By Lawrence G. McMillan

We’re going to look at two things here. First, there was recently a period of five trading days in which both $VIX and $SPX were up each day. That has never happened before. Is it significant, or might it be?Second, we have been seeing implied volatility trading significantly higher than realized volatility. That is a subject that we’ve addressed in the past, but we are going to update that analysis to incorporate current conditions.

$VIX and $SPX both up five days in a row

This is something that has never happened before. Is it significant? We went back through the entire history of $VIX prices, and found that once before there had been a 4-day sequence: from 1/29/96 through 2/1/96. At that time, the market was up sharply after that sequence – rising 2% over the next ten trading days. Eventually, it gave up those gains, but then rallied again later. Of course, a sample size of one means nothing.

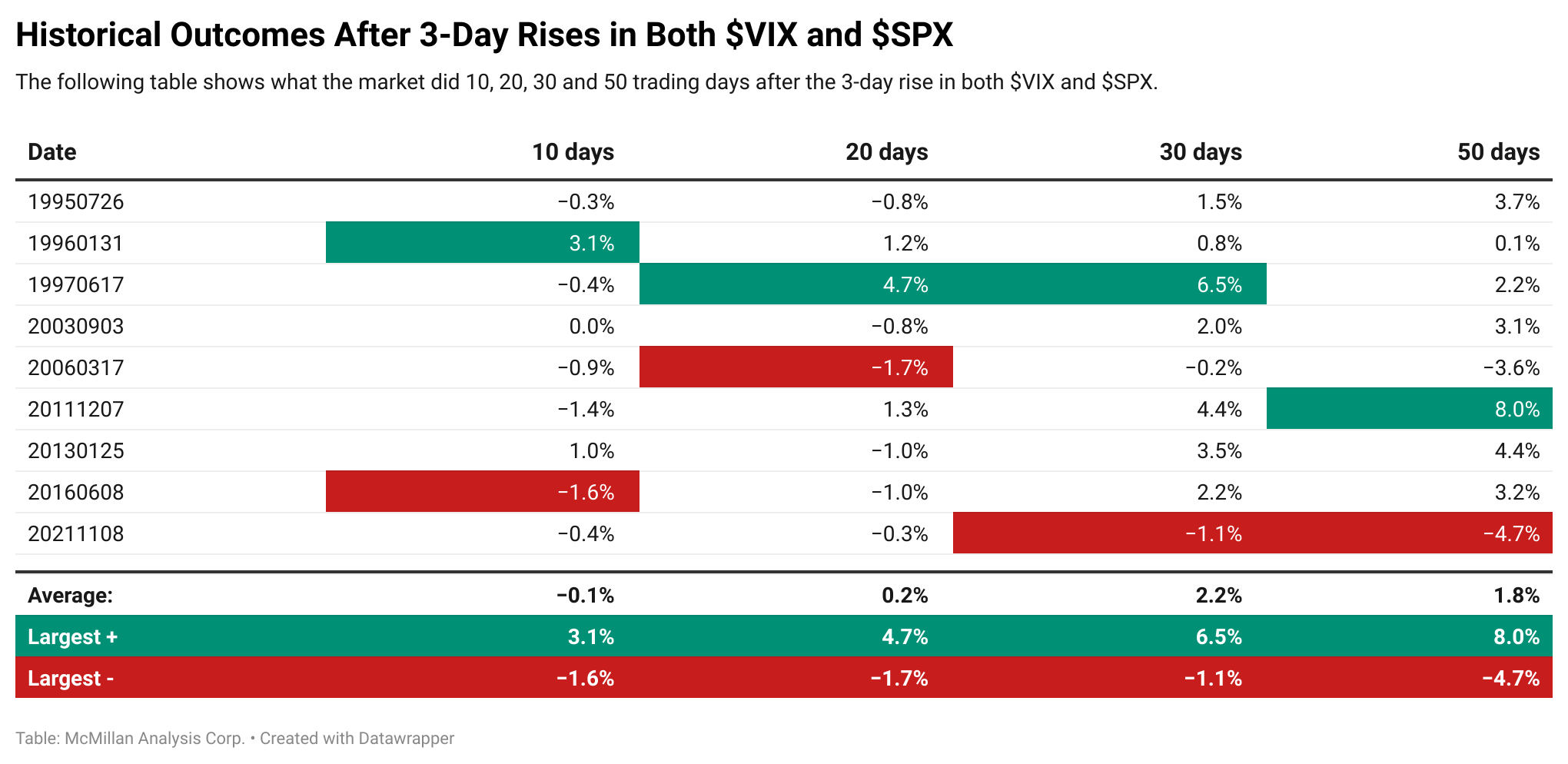

So, we looked at cases where both $VIX and $SPX had been up for three days together. There are nine of those, not including the most recent one. Even a sample size of nine is questionable, but if a distinct pattern emerged it might be worth considering. The following table shows what the market did 10, 20, 30 and 50 trading days after the 3-day rise in both $VIX and $SPX...

Read the full article by subscribing to The Option Strategist Newsletter now. Existing subscribers can access the article here.

© 2023 The Option Strategist | McMillan Analysis Corporation