By Lawrence G. McMillan

This article was originally published in The Option Strategist Newsletter Volume 13, No. 16 on August 27, 2004.

Recently, stocks have been responding with undue volatility to earnings and other corporate announcements. The option market has recognized this, and we have seen a great number of stocks with horizontal skews and high implied volatility preceding these earnings reports, etc. In this article, we’ll discuss this phenomenon, presenting some guidelines as to if and when trades are viable for option strategists.

Background

As usual, since we have some new readers who may not be familiar with some of the terms – and even some of our regular subscribers may need a review – we’ll spend some time on the definitions and basics before getting into the more esoteric aspects of the subject.

When option traders know that an “event” lies on the horizon, but the outcome of the event is unknown, then the options will get more expensive. The event may be an earnings announcement, or possibly an FDA hearing, a verdict in a lawsuit, or some other news that might cause the stock price to experience a sudden jolt – either up or down. In general, the event date may or may not be known (although one has to have some notion of the time horizon in order to price options). In addition, the outcome of the event – earnings better or worse than expected, FDA ruling as an approval or a denial, a jury verdict of guilty or not guilty – is not known in advance. Thus, the stock price may remain rather stable up until the event, because traders of the stock don’t really know what the event’s outcome is going to be.

However, option traders will generally speculate on how volatile the event will be. Typically, all the options on the stock become somewhat more expensive, with the options expiring just after the event date being the most expensive of all. Hence, if a company is going to report earnings this week, and the marketplace feels that the earnings announcement could be volatile, then the September options will be the most expensive, with October options and December options, say, being less expensive.

We have written articles in the past about this subject: Volume 7, No. 4; Volume 8, No. 17; and Volume 9, No. 20. Our general conclusion has been that buying straddles in advance of earnings is not nearly as profitable as buying straddles in advance of other events. In fact, in the long term, buying straddles in advance of earnings is normally a losing proposition.

The Current Situation

However, there are exceptions to nearly every “general” observation, and recently we have seen some huge moves after earnings announcements. Not all have been “predicted” by option prices in advance, but several have. Usually, one doesn’t see a big surge in implied volatility and a large increase in the skew of a stock’s options unless there is some information circulating in the rumor mills that the earnings will be outrageously good or bad. But, in the past month there has been an abundance of such situations. Many have not proven to be profitable, even though the skew was very steep and there was very heavy option volume in advance of the earnings.

