By Lawrence G. McMillan

This article was originally published in The Option Strategist Newsletter Volume 13, No. 5 on March 11, 2004.

In the last issue, we spelled out the details of the CBOE’s new volatility contracts, which are due to be listed on March 26, 2004. In this issue, we’ll spell out some strategies that every stock portfolio owner should consider – whether or not you currently trade options and/or futures. These new contracts (futures symbol: VX) are dynamic in that they will provide a hedge for you during a declining market, no matter when that decline occurs, and no matter where the market is when the decline begins. This is a vast improvement over, say, buying puts for insurance purposes. We’ll spell out the mechanics of operating such a hedging strategy, and we’ll look at some of the problems that may occur – at least as we can envision them from this vantage point in light of the fact that actual trading has not yet commenced.

A Futures Account Is Necessary

The CBOE’s volatility trading instrument is a futures contract, traded on the newly-created CBOE Futures Exchange (CFE). Thus, in order for any trader or investor to be able to trade the new contracts, he or she must open a futures account. Now, this may seem like a formidable impediment to many stock owners, but it shouldn’t be. You don’t have to trade corn, pork bellies, or cattle futures. No, you merely have to put some cash in a new account, fill out a new account form, and, voila, you are ready to trade the VX futures. The reasons that I highly recommend that all stock owners consider doing this will be laid out in this article. Suffice it to say that I believe this is the most efficient way to safeguard your assets during a bearish trend – or full-fledged bear market – that has yet been designed for use by the layman in the listed markets. The benefits of that ability to hedge are overwhelmingly superior to the minor inconvenience of having to open an additional account – a futures account – at your favorite brokerage firm.

A Review Of The Contract Details

This is a brief review of the details of the new futures contract. For a more detailed explanation, please see the feature article in the last issue – Volume 13, No. 4, of The Option Strategist Newsletter. The futures are based upon the CBOE’s Volatility Index ($VIX), which measures the implied volatility of the S&P 500 ($SPX) options traded there. As stated above, the futures base symbol is VX.

The futures will actual have, as their underlying, a new “Jumbo CBOE Volatility Index” (symbol: $VXB), which is merely $VIX multiplied by 10. A one point move in the VX futures will be worth $100. So, if $VIX moves by one point, from 15.00 to 16.00, say, then $VXB will move from 150 to 160, and if a VX futures contract also gains 10 points, then that would be a $1000 move (10 points at $100 per point).

There will be futures available in the nearest two contract months, plus two months in the Feb, May, Aug, Nov cycle. The futures last trading day will be the Tuesday immediately preceding the 3rd Friday of the contract month (which is option expiration day for stock and index options on the CBOE). Expiration of the VX futures takes place the next morning (Wednesday) on the opening, by a predetermined procedure. If held all the way to expiration, the VX futures will settle on their final day at the $VXB price at the opening of trading on expiration day.

A futures contract must be margined. While the margin requirements have not yet been set, it is likely that the margin for one contract will be on the order of $3000. The margin may fluctuate over time as the volatility of the underlying index ($VIX) increases or decreases.

Strategies For Protecting A Portfolio of Stocks

The reason that VX futures are a good hedge in a down market is that implied volatility – i.e., $VIX – shoots up when the market falls, especially if it falls sharply. The longterm graph of $VIX presented in the last newsletter clearly showed this, but if you have any doubts, just look at a longterm chart of $VIX and you will see that it rises strongly during declining markets.

So a simple hedge for a portfolio of long stocks would be to buy some volatility futures. Furthermore, as noted at the beginning of this article, a hedge of this sort is dynamic. That is, it works for you no matter when the market starts to decline (as long as it’s prior to the expiration of the VX futures contract you own), or from what level. This is distinctly different from buying put options as protection. In the latter case, if you buy puts as protection, but then the market rallies strongly for a while, your puts are then so far out-of-the-money as to be essentially worthless for insurance purposes, should the market suddenly decline from that elevated level. That is not the case with VX futures. They will shoot up whenever and wherever the market declines.

Suppose that you own a broad portfolio of stocks, and it is worth $100,000. Furthermore, you agree with the premise of hedging by buying VX futures. Let’s say you are cautious about the idea, though, and buy only one futures contract, as shown in the following example:

Example: with $VIX near 15 in April, you buy one August VX futures contract at a price of 159. Note: this means that there is a premium in the futures (150 would be parity, so you are paying 9 points, or $900, above parity to buy the futures). Such a premium is likely to be built into the futures, especially when they are trading at low levels, so that there is an expense to this hedging strategy – the premium in the futures.

Furthermore, let’s assume that your stock portfolio moves in line with the broad market, more or less.

