By Lawrence G. McMillan

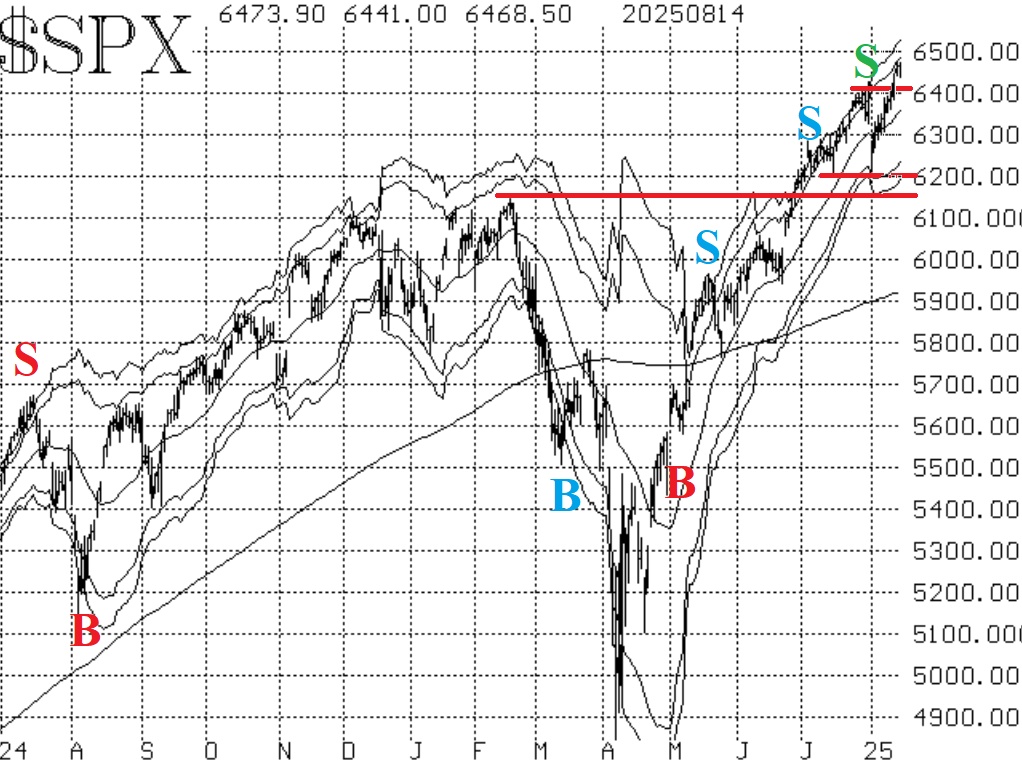

Stocks pushed to new all-time closing and intraday highs this past week on two separate days -- August 12th and 13th. Any chart making new all-time highs is, by definition, bullish. There is support at 6400, 6200, and 6150.

Equity-only put-call ratios remain on sell signals for stocks. Their sell signals date back to the beginning of the last correction --in late July. They have continued to rise, though, even while $SPX is making new all-time highs. I attribute this to the fact that investors and traders are buying puts along with stocks in this latest bullish $SPX phase. These sell signals will remain in effect until the ratios roll over and begin to trend downward.

Market breadth has been giving mixed signals. It is positive that breadth was very expansive on August 12th and 13th, when $SPX was making those new all-time highs. But, other than that, breadth has had some difficulties, and the oscillators are on the verge of rolling back over to sell signals.

The remaining indicators have to do with implied volatility $VIX or things related to $VIX trading instruments, and they are bullish. The chart of $VIX is currently giving us two bullish indicators. The first is the most recent "spike peak" buy signal of August 4th (marked with a green "B" on the chart in Figure 4). The second signal is the trend of $VIX buy signal, which was initiated in early July (pink "B" on the chart in Figure 4). It will continue to remain in place unless $VIX closes above its 200-day Moving Average for two consecutive days.

In summary, we remain basically bullish in line with the $SPX chart. However, we will continue to trade all confirmed signals. Moreover, continue to roll deeply in-the-money options when they appear.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation