Ends Jan 8, 2026.

By Lawrence G. McMillan

This article was originally published in The Option Strategist Newsletter Volume 12, No. 2 on January 23, 2003.

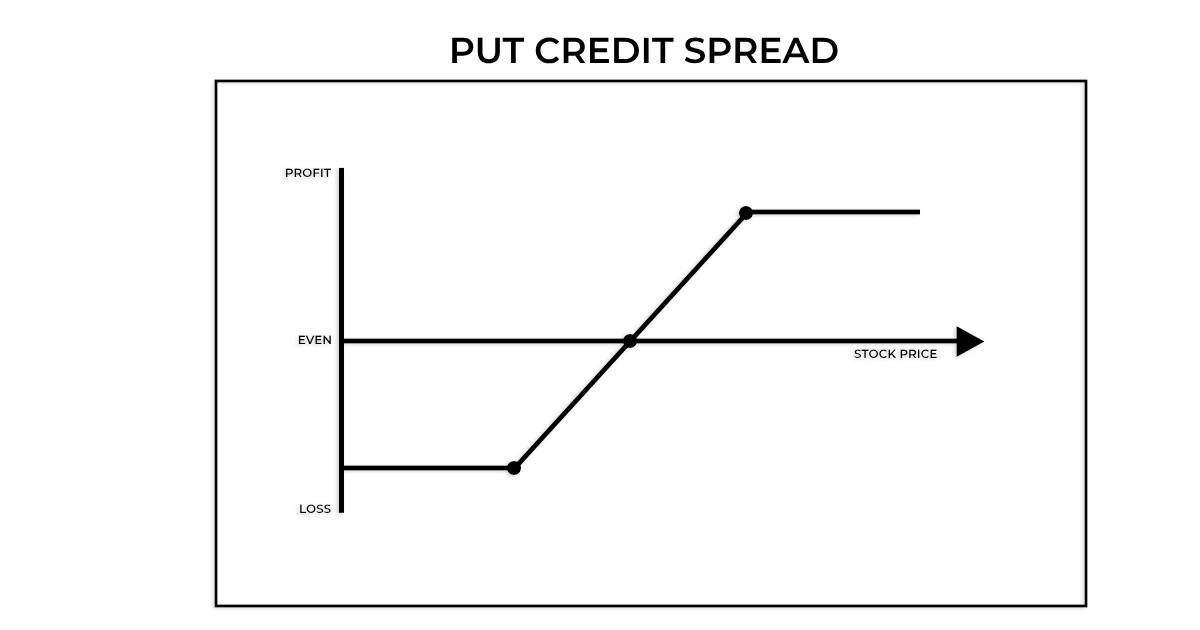

We have often stated that we prefer to sell index options naked rather than use credit spreads, when conditions are “right.” When are conditions right? When options are expensive, when there are strikes beyond those you intend to use – so that you have somewhere to roll to for defensive purposes, and when you as a trader are suitable. Suitability involves having the experience to adhere to stops, the financial wherewithal to margin the position adequately (to the point where you expect to take defensive action), and the psychological makeup to handle the potential risk involved.

Often, traders find that the hardest of those three suitability requirements to satisfy is the one regarding margining the position. Even if one uses futures options (S&P’s, say) to take advantage of the lower margin requirement on naked futures options, there can still be considerable margin required if one wants to margin the position as if the underlying had moved to the striking price of the written option – a requirement that is considerably larger than the initial margin. This is where a credit spread might help. Buy an out-of-the-money option at a fractional price (so as to not give away much profit potential) and then the margin will only be the difference in the strikes – almost certain to be less than the margin required for an at-themoney option (which is what you should set aside otherwise).

This article was originally published in The Option Strategist Newsletter Volume 12, No. 2 on January 23, 2003.

© 2023 The Option Strategist | McMillan Analysis Corporation