By Lawrence G. McMillan

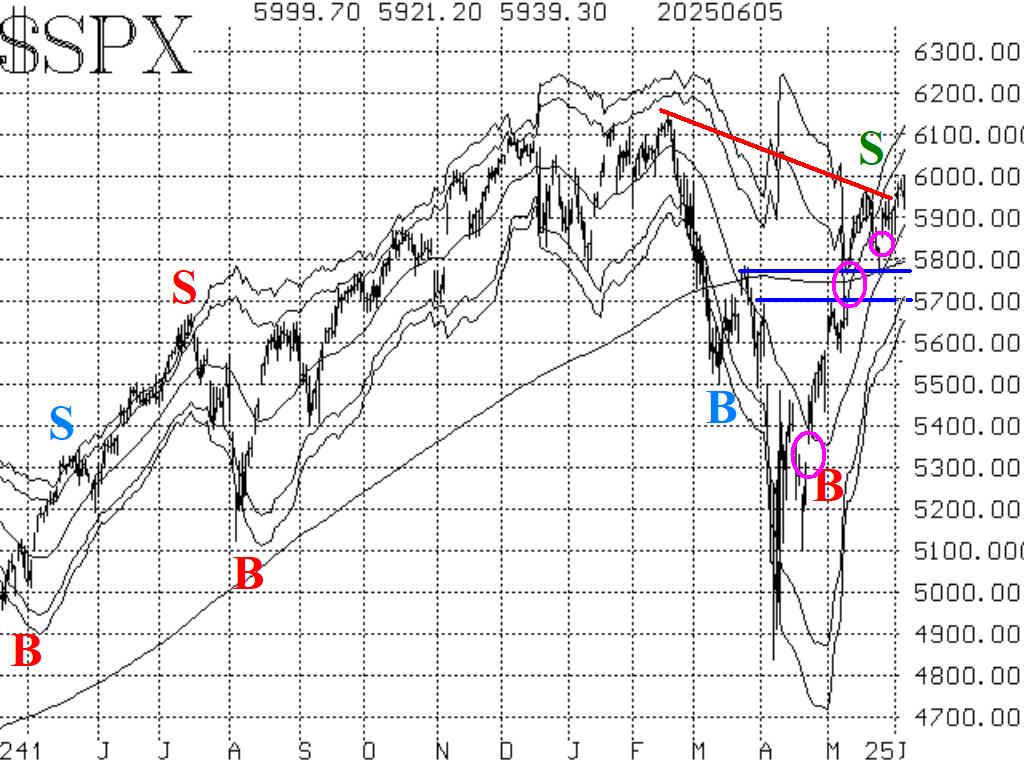

The downtrend line connecting the February and May highs was a major impediment on the upside, and now $SPX has overcome that. For the previous three days, $SPX has traded above that downtrend line, probing up towards 6000. But each day's close has seen the Index slip back. Today, a strong reaction to the Unemployment Report, has seen $SPX trade up to new relative highs. If it can hold this level today, above 6000, new highs should be the next stop.

Those all-time highs are at 6150, so that is resistance for now. There should be support just above 5900, and at the next two gaps (5840 and 5700). A move below 5700 would be very bearish, but I don't expect to see that in the near-term.

Despite the improvement in the $SPX chart, there are still some mixed signals amongst our indicators.

On the positive side of the ledger, the equity-only put- call ratios continue to decline. Thus, they remain on buy signals for the stock market.

Market breadth has not been able to expand. The NYSE-based breadth oscillator has steadfastly remained on a sell signal all week, although the "stocks only" oscillator did move above +200 for two days before falling back again.

$VIX itself has continued to decline, and that is perhaps having some important consequences. First of all, the "spike peak" buy signal of May 23rd remains intact. That buy signal will remain in effect for 22 trading days, unless stopped out by $VIX re-entering "spiking mode." And now currently, there is a new trend of $VIX signal in place.

Overall, things continue to improve, as a majority of our indicators -- but not all -- are bullish. A move above 6150 would be very positive, of course. In any case, we will trade individual signals as they occur, and we will continue to roll deeply in-the- money options.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation