By Lawrence G. McMillan

Stocks sold off on the Israel-Iran conflict, but only modestly as it appeared that traders were most worried about the U.S. directly entering the conflict which hasn't happened. Moreover, there has not been any particular disruption in the flow of oil.

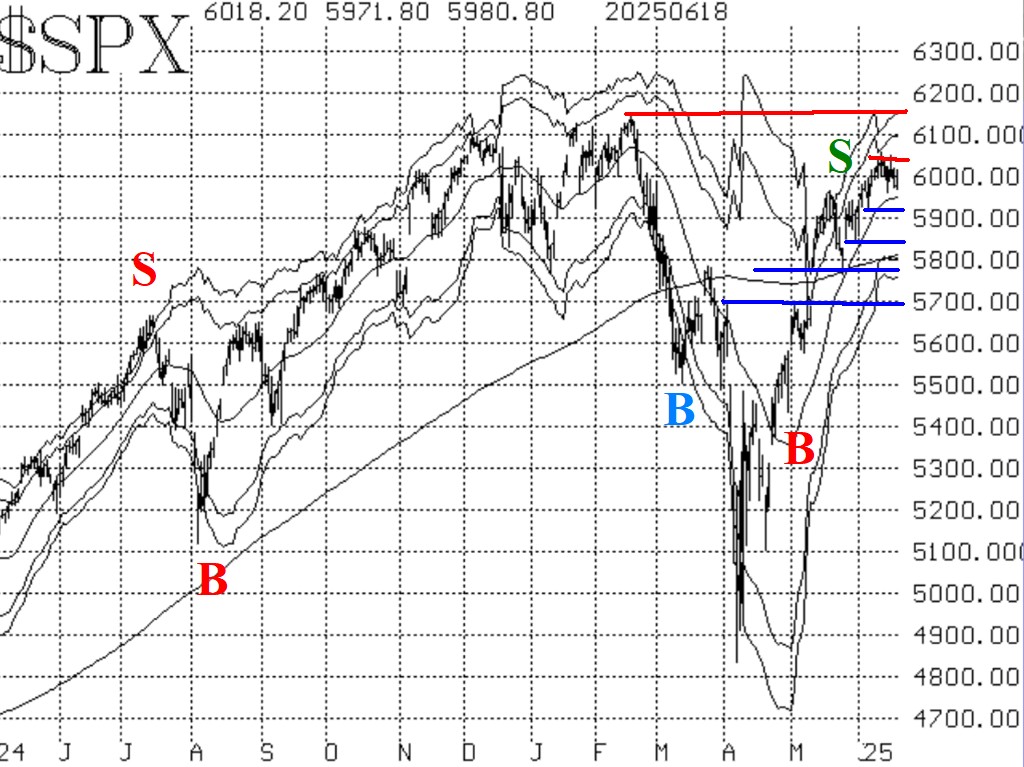

The chart of $SPX remains bullish. It did not even trade down to last week's lows at 5920, which is a support area. There are several more support areas, all the way down to 5700. They are marked with blue horizontal lines on the $SPX chart in Figure 1. Meanwhile, there is resistance at 6060 (recent highs) and then at 6150 (the all-time highs).

Even with the $SPX chart remaining positive, the internal indicators have begun to slip in some cases. The equity-only put- call ratios remain on the new sell signals that they generated last week.

Breadth oscillator sell signals were reaffirmed this past week, after two particularly negative days on June 13th and 17th. These breadth oscillators can swing quickly, and are thus subject to whipsaws, but for the moment they are back on sell signals.

$VIX has not risen much recently but it remains very close to its 200-day Moving Average, which is a primary factor in our trend of $VIX signals. Technically, the trend of $VIX buy signal remains in place.

Meanwhile, $VIX did advance enough to re-enter "spiking mode" as of the close of trading on June 13th. Its high that day was 22.00. A new "spike peak" buy signal will occur if $VIX closes at or below 19.00.

In summary, the $SPX chart remains bullish, while many of the internal indicators are bearish. That type of situation is usually resolved in favor of the $SPX chart. Regardless, we will trade individual signals as they occur and will continue to roll deeply in- the-money options.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation