By Lawrence G. McMillan

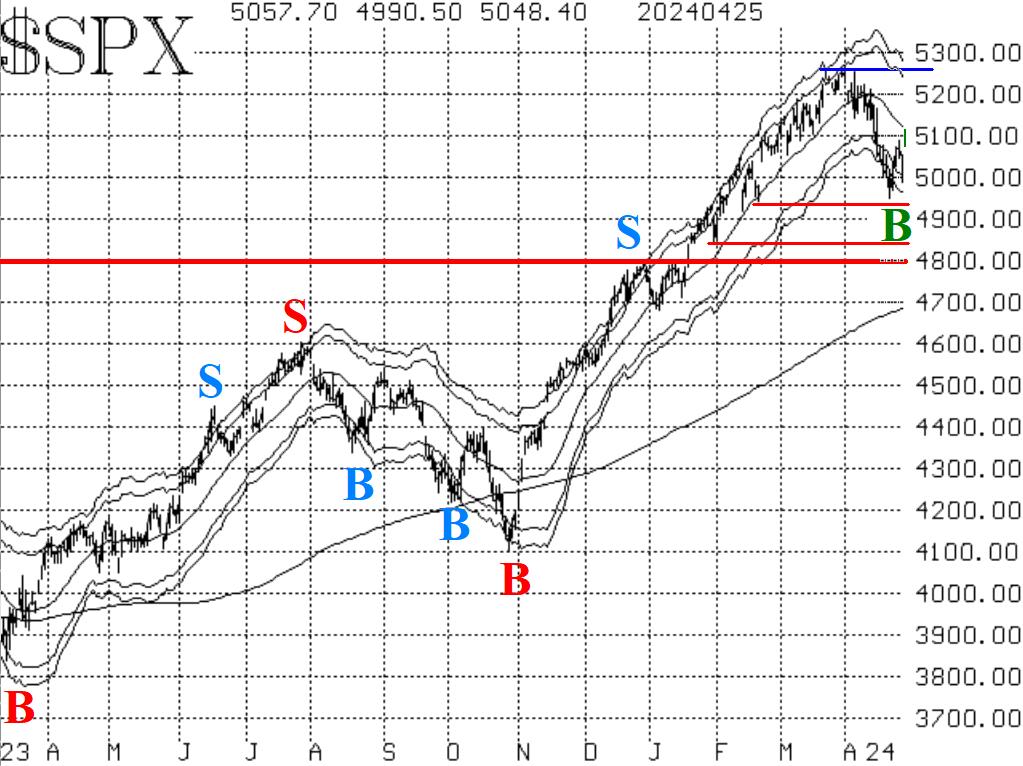

Stocks fell sharply after the beginning of the month of April and reached an oversold condition about a week ago. Since then, a strong oversold rally has unfolded, generating some buy signals along the way. From strictly an $SPX chart point of view, things are still bearish. Most oversold rallies die out after reaching the declining 20-day moving average, and this one just reached that target this morning (Friday, April 26th). Sometimes there is an overshoot, but there is resistance just above there, at 5180, and then of course at the all-time highs, near 5260.

There is support at 4950, the lows of last week, whence this rally began. Below there is the very important support level of 4800. 4800 was the high of the previous bull market that ended in January 2022, and then 4800 was also a resistance area at the end of last year. But once it was broken through on the upside, 4800 became a support level, and still is.

Equity-only put-call ratios remain on sell signals for stocks, though. They have continued to move higher at a rapid pace, even while the oversold rally was taking place in the stock market. These sell signals will remain in effect until the ratios roll over and begin to trend downward.

Breadth has been all over the place. The NYSE breadth oscillator confirmed a buy signal on April 23rd. The "stocks only" breadth oscillator has not really registered a two-day confirmation buy signal, but if today's (April 26) rally holds throughout the day, then the "stocks only" oscillator will fall in line with a buy signal as well.

$VIX has bounced around with these recent stock market movements, and two opposing signals have been confirmed as a result. First, $VIX generated a trend of $VIX sell signal on April 17th, but then followed with a "spike peak" buy signal on April 22nd.

In summary, we are maintaining a "core" bearish position because of the negativity of the $SPX chart and because of the sell signals from the equity-only put-call ratios. However, we have traded the other confirmed signals around that and will continue to do so.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation