By Lawrence G. McMillan

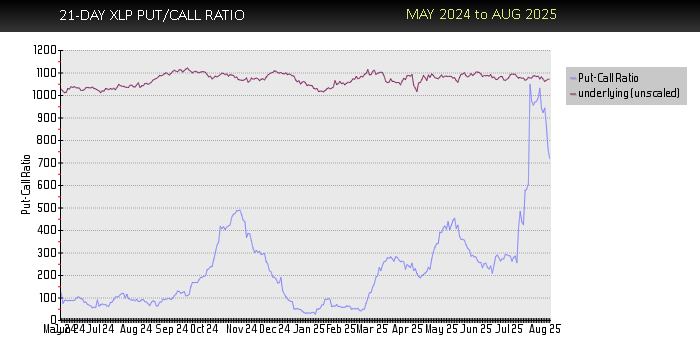

$XLP (Consumer Staples Select Sector SPDR Fund) just triggered a weighted put-call ratio buy signal, as its weighted 21-day put-call ratio peaked at extreme levels and has now begun to roll over. This type of signal typically suggests that bearish sentiment has reached a capitulation point, and that upside follow-through likely.

XLP, which tracks defensive consumer staples names like Procter & Gamble and Walmart, has been trading sideways for several months following an April rebound. Today’s move higher, supported by the sentiment reversal in the options market, adds weight to the bullish technical case.

However, context matters: when a defensive sector like Consumer Staples begins to outperform, especially on the back of extreme hedging activity, it can signal growing unease about the broader market. Investors often rotate into staples when they’re worried about riskier areas such as tech, cyclicals, or small caps.

So while the signal implies further upside for XLP in the short term, it may also reflect a market environment where participants are becoming more defensive.

For put-call ratio signals and charts on a daily basis, subscribe to The Strategy Zone.

© 2023 The Option Strategist | McMillan Analysis Corporation