Nov, 25, 2025

By Lawrence G. McMillanWe have several seasonal trades around Thanksgiving, and we’ll get into those more in next week’s newsletter, but for now we want to prepare to enter the first part, which is...

Nov, 24, 2025

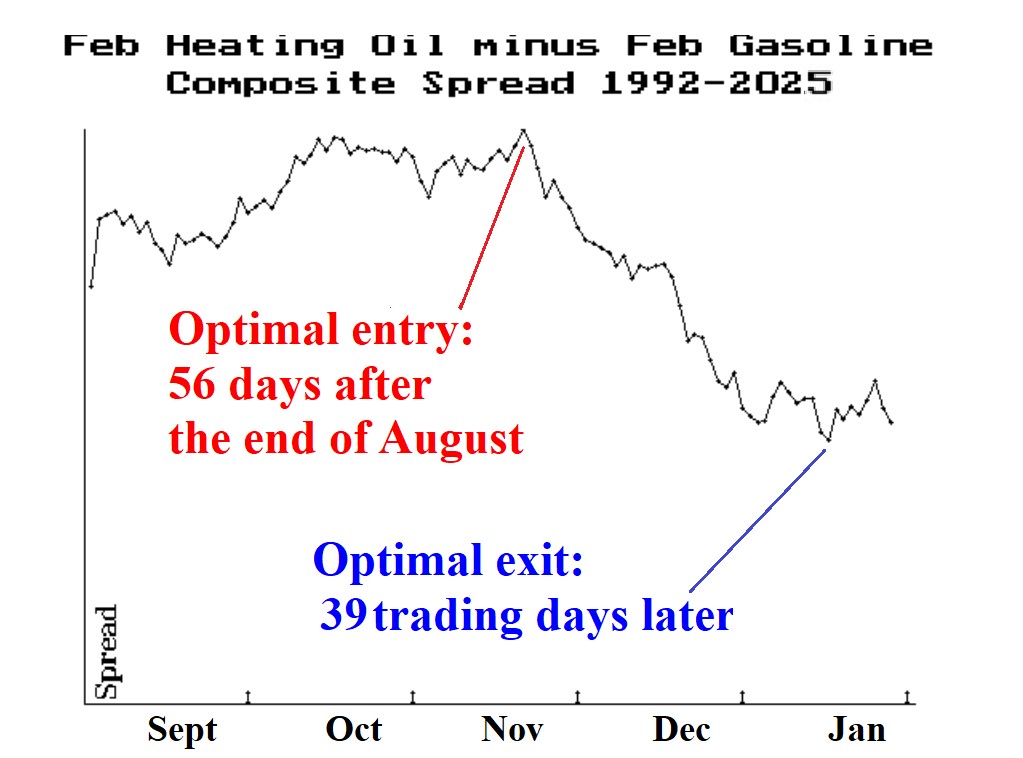

By Lawrence G. McMillanWe have been trading this seasonal spread annually every year since 1994, except for 1995. Last year, we were stopped out with a rather large loss after 53 trading days....

Nov, 21, 2025

By Lawrence G. McMillanStocks sold off early in the week, but traders were sort of waiting around for the NVDA earnings, which were released after the close on Wednesday, November 19th. When those...

Nov, 17, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on November 17, 2025.

Nov, 14, 2025

By Lawrence G. McMillanIf you missed my presentation at the MetaStock Stock & Option Traders Conference on November 11, 2025, the full replay is now available.In this session, I break down the...

Nov, 14, 2025

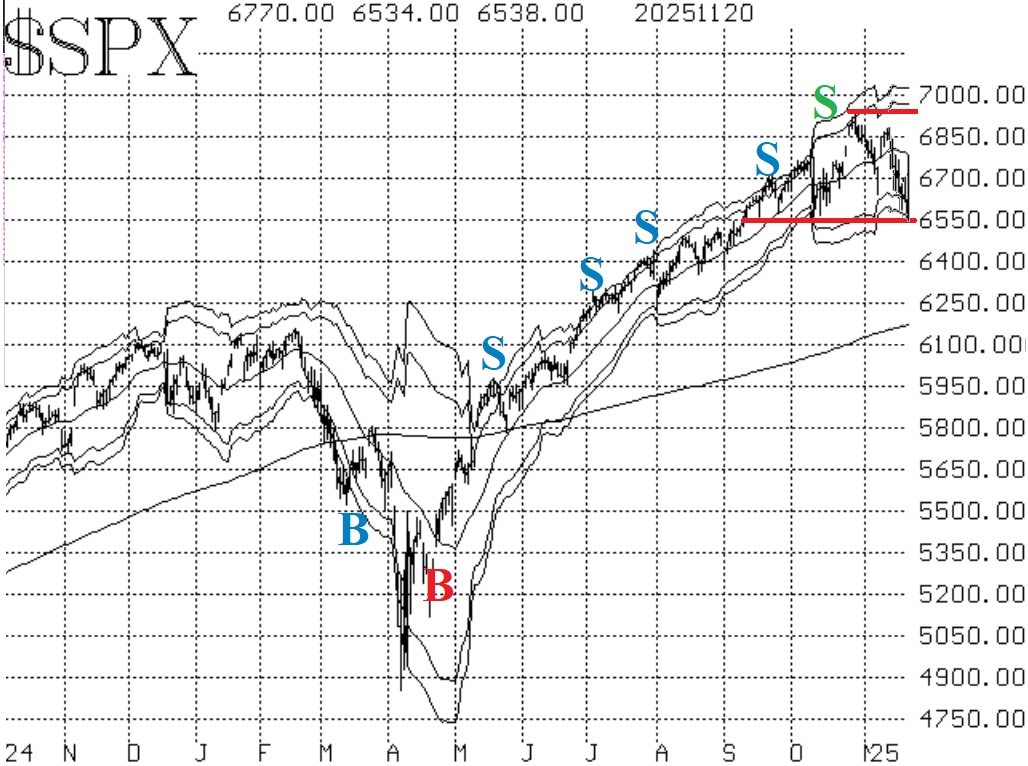

By Lawrence G. McMillanFor over a week now, strong selloffs have been followed fairly quickly by strong rallies. This is the type of action that occurs in a trading range environment, and we might...

Nov, 10, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on November 10, 2025.

Nov, 07, 2025

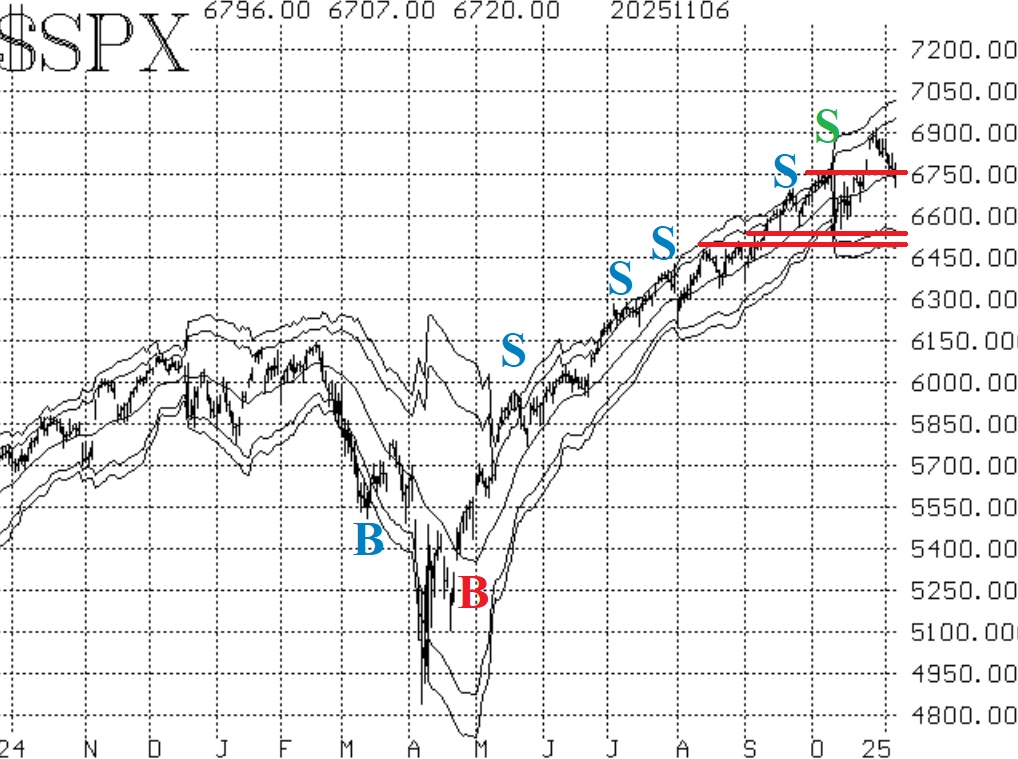

By Lawrence G. McMillanAfter having gapped to new all-time highs a little more than a week ago, the broad stock market has gone into a modest (so far) corrective mode. $SPX has now closed both of the...

Nov, 03, 2025

By Lawrence G. McMillanJoin Larry McMillan as he discusses the current state of the stock market on November 3, 2025.

Oct, 31, 2025

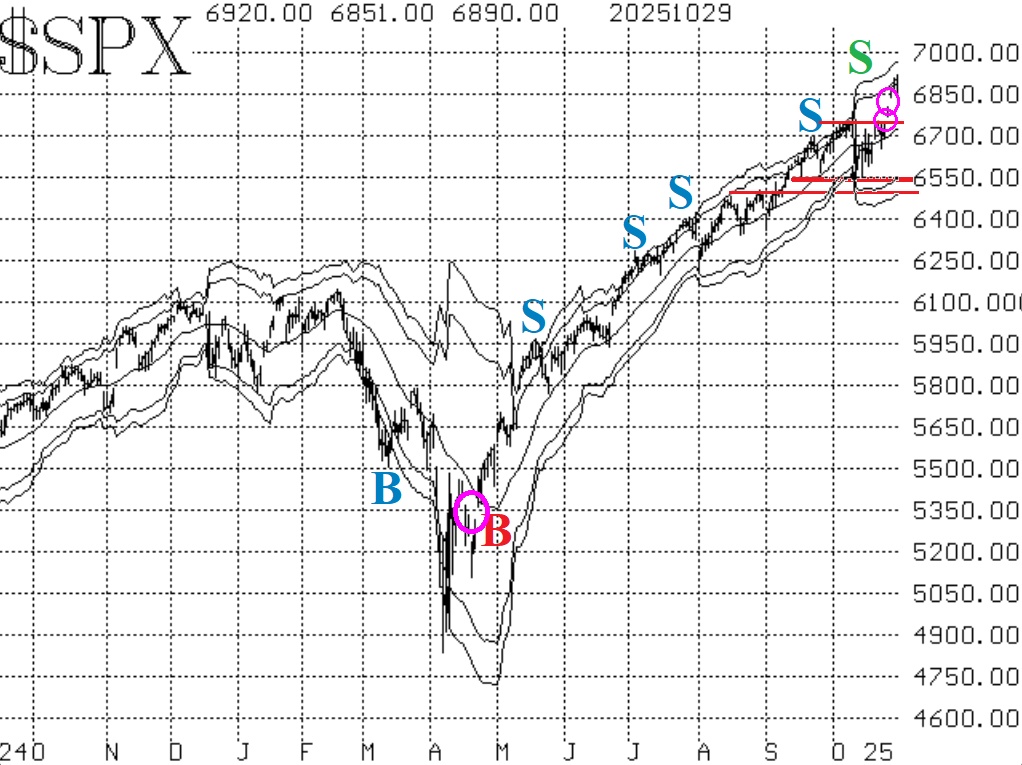

By Lawrence G. McMillanThe market eventually shrugged off the most recent "tariff tantrum" and moved to new all-time highs. The breakout came on two gap days to the upside -- very strong action. That...

Pages

© 2023 The Option Strategist | McMillan Analysis Corporation