By Lawrence G. McMillan

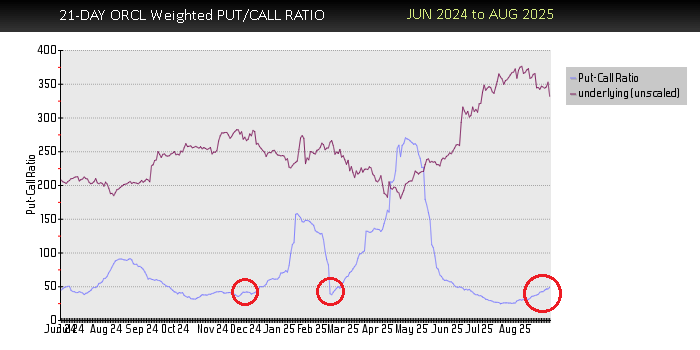

Oracle Corp. ($ORCL) just flashed a notable technical shift this morning: a weekly MVB Sell Signal — its first since January 2025 (chart above). The stock also recently issued a weighted Put-Call Ratio Sell Signal (below), meaning several of our intermediate-term indicators are now pointing in the same bearish direction. When these signals align, the probability of further downside increases.

A Look Back at the Rally

Oracle has been one of the market’s standout performers in 2025. After bottoming in April, the stock surged on strong demand for its cloud infrastructure and AI-driven database products, riding the same wave of enthusiasm that lifted other large-cap tech names. A weekly MVB Buy Signal at the April lows added fuel to the move, and the stock hasn’t looked back since.

From there, Oracle steadily carved out a bullish trend, consistently printing higher highs and higher lows through the summer. The momentum carried the stock above $260, reflecting investors’ confidence in both the company’s long-term growth story and the broader technology sector’s resilience.

What’s Changed?

Today’s action, however, breaks that pattern. Oracle traded at a new low for the first time in months, setting off the sell signals. If the stock can close below 225, that would be confirmation of the breadown. On the daily chart, there is also an open gap near $190 — a potential downside target if the stock closes below 225 and the selling accelerates.

While Oracle’s business fundamentals remain strong, our indicators suggest the stock is due for at least an intermediate-term pullback. For traders, this creates opportunities on the short side, or at the very least, a reason to exercise caution if holding long positions.

Get the Tools We Use

- MVB Trading Charts & Signals → Learn more here

- Daily Put-Call Ratio Signals & Charts → Available as part of The Strategy Zone

© 2023 The Option Strategist | McMillan Analysis Corporation