By Lawrence G. McMillan

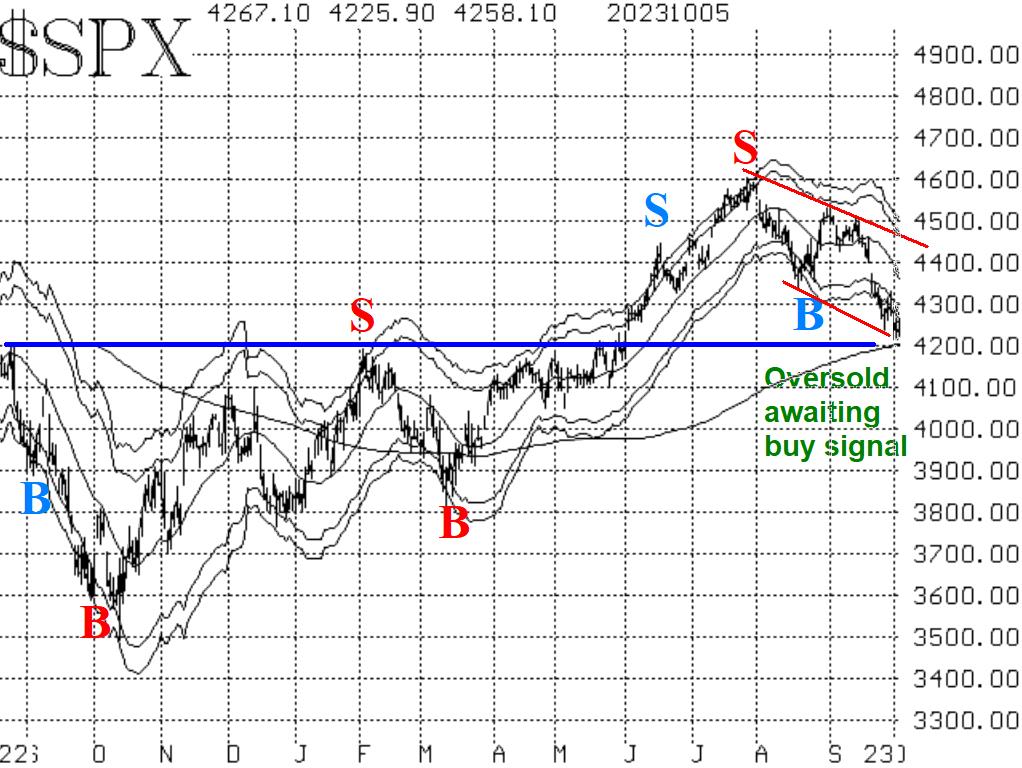

Stocks continue to fall, as the downtrend that began at the end of July persists (red lines on the chart in Figure 1). New relative lows were made again this week, so the pattern of lower highs and lower lows is evident. That defines a downtrend, and it also warrants holding a "core" bearish position.

Overhead, there is resistance in the 4330 to 4400 area. There is support at 4200, since it was previously a resistance area -- blue horizontal line in Figure 1. The 200-day Moving Average of $SPX, which is still rising, is also in the 4200 area. That may be enough to initially provide a launch point for an oversold rally, but it seems to me that this market will be making lower lows into a later date in October, at least.

Equity-only put-call ratios continue to race higher and that keeps them on sell signals. They will remain that way until they roll over and begin to trend lower. Other put-call ratios are moving to extreme oversold states as well.

Market breadth has mostly been poor, and both breadth oscillators remain on sell signals, mired in oversold territory. It is going to take at least a couple (maybe three) days of positive breadth in order to generate buy signals from these oscillators.

Meanwhile, the volatility complex -- which has been our most bullish indicator for nearly a year now -- has begun to waffle as well. $VIX is in "spiking" mode, and as long as that is the case, the market can decline (even sharply, perhaps). Eventually, though, $VIX will generate a new "spike peak" buy signal.

Just a mention of seasonality: October has seen some severe stock markets declines, during which oversold conditions are exacerbated. Eventually, though, October has earned the nickname "bear killer" because those oversold conditions get so extreme that a meaningful market bottom often forms in October. That might just be the case again this year. Meanwhile, we are maintaining a "core" bearish position because of the downtrend on the $SPX chart which is the dominant technical feature at this time.

This Market Commentary is an abbreviated version of the commentary featured in The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation