By Ryan Brennan

Do You Sell Naked Puts? If not, you may want to consider doing so. People often stay away from uncovered put writing because they hear that it is "too risky" or that it doesn't have a sufficient risk-reward. The truth is that put-selling, when secured by cash, is actually less risky than owning stock outright and can out-perform the broad market over time. The following article debunks myths surrounding put-writing and explains some of the benefits of this simple-yet-effective strategy.

Put-Selling is Conservative

"The basic concept of option writing is a proven investment technique that is generally considered to be conservative. It can be implemented as 'covered call writing' or, alternatively, 'naked put writing' – which is the equivalent strategy to covered call writing."1

Put-Selling Offers a Better Risk-Adjusted Return

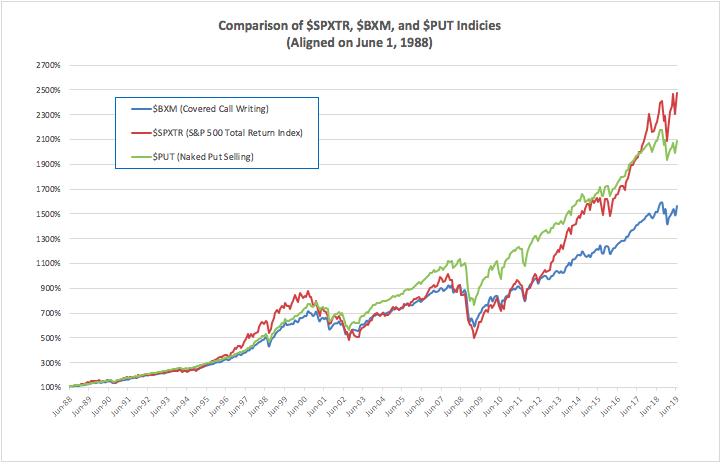

The Chicago Board Option Exchange (CBOE) has created certain benchmark indices so that investors can compare covered call writing ($BXM), naked put selling ($PUT), and the performance of the S&P 500 Index including dividends ($SPXTR). The chart below compares these indices, with all three aligned on June 1, 1988.

Although The S&P 500 Total Return Index has slightly outperformed $PUT since inception, one can see the Cboe S&P 500 PutWrite Index ($PUT) has achieved close to the same returns with much less volatility. $PUT averaged 9.65% annually, with a standard deviation of 9.94%, resulting in a Sharpe Ratio of 0.39, while $SPXTR averaged 10.21% annually with a standard deviation of 14.98% resulting in a Sharpe Ratio of 0.29. "For this reason, naked put writing is the preferred option-writing strategy that we employ" in our newsletter services.1

Positions Can Be Hedged

One of the main arguments against put-selling is that the draw-downs can be large in severe market downturns. One way to avoid these draw-downs would be to hedge each individual position or the entire put-sale portfolio. For example, in our publication The Daily Strategist Newsletter, we attempt to offset the market risk that is inherent to option writing by continually hedging our portfolio with dynamic volatility-based modern portfolio protection techniques.

The Odds Can Be in Your Favor

Out-of-the-money put-selling win rates based on statistical analysis such as probability and expected return can be quite impressive. For example, The Daily Strategist has produced a combined 89.4% winners in its index and equity naked put-selling/covered-writing trades since the newsletter started recommending them in May of 2007.

In summary, contrary to what may be popular opinion, naked-put writing is a conservative strategy that has the potential to out-perform the broad market over time. When implemented correctly, the strategy can have high rates of success and can also be hedged against large stock market-drawdowns. Investors looking for put-selling trading ideas and recommendations on a daily or weekly basis may be interested in The Daily Strategist or The Option Strategist newsletters.

For naked-put selling ideas and actionable trade recommendations, subscribe toThe Daily Strategist newsletter. Free 7 day trials are available.

1Lawrence G. McMillan, The Volatility Capture: Total Return Program, 2014, p. 2.

© 2023 The Option Strategist | McMillan Analysis Corporation