Ends Jan 5, 2026.

By Lawrence G. McMillan

Neutrality, as it applies to option positions, means that one is non-committal with respect to at least one of the factors that influence an option's price. This isn't quite the same neutrality that governments display -- theirs being a much more diplomatic undertaking -- but it is a viable approach to trading options. Simply put, this means that one can design an option position in which he may be able to profit, no matter which way the underlying security moves.

Most option strategies fall into one of two categories: 1) as a hedge to a stock or futures strategy (for example, buying puts to protect a portfolio of stocks), or 2) as a profit venture unto itself. This latter category is where most traders find themselves, and they often approach it in a fairly speculative manner -- either by buying options or by being a premium seller (covered or uncovered). In such strategies, the trader is taking a view of the market; he needs certain price action from the underlying security in order to profit. Even covered call writing, which is considered to be a "conservative" strategy, is subject to large losses if the underlying stock drops drastically.

It doesn't have to be that way. Strategies can be devised that will have a chance to profit regardless of price changes in the underlying stock, as well as because of them. Such strategies are neutral strategies and they always require at least two options in the position -- a spread, straddle, or other combination. Often, when one constructs a neutral strategy, he is neutral with respect to price changes in the underlying security. It is also possible, and often wise, to be neutral with respect to the rate of price change of the underlying security, with respect to the volatility of the security, or with respect to time decay. This is not to imply that any option spread that is neutral will automatically be a money-maker; rather one looks for an opportunity -- perhaps an overpriced series of options -- and attempts to capture that overpricing by constructing a neutral strategy around it. Then, regardless of the movement of the underlying stock, the strategist has a chance of making money if the overpricing disappears. Many of the strategies recommended by The Option Strategist will be of this type. In this issue, the concept of being neutral with respect to price changes in the underlying security -- "delta neutral" -- will be discussed. Coming issues will feature discussions on being neutral with respect to other factors.

Delta Neutral

The "delta" of an option is the measure of how much the option changes in price for a one-point move in the underlying stock. For example, if XYZ is at 50 and the Jan 50 call has a delta of 0.50, then the call can be expected to increase by 1/2 point (0.50) if XYZ rises one point in price. Conversely, the call will lose 1/2 point if XYZ falls one point. Deeply in-the-money calls have deltas approaching 1.00 (the maximum value), while deeply out-of-the-money calls have deltas that approach zero (the minimum value). Deltas of puts are expressed as negative numbers -- to signify that they move in the opposite direction of the underlying security -- and range between 0 (far out-of-the-moneys) and -1.00 (deep in-the-moneys).

One popular type of neutral position is to be "delta neutral". A delta neutral position is one in which the sum of the projected price changes of the long options in the spread is essentially offset by the projected price changes of the short options in the same spread.

Example: XYZ is trading at 50. The following three options are trading with the prices and deltas indicated. Furthermore, the "theoretical value" of each option is shown:

|

Option

|

Price

|

Delta

|

"Theoretical

Value" |

| Jan 50 call |

3

|

0.55

|

3.50

|

| Jan 55 call |

1.50

|

0.35

|

1.48

|

| Feb 50 put |

3.50

|

0.40

|

3.44

|

Assuming that one can rely upon these "theoretical values" (a big assumption, by the way), it is obvious that the Jan 50 call is cheap with respect to the other options -- they are close to their values while the Jan 50 is 50 cents under. The neutral strategist would want to buy the Jan 50 call and hedge his purchase with one of the other two options presented. One choice would be to establish a spread wherein the Jan 50 calls are bought and a number of Jan 55's are sold. To determine how many are to be bought and sold, one merely has to divide the deltas of the two options:

Delta neutral spread ratio = 0.55 / 0.35 = 11-to-7

Thus, a delta neutral ratio spread would consist of buying 7 Jan 50's and selling 11 Jan 55's. To verify that this spread is neutral with respect to the change in price of XYZ, notice that if XYZ moves up in price 1 point, the Jan 50 will increase in price by 0.55; so seven of them will increase by 7 * 0.55 or 3.85 points total. Similarly, the Jan 55 will increase in price by 0.35, so 11 of them would increase in price by 11 * 0.35, or 3.85 points total. Hence the long side of the spread would profit by 3.85 points while the short side loses 3.85 points -- a neutral situation.

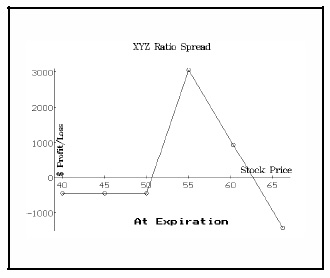

The resulting position is a ratio spread. The profitability of the spread occurs between about 51 and 62 expiration as shown in the profit picture on the next page, but that is not the major point. The real attractiveness of the spread to the neutral trader is that if the underpriced nature of the Jan 50 call vis-a-vis the Jan 55 call should disappear at any time, the spread should produce a profit, regardless of the short-term market movement of XYZ. The spread could then be closed if this should occur. To illustrate this fact, suppose that XYZ actually falls to 49, but the Jan 50 call returns to "fair value."

The resulting position is a ratio spread. The profitability of the spread occurs between about 51 and 62 expiration as shown in the profit picture on the next page, but that is not the major point. The real attractiveness of the spread to the neutral trader is that if the underpriced nature of the Jan 50 call vis-a-vis the Jan 55 call should disappear at any time, the spread should produce a profit, regardless of the short-term market movement of XYZ. The spread could then be closed if this should occur. To illustrate this fact, suppose that XYZ actually falls to 49, but the Jan 50 call returns to "fair value."

|

Option

|

Price

|

Delta

|

"Theoretical

Value" |

| Jan 50 call |

3

|

0.55

|

2.95

|

| Jan 55 call |

1.13

|

0.35

|

1.13

|

| Feb 50 put |

3.88

|

0.40

|

3.84

|

Notice that the "theoretical values" in this table are equal to the "theoretical values" from the previous table, less the amount of the delta. Since the XYZ Jan 50 call is no longer underpriced, the position would be removed and the strategist would make nothing on his Jan 50's but would make 3/8 on each of the 11 short Jan 55's for a profit of $412.50, less commissions.

This example leaned heavily on the assumption that one is able to accurately estimate the "theoretical value" and delta of the options. In real life, this chore can be quite difficult since the estimate requires one to define the future volatility of the common stock. This is not easy, and will assuredly be the topic of many articles in the future. However, for the purposes of a spread, the ratio of the two deltas can be relied upon. Moreover, the example didn't require that one know the exact theoretical value of each option; rather, the only knowledge that was required was that one of the options was cheap with respect to the other options.

Delta neutral straddle ratio = 0.55 / 0.45 = 11-to-9

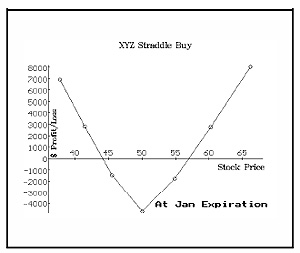

Thus a delta neutral straddle position would consist of buying 9 Jan 50 calls and buying 11 Feb 50 puts. The straddle has no market exposure, at least over the short term. Note that the delta neutral straddle has a significantly different profit picture from the delta neutral ratio spread, but they are both neutral and are both based on the fact that the Jan 50 call is cheap. The straddle makes money if the stock moves a lot, while the other makes money if the stock moves only a little.

Thus a delta neutral straddle position would consist of buying 9 Jan 50 calls and buying 11 Feb 50 puts. The straddle has no market exposure, at least over the short term. Note that the delta neutral straddle has a significantly different profit picture from the delta neutral ratio spread, but they are both neutral and are both based on the fact that the Jan 50 call is cheap. The straddle makes money if the stock moves a lot, while the other makes money if the stock moves only a little.

Can these two vastly different profit pictures be depicting strategies in which the same thing is to be accomplished (that is, to capture the underpriced nature of the XYZ Jan 50 call)? Yes, but in order to decide which strategy is "best", the strategist would have to take other factors into consideration: the historic volatility of the underlying security, for example, or how much actual time remains until January expiration, as well as his own psychological attitude towards selling uncovered calls. The application of these factors will be discussed in future issues.

Note that the neutral approach is distinctly different from the speculator's, who, upon determining that he has discovered an underpriced call, would merely buy the call, hoping for the stock to increase in price. He could never make money, as the ratio spreader did in the first example, if XYZ fell in price. "The Option Strategist" will attempt to identify mispriced derivative securities and design neutral positions around them, so that subscribers may be able to have profitable positions that are not so subject to market risk.

Originally published in The Option Strategist Newsletter Volume 1, No. 1 on December 10th, 1991.

© 2023 The Option Strategist | McMillan Analysis Corporation