By Lawrence G. McMillan

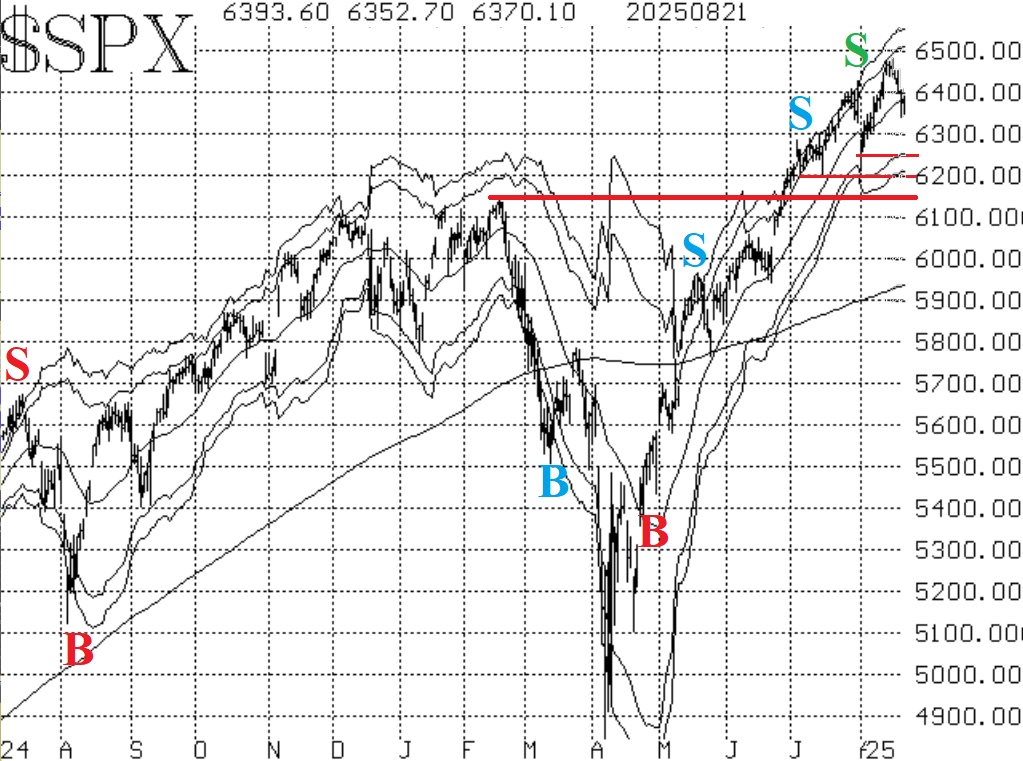

The $SPX Index has backed off slightly from its all-time highs at 6480, set last Friday. This is a modest correction, and the support levels at 6260, 6200, and 6150 are still in place. Any pullback to those levels followed by a resumption of the market rally would just be considered a correction in an ongoing bull market. However, a breakdown below 6150 would be quite negative.

The $SPX chart continues to be the strongest bullish indicator. Equity-only put-call ratios continue to present a negative picture. They are on sell signals for the stock market, since they are rising steadily. However, that may be due to the fact that traders are buying stocks AND buying puts.

Breadth has not been good. Both breadth oscillators returned to sell signals on August 14th and 15th. There has been a disconnect for some time, in that the breadth oscillators did not move into heavily overbought territory when $SPX was making its new all- time highs over the past month.

All of the other indicators are bullish. $VIX remains at low levels. A low $VIX is not a sell signal, but merely an overbought condition, and the market can continue to rise during periods when it isoverbought. In particular, the "spike peak" buy signal of August 4th (green "B" on the chart in Figure 4) has another couple of weeks to run (it lasts for 22 trading days, unless stopped out). In addition, the trend of $VIX buy signal, which began way back on June 4th (circle on the chart in Figure 4), is still in place,too.

In summary, the $SPX chart is positive. This morning, with the Fed seemingly indicating a move towards lower rates, the Dow has already made a new all-time high, and $SPX is doing the same thing. Thus, the $SPX chart remains bullish, and that is the most important indicator. We will continue to trade any other confirmed signals. Also, be sure to continue to roll deeply in-the-money options when they occur.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation