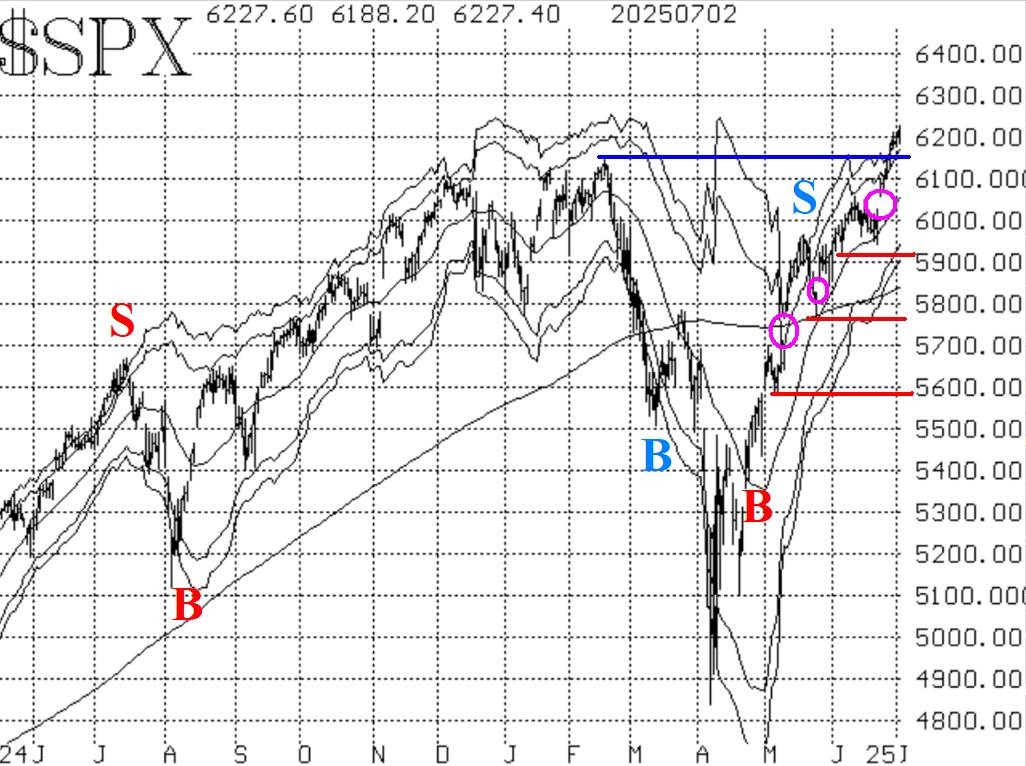

The stock market, has continued to rise, registering new all-time highs repeatedly. It appears that the current breakout to new all-time highs is stronger than the failed one of last February. There is support at 6150 (the old highs), 6020 (the highest circled gap on the accompanying $SPX chart in Figure 1), and 5920. A pullback below 5920 would negate the current upside breakout, but I don't expect that to happen.

The market internals are strong. This is in stark contrast to the upside breakout in February when they were not. Equity-only put-call ratios had been on a sell signal, but that has been stopped out by the fact that both ratios have moved to new relative lows below the June lows. So, they are once again on buy signals in overbought territory.

Breadth has been very strong since new all-time highs were reached by $SPX. Thus, the breadth oscillators are on buy signals and are overbought. It is a good thing for them to be overbought when $SPX is pushing into new all-time high territory.

Implied volatility, in the form of $VIX, has declined and that presents a bullish situation. Both the $VIX "spike peak" buy signal of June 24th and the trend of $VIX buy signal remain in place. It would require a sharp rise in $VIX to stop out either buy signal.

In summary, the situation is bullish. The $SPX chart is bullish and so are most of the internal indicators. We will, however, trade any confirmed signal that occurs. Meanwhile, continue to roll calls that are deeply in-the-money up to higher strikes.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation