By Lawrence G. McMillan

The market continues to plow through worries galore and continues to register new all-time highs. This is true for $SPX, $NDX (the NASDAQ-100; QQQ), and the Dow ($DJX; DIA), but not the Russell 2000 ($RUT; IWM). Yesterday's CPI report was benign, and so it seems that the path is clear for a rate cut at next week's FOMC meeting. $SPX responded accordingly by having one of its strongest days in weeks.

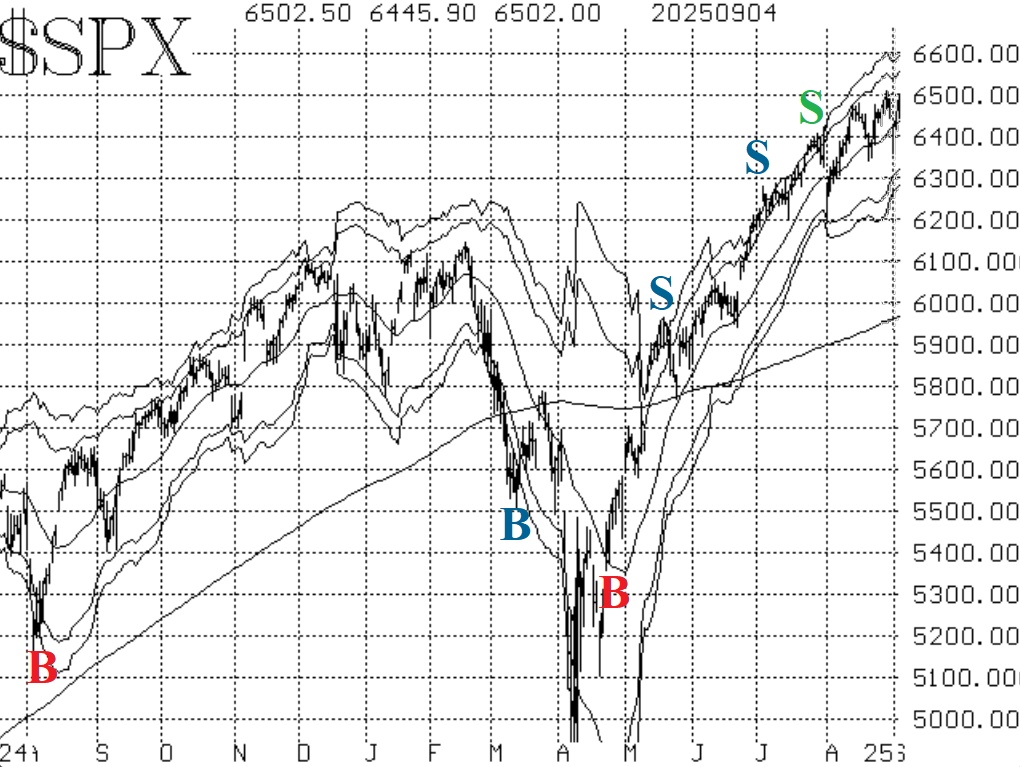

There are three support areas, shown as red horizontal lines on the $SPX chart in Figure 1: 6500 (the August highs), 6340-6360 (the August lows), and 6200 (the July lows).

There is an old adage: "buy the rumor, sell the news." What it means is that the market will often rally into what it expects to be good news (rate cuts, in this case), and then sell off after the news is announced, as profit taking occurs.

Equity-only put-call ratios have continued to decline over the past week, and so they remain on buy signals for stocks. They are low on their charts, though, which means they are in an overbought state, but until they roll over and begin to trend higher, they will continue to convey a positive outlook for the broad market.

Breadth has been something of a problem. Even on some days when $SPX was making new all-time highs (September 9th and 10th, for example), breadth was negative. It did expand nicely on September 11th, so that is a positive sign. For the record, after the positive breadth on September 11th, both breadth oscillators are on buy signals, but it won't take much to turn them negative again.

Implied volatility remains in a bullish state for the stock market, in general. $VIX continues to hover near 15, and thus the trend of $VIX buy signal remains in place. It will do so as long as $VIX continues to close below its 200-day Moving Average, which is currently at 19.10.

In summary, we continue to view the market positively, to a great extent because of the positive $SPX chart. That outlook is aided, of course, by the number of buy signals which still remain in place. We will continue to roll options that are deeply in-the- money.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation