By Lawrence G. McMillan

The broad market continued to rally through May 20th -- even shrugging off a downgrade of US debt over the weekend. But on Wednesday (May 21st), a poorly received US Bond auction finally sent the market spiraling downward 100 points. That was enough to generate some sell signals.

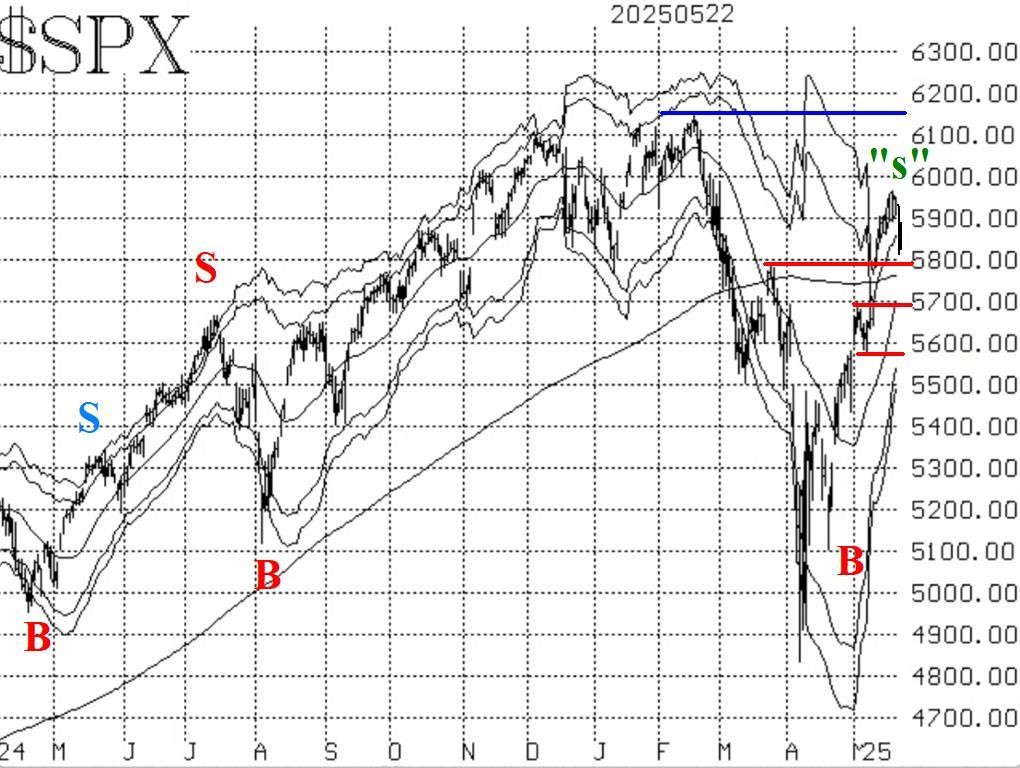

The $SPX chart is now probing below 5800, perhaps looking to close the gap at 5700. Those are support levels and would not deter the bullish case. The rising 20-day moving average is also at about 5700. Below there is another support area from early May, at 5580. If $SPX should close below there, the chart would have turned negative once again and that might even be true if it closes below 5700.

Equity-only put-call ratios remain bullish as they continue to fall. That could change, of course, but for now they are still bullish in their outlook for stocks. The are nearing the lower regions of their charts, which is overbought territory for this buy signal, but is certainly not a sell signal.

Breadth is an area that has turned negative. The breadth oscillators rolled over to sell signals as of the close of trading yesterday, May 22nd. That is a two-day confirmation of the sell signal, which is what we require for these often-whipsawed oscillators. The last buy signal was a strong one, though, so we will be trading these new sell signals as well.

$VIX is an area that has generated another new sell signal. $VIX has once again closed above its 200-day Moving Average for two consecutive days, so that confirms a new Trend of $VIX sell signal. That will remain in place until $VIX closes back below its 200-day MA for two consecutive days. However, $VIX is also in "spiking mode" (it rose more than 3.00 points from May 16th through May 21st three trading days). So, a new "spike peak" buy signal will be forthcoming when $VIX pulls back from its peak, which frankly could occur as soon as today!

In summary, things have quickly taken a bearish turn, with a number of sell signals appearing. However, all is not lost for the bullish case, so we will continue to trade the individual signals as they occur, stopping out trades by the rules of each individual trading system. Also, it is important to roll deeply in-the-money options.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation