By Lawrence G. McMillan

The stock market didn't seem to care much about the government shutdown at all. This is a government spending shutdown and is not nearly as negative for stocks as would be a government default. In general, the stock market seems to drop initially and then moves on to other things. This time, there have been nothing but higher highs by $SPX since the shutdown began. These are all new all-time highs by the Index.

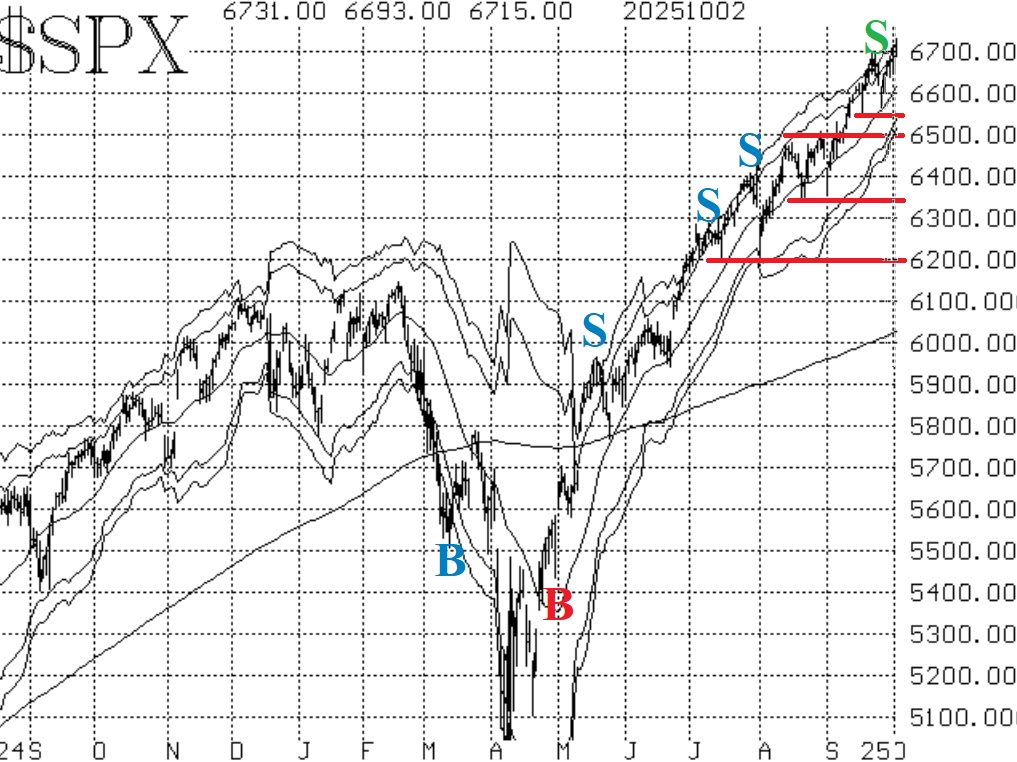

$SPX has support at the various areas denoted by red horizontal lines on the chart in figure 1: 6550, 6500, 6346-6360, and 6200. In reality, I would think that a drop below 6500 would generate some additional selling, for that is the area that was finally overcome in early September after having toyed with that level as resistance for much of August.

Equity-only put-call ratios continue to decline, and that is bullish for the broad market. Even though these ratios are nearing the lower end of their charts and the standard ratio is the lowest it's been since December 2021 that is merely an overbought condition. Overbought conditions can exist for a long time in a strong bullish environment.

Breadth --as least in terms of number of issues advancing and declining -- has been lagging. As a result, the breath oscillator sell signals that were generated a week ago are still in place.

Implied volatility ($VIX) continues to be subdued. $VIX is hovering near 16, and so the trend of $VIX buy signal (for stocks) remains intact. That signal also has been in place since late June. As we've often said, a low $VIX is merely an overbought condition, and that's not a problem. What is a problem, though, is a rising $VIX. So, if $VIX begins to jump higher, then that could be a cause for concern.

So, we continue to maintain a bullish attitude based on the $SPX chart and most of our indicators. Even so, we will continue to trade all signals as they occur. Also, it is important to roll deeply in-the-money options up to higher strikes when possible.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation