By Lawrence G. McMillan

One of most important things an option trader watches is volatility. The daily Volatility History report in The Strategy Zone offers you the data you need to be a well-prepared option trader: three historical volatility levels, plus implied volatility, and the percentile of implied volatility.

By Lawrence G. McMillan

There are various trading strategies -- some short-term, some long-term (even buy and hold). If one decides to use an option to implement a trading strategy, the time horizon of the strategy itself often dictates the general category of option which should be bought -- in-the-money vs. out-of-the-money, near-term vs. long-term, etc. This statement is true whether one is referring to stock, index, or futures options.

By Lawrence G. McMillan

With the “fiscal cliff” dominating the news, the media tries to link every market wiggle to what some politician has just said about it. Meanwhile, there are plenty of real market forces that are influencing the stock market, but those seem to only be of interest to participants who aren’t media addicts – i.e., only a few. It is our contention that these “real” factors are what is actually driving the market.

By Lawrence G. McMillan

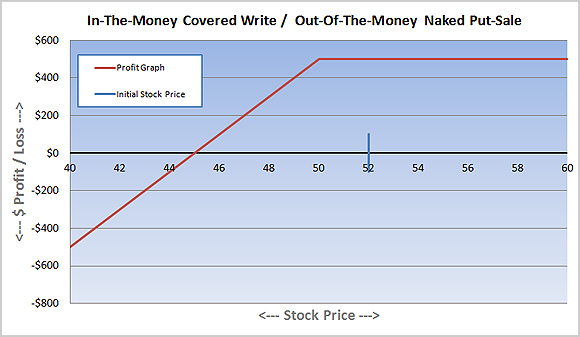

In past issues of The Option Strategist Newsletter, we have stated that we mainly utilize naked put sales rather than covered call writes in its traditional form – even for cash accounts. Several readers have asked not only how this works, but why we do this. So let us explain.

By Lawrence G. McMillan

I was recently asked what guidelines I generally follow in my option trading. This is actually a rather thought-provoking question, especially when it regards something one does almost every day. In our feature articles, many useful general strategies have been given, but not assembled all in one place. After giving the matter some thought, it seemed like it might be beneficial to list some of the "rules" that we follow, either consciously or sub-consciously after all these years.

By Ryan Brennan

Naked put-selling is a very popular and potentially profitable trading strategy, but choosing what puts to sell can sometimes be a guessing game. McMillan's Probability Calculator Software is a very helpful tool for analyzing potential put-sales since it can estimate the chances of making money in your positions.

By Lawrence G. McMillan

This market is becoming the ultimate in defying bearish opinion. Since June 1st, $SPX has advanced almost exactly 150 points and is nearly back to the yearly highs -- and therefore at a post-2008 high. Yet, bearish opinion is still rather rampant.

$SPX remains within the rising trading channel that extends back to early June (see Figure 1). It is near the top of the channel, so in that sense, it is "overbought."

Equity-only put-call ratios continue to remain on buy signals.

Watch McMillan's Traders Expo educational video interviews on portfolio protection, option strategies for high volatility environments and "90% days" at the money show website. Click on the links below to watch each video topic.

In this video recorded at the TradersExpo Las Vegas, Lawrence McMillan, founder of McMillan Analysis, explains what he means by a "90% day," and why it can provide important signals for both traders and investors.

Click here to visit MoneyShow.com and watch the video

Released: 11/29/2011

Focus: STOCKS