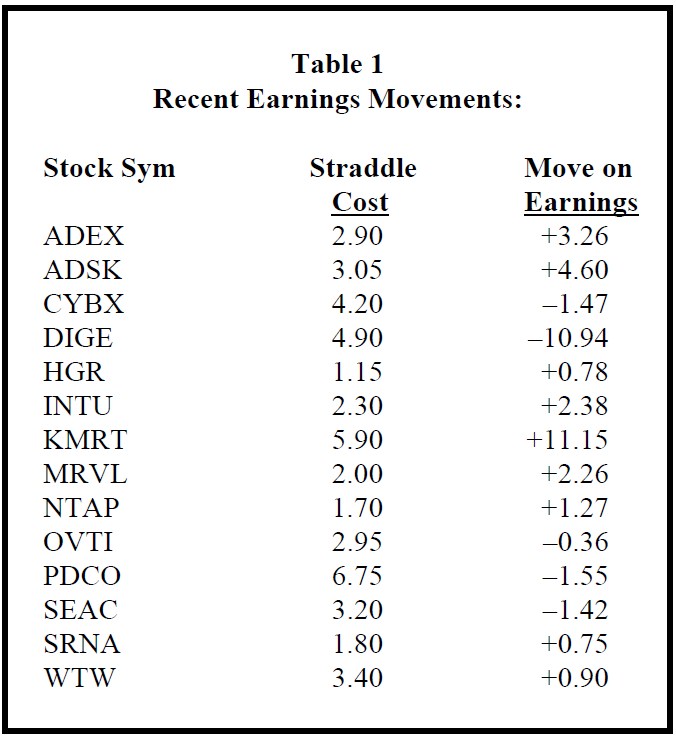

The list in Table 1 summarizes some of the major ones that have had skews and/or high implied volatility in advance of the earnings announcement. The “move on earnings” column is the amount by which the stock closed up or down the next day. In some situations, the stock opened with a much smaller move and that move was exacerbated during the trading day. Very few had any follow-through on subsequent days. So, if you are going to try this strategy, it seems best (currently) to exit on the close of the first day the earnings news is being assimilated into the marketplace. By the way, there were a few situations where the stock initially opened down but then reversed and traded up substantially (INTU and MRVL, for example). If you have the skills for day trading, you might be able to improve on the “sell at the end of the first day” strategy.

One that did not have a skew, and did not have heavy put volume in advance of the earnings was Sanderson Farms (SAFM), which fell 11.10 after earnings were reported. The straddle had sold at 5.50 the day before. In fact, there was above-average call buying in SAFM the day before it dropped so much. It just goes to prove that not everything is leaked in advance!

Even with the big moves in KMRT and DIGE, a straddle buyer would have only made a small profit in these earnings-based situations. And, should you have failed to buy either one of those, you would have a loss – had you bought all of the others on the list.

This analysis is consistent with observations that we have made in the past regarding buying straddles in advance of earnings. In our previous writings on the subject, we estimated that straddle buyers lost in these situations. Not a large loss, but still a loss. With some of the big moves in recent weeks, it seemed that perhaps things had changed, and they have to a certain extent – for the data in Table 1 represents a small profit to the straddle buyer.

There doesn’t seem to be any connection between the steepness of the skew or how long it lasted prior to the earnings date, and the actual result of the straddle buy. That is a little disappointing. We had expected to find some correlation, but there really isn’t any. Neither DIGE nor KMRT had expensive options more than a few days before the earnings, while situations such as MRVL and OVTI had volatility building for quite some time prior to the earnings date itself.

So, it might behoove one to pay attention to earnings movements in this market which seems to be treating results with more volatility than usual. In general, however, the following approach may be better.

Note: Table 1 does not include movements based on events such as Possis Medical’s (POSS) release of disappointing drug trial data that caused the stock to fall by 12 points. POSS options had been expensive and skewed prior to the “event,” but there was no advance announcement of the timing of the trial results.

This type of ”event” falls into the more general category of non-earnings news. It is usually found in pharmaceutical and biotech companies – particularly smaller ones – as they react to FDA hearings or drug testing results.

These can sometimes be telegraphed months in advance, as was the case with Cyberonics (CYBX) early this year. CYBX options rose in implied volatility from late March through early June before positive FDA news doubled the stock price.

In other cases, the lead time is short. For POSS, the options only gain volatility sharply for about five days before the disappointing trial results were released.

An FDA hearing normally has a longer lead time because it has to be scheduled with that governmental body. The release of drug trial results doesn’t require much lead time at all, since it is up to the discretion of the company making the announcement.

One big event about to occur is in Eyetech Pharm (EYET), which is having an accelerated FDA hearing on its drug for treatment of macular degeneration, Macugen, on Friday, August 27th. The stock is likely to be halted that day, so you will not have a chance to buy the straddles prior to the event.

Others on the horizon include Maxim Pharm (MAXM) – which is supposedly announcing trial results in late September – Atherogenics (AGIX), Eli Lilly (LLY), Elan Corp. (ELN), Novavax (NVAX), and United Therapeutics (UTHR). Another stock that has expensive options right now is Select Comfort (SCSS), the mattress company, as mold has been found in its mattresses, and the consequences to the company are unknown at the present time.

Strategy

There are a number of ways to play these event-driven situations. In general, one would want to be long if he feels volatility will be great. Even if he suspects the option traders have overpriced the situation (which sometimes happens), he would want to be hedged, for it is not a pleasant experience to be naked calls into something like a CYBX favorable report, where the stock rose 20 points in just over a day.

The simplest strategy, of course, is the straddle buy. In this case, one buys the near-term straddle since it is the least costly in dollar terms (even though it might be quite expensive in terms of implied volatility). As noted earlier, the straddle would generally be removed on the day after the event occurs. Waiting around does not always pay off (CYBX, for example, has lost back all the ground it gained back in June). In general, I would suggest making the straddle delta neutral when bought, so that you have approximately equal profit potential on an upward move or a downward move.

Another strategy that is similar to the straddle buy is one sometimes practiced by market makers or other professionals who don’t have to worry about margin requirements for naked options. Essentially, one buys the near-term call, sells the farther-term call in an equal dollar amount, and uses the underlying stock to create a delta neutral position.

Example: last Tuesday, OVTI was about to announce earnings, and the stock was trading at 11.65. Buying either the Sept 12.5 straddle (for 2.95 points) or the Sept 12.5 call-Sept 10 put strangle (for 1.70 points) would require a fairly steep ratio to make it delta neutral. The following approach can make the position neutral about the current stock price.

The following data existed:

Sept 12.5 call: 1.00 (delta 0.47) Dec 12.5 call: 1.80 (delta 0.54)

An “even-money” spread would be constructed by buying 18 of the Sept 12.5 calls at 1.00 and selling 10 of the Dec 12.5 calls at 1.80. $1800 would be expended on the Sept calls, while $1800 would be taken in from the sale of the Dec calls.

The resulting position is not delta neutral.

Long 18 Sept 12.5 calls = delta long 846 shares

Short 10 Dec 12.5 calls = delta short 540 shares

Net: long 306 shares

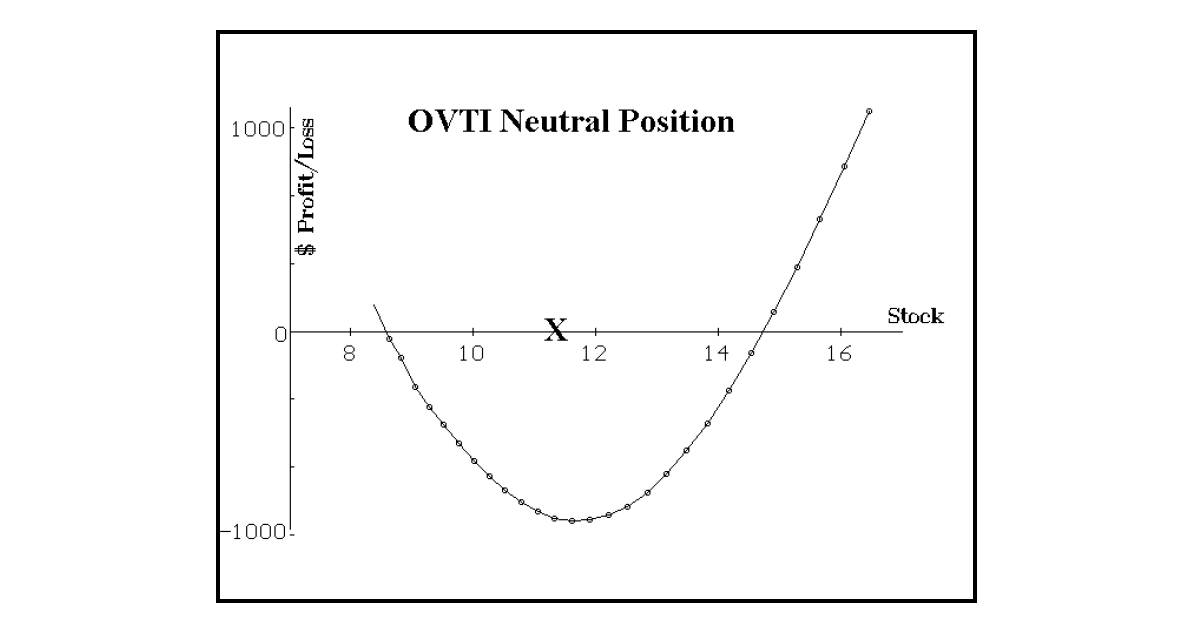

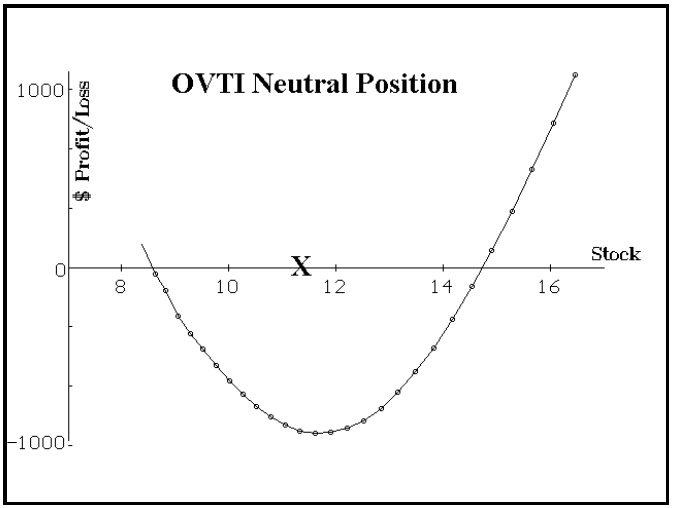

So a short sale of 300 shares of OVTI would neutralize the position. The profit graph below shows the profit potential of the position if it were removed within 2 days:

The breakevens are approximately 14-1/2 and 8-1/2 – about 3 points either way from the current stock price. That is the same distance from the stock as the Sept 12.5 price.

For those wanting a more neutral strategy, there is always the calendar spread. Calendar spreads are attractive in these situations since the near-term options are much more expensive than the longer-term ones. However, the drawback is that both options are overpriced and can thus be expected to lose implied volatility after the event. There are two things that can cause losses in calendar spreads: 1) a decrease in overall implied volatility, and 2) extreme movement by the underlying stock. Both are possible if one buys a calendar spread where the options are expensive in advance of an event. The first problem can be eliminated, though, if implied volatility levels are not high prior to the event. This is possible, although not likely. At the current time, options on NPS Pharma (NPSP) are very skewed, but are only in the 46th percentile of implied volatility. Hence they might make an excellent calendar spread – especially since there is no announced event on the horizon. See page 8 for a recommendation.

Another hedged strategy one might use when he thinks there is a chance that the stock will not move much is one we wrote about earlier this year: buy a large number of calendar spreads and also buy a few short-term straddles.

Example: suppose XYZ is trading at 30, and there is a large skew between the December and September options. If one were to buy 10 December-September call calendar spreads (with a strike of 30), and also were to buy 3 September straddles, this would be his position:

Long 10 Dec 30 calls Short 7 Sept 30 calls Long 3 Sept 30 puts

The idea here is that the calendar spreads would make money if the stock were unchanged, while the straddles would make money if the stock moved by a great deal. Note that this position would profit if the movement were large, since there are 3 extra long calls and there are 3 unencumbered long puts. Remember, though, that if the options are expensive when the position is established, the calendars won’t make much money. Hence, once again, this strategy is best if the options are not too expensive to begin with.

Finally, there is the choice of selling naked options. This is extremely dangerous and I would not recommend it unless you are a very sophisticated trader. Even market makers do not go into these events naked. They will attempt to get themselves delta neutral with positive gamma if at all possible. Positive gamma means that they have a position that will make money if a large move occurs in the stock.

Summary

When options are skewed and expensive, they are that way because an event is about to occur. There are several ways to play the event, mostly involving long straddles. Remember that it is usually the case that the options are underpriced in terms of the movement that the stock makes after the event (even though they are statistically expensive) – especially in situations not related to earnings).

This article was originally published in The Option Strategist Newsletter Volume 13, No. 16 on August 27, 2004.

© 2023 The Option Strategist | McMillan Analysis Corporation