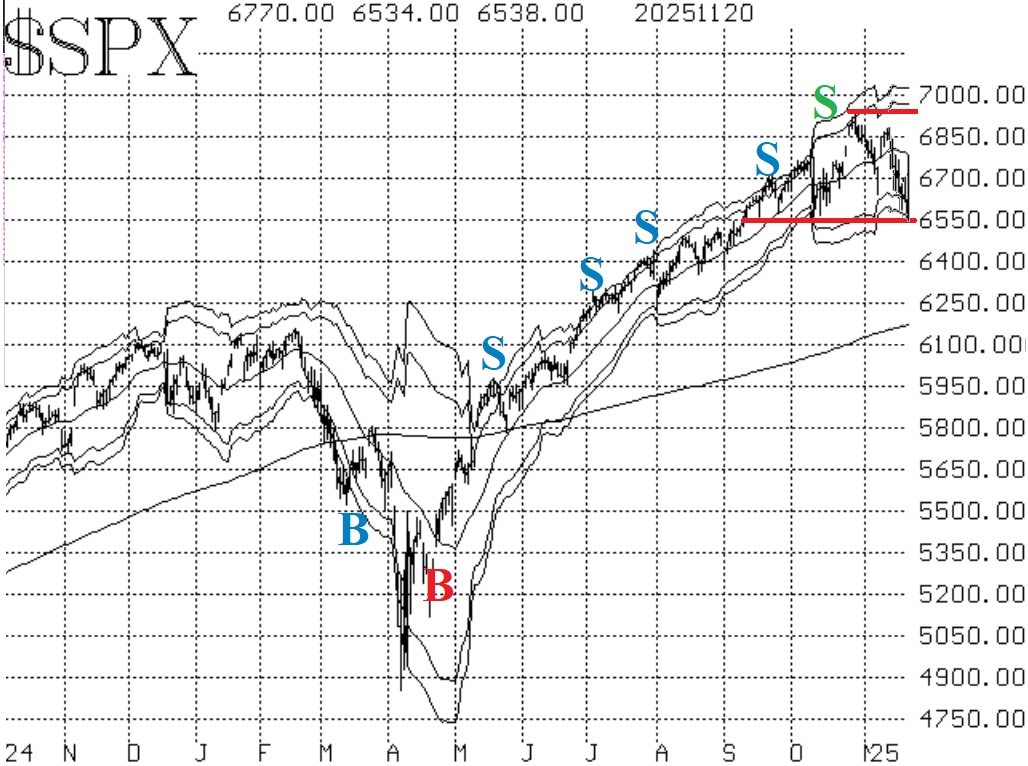

$SPX has reached major support at the 6500-6550 level. It is there right now. If this holds, then there is no problem, and $SPX will remain in its trading range, where the high is 6900 (the all-time highs). There is also resistance at 6770, which is where the massive downside reversal took place on Thursday.

But if 6500 is breached, then you might be looking at a trip down to the 200-day Moving Average, which is currently at 6200 or so.

Equity-only put-call ratios are now exploding to the upside, reaffirming their sell signals that were first generated back in mid- October.

Both breadth oscillators are on sell signals, and they are mired deeply in oversold territory. Stocks can continue to decline while these oscillators are oversold.

Implied volatility -- the $VIX "space" is where things are heating up. $VIX is now back in "spiking" mode. The stock market can decline sharply while $VIX is spiking, but eventually a "spike peak" buy signal will occur.

To summarize: things have taken on a much more bearish slant, but as long as $SPX holds at support near 6500, it's not going to matter much. We'll make specific recommendations regarding the individual indicators in the next section, but we are going to follow them pretty much as they occur.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation