By Lawrence G. McMillan

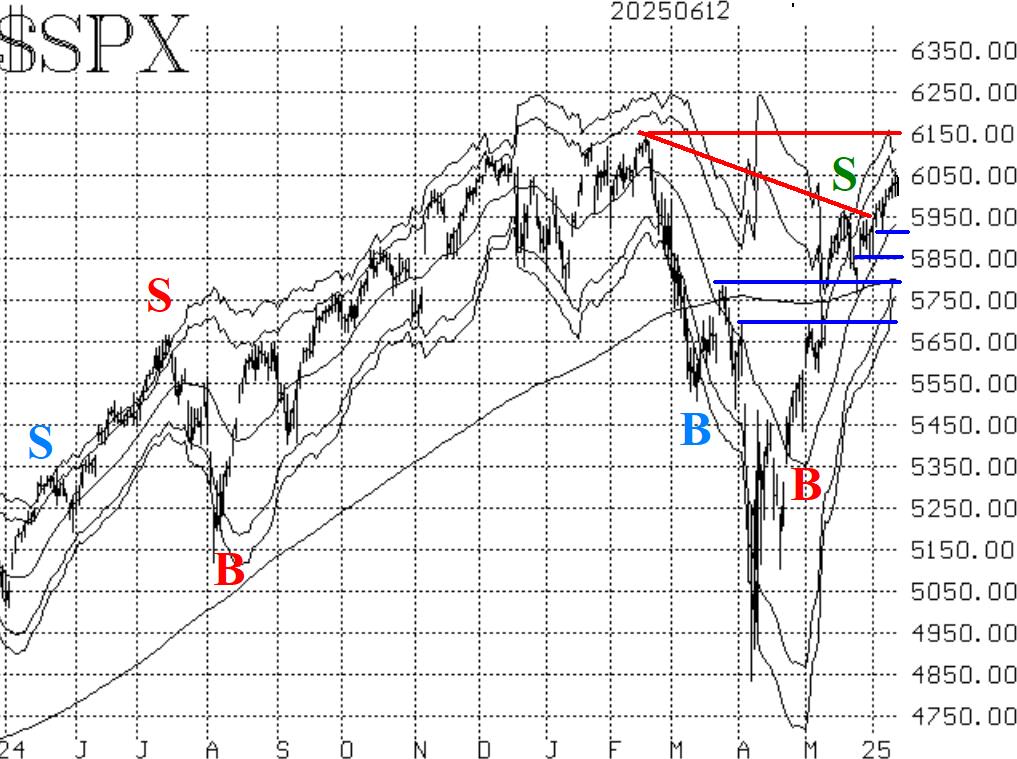

The broad market continues to inch higher, and has so far remained above the previous downtrend line that connected the February and May highs. The only overhead resistance is the all-time highs at 6150. There are several support levels below, from 5940 down to 5700. Several of them are denoted with horizontal blue lines on the $SPX chart in Figure 1.

Thus, as far as the $SPX chart itself is concerned, the bullish case is still intact. However, some of the internal indicators are beginning to wane, partly because the pace of the $SPX advance has been so slow recently. That has allowed overbought conditions to roll over to sell signals.

Meanwhile, there has been a major development in the equity- only put-call ratios. Both are now on confirmed sell signals. Earlier this week, the computer analysis programs were "saying" that these ratios were going to roll over to sell signals. However, visual confirmation was required (by me). That has now been attained as both ratios jumped higher yesterday even though $SPX closed at a new relative high for this move. Today's selling in the broad market is likely to further solidify these new sell signals.

Market breadth has weakened over the past few days especially in NYSE terms. The "stocks only" breadth has been stronger. So, now the NYSE breadth oscillator is rolling over to a sell signal although it doesn't have two-day confirmation yet.

$VIX has continued to decline, and that has been beneficial to both of its current buy signals. The first is the "spike peak" buy signal of May 23rd. That signal lasts for 22 trading days (so another 10 days or so).

The other $VIX signal is the trend of $VIX buy signal, which was just confirmed a week ago (marked with a square on the lower right of the $VIX chart in Figure 4).

In summary, we still expect $SPX to trade at a new all-time high, but we're not going to be stubborn about it. We will take all confirmed signals that appear along the way. And just as important: roll deeply in-the-money options as they occur.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation