By Lawrence G. McMillan

Some companies typically make a large gap move after earnings are reported. Large post-earnings moves are caused by the fact that – for some companies – it is difficult for analysts to accurately forecast the earnings. Historically, NVDA has been one of many such companies.

Prior to the actual earnings announcement, option traders bid up the combined price of the puts and calls, reflecting an event-driven (earnings) one-day move. They use a variety of analyses to determine how much to pay for the straddle, but since the earnings are hard to predict, these straddle prices are often inaccurate in forecasting just how far the stock is going to move, post-earnings.

NVDA is set to report earnings after the NYSE close on Wednesday, May 28. The option market is expecting a post-earnings move of 7.4%. We’ll see in this report that the option market has greatly lowered its expectations from where they had been in the past.

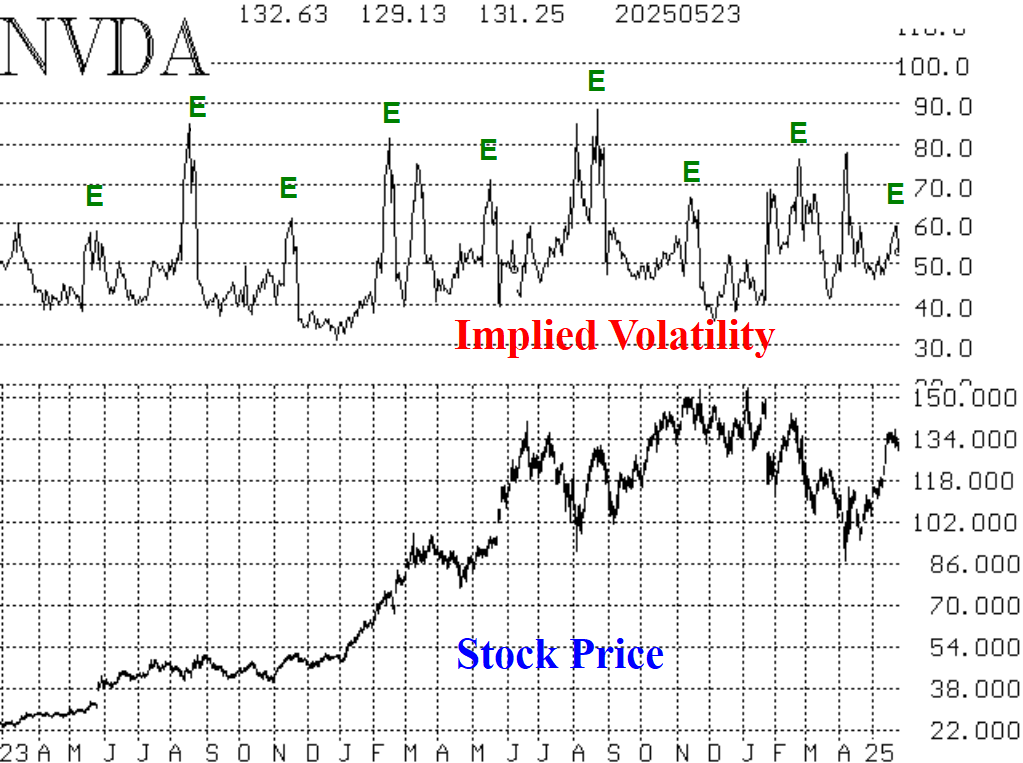

The option traders’ penchant for bidding up the price of the straddle in advance of the earnings shows up quite clearly in a chart that includes both stock price and composite implied volatility. The current chart is shown above.

Note the spikes in implied volatility (marked as “E” on the chart) in advance of every earnings report. There are some other spikes in implied volatility, but that’s just because NVDA is one of the more volatile stocks, and sometimes other news besides earnings can cause option traders to aggressively pay up for the options. It is probably also worth noting that NVDA stock price split 10-for-1 in June 2024, and implied volatility has been more subdued since then.

The last 10 earnings reports have produced the following one-day moves in NVDA:

Prior to the last two earnings reports, the near-term NVDA straddle cost 9.5% and 9.4% respectively. That was more than the actual post-earnings moves of –8.47% (February 2025 earnings) and +0.53 (November 2024). In fact, the November 2024 earnings report produced the smallest move of the entire data set. Alternatively stated, the analysts got that earnings forecast right, while option traders were far too optimistic in their expectations for the impact of that earnings report on the stock price.

At the current time, NVDA is trading near 135, and the NVDA (May 30) 135 straddle is selling for 10. That’s an expected move of 7.41% (10 divided by 135). As one can see from the above table, that’s right in the middle of the absolute values of the previous 10 post-earnings moves – higher than five of them, and lower than five of them.

If the straddle cheapens slightly to the point where one could buy it for 6.3% of the stock price (which would be a straddle price of 8.50 with the stock at 135), then it would be cheaper than six of the previous ten post-earnings moves.

It’s interesting to note that this quarter, the straddle price is down to 7.4%, as compared to 9.4% and 9.5% the last two quarters. In fact, we went back and looked at the straddle prices in front of each of those last ten earnings reports. Here is what we found.

Simply stated, option traders have been overly optimistic about the size of the post-earnings moves for the last seven quarters. This optimism was probably based on the large gap moves after the February 2023 and May 2023 earnings reports, which produced post-earnings moves of 24.36% and 14.02% -- far exceeding the respective straddle costs of 6.79% and 7.78%. In fact, the current quarter is the first time since then that the straddle has cost so little.

So, is it worth buying this straddle at 7.4% currently? Probably not. It seems to be just a toss-up compared with the earnings moves of the past ten quarters (higher than five, lower than five). If you can buy it for 6.3% (a straddle cost of 8.50 with the stock at 135), then it might be worth a small speculation. Even so, based on past post-earnings moves, the option market still seems to be overstating the size of the expected move.

© 2023 The Option Strategist | McMillan Analysis Corporation