Shortly thereafter, the market starts to head south, and gains momentum. By the time it has fallen 10%, $VIX has traded up to 20. Your futures contract is now trading at 205, say. So, you have a $10,000 loss (on paper) in your stock account and a 46 point gain ($4600) in your futures contracts. Now, the one futures contract has not completely hedged away the loss in your stock account, but it has certainly helped.

However, suppose that the market continues to decline and a bit of panic sets in. With the market now down 20% from the top, and falling rapidly, $VIX shoots up to 30. The futures should be trading somewhere near 300 – a gain of 141 points from your purchase price. So, while there is a $20,000 loss on paper in your stock account, you have a $14,100 gain in your futures account.

Thus, the futures provided an excellent hedge against a declining market. A complete hedge could have been constructed by buying more than one futures contract, of course. Once $VIX has made its move, you could remove the hedge or keep it, realizing that if the market rallied, you would lose back some of the profits on your futures. Of course, if the market continued to decline rapidly, your VX futures would shoot through the roof.

Just as an example, when the last bear market began in March, 2000, $VIX was near 20. By the time that bear market bottomed, in July or October, 2002, $VIX had risen above 40. Hence one VX futures contract would have appreciated by $20,000, had they existed at the time.

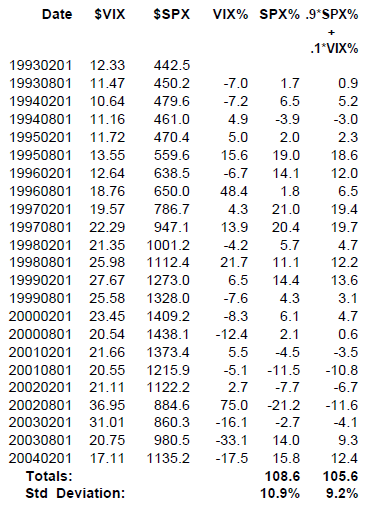

Such random or selective data points don’t make for a long-term study, though. So, let’s construct a more rigorous study. The following table compares the semiannual changes in $VIX and $SPX, in percentage terms. The final column shows how a portfolio would have done had it invested 90% of its assets in the $SPX Index and hedged that by taking a one-tenth position in the VX futures – in other words, the right-hand column is the 90% of the percentage change in $SPX plus one-tenth the change in $VIX.

With just this simplistic model – long 90% $SPX and long 10% VX futures – one can see the benefits of the hedge. The total profit is nearly the same, whereas the total of the $SPX % column is 108.6, while the same total for the hedged position (last column) is 105.6. However, the volatility of the portfolio was greatly reduced. Notice that during the bear market the $SPX was down five periods in a row, but in four of the five, the hedged portfolio lost less (since $VIX rose during those quarters). To put it in statistical terms, the standard deviation of the semi-annual returns was near 11% for the $SPX Index, while is was just above 9% for the hedged portfolio. Hence, the hedge not only reduces losses in a bear market, it reduces the volatility of the portfolio’s returns, while not harming the overall return significantly.

The above study is really quite simple. A more complicated study was performed by Merrill Lynch, and published until the title, “Volatility – The Perfect Asset?” The study was quoted in The Striking Price column in Barron’s this week. While it is quite mathematical in nature, several conclusions are drawn from the paper: a portfolio of long 10% VIX and long 90% SPX, rebalanced weekly, has outperformed the S&P 500 Index by about 5% per year with 25% lower risk since 1986 (Note: the strategy made a large amount of money, theoretically, in the crash of ‘87 since VIX rose nearly 7-fold on the day of the crash; this fact helps the overall returns since 1986. Without including 1987, the yearly outperformance was about 2% – still very respectable considering the lowered volatility of the combined portfolio).

What Can Go Wrong?

The theoretical studies above did not encompass one thing that we had shown in our original example on page 2 – there may be a premium in the futures contract. If one had to pay a premium consistently, that would reduce returns.

When can we expect the futures to have a premium? When they are low-priced as they are now. The reason I can state that with some assurance is this: $VIX trades in a range. Its lifetime low is about 10 and its lifetime high (excluding the Crash of ‘87) is about 60. So, when VIX is near 10, speculators will be buyers along with hedgers, and VIX will probably trade at a premium as a result. When VIX gets expensive – at or above 40, say, then VIX will probably trade with a discount, since sellers figure it will decline from there. The latter (discount) is less certain than the former (premium) because VIX could temporarily spike quite high, as it did in the Crash of ‘87.

However, it is a certainty that it cannot go below zero and cannot go up forever. So the lower it goes towards zero, the more buyers there will be among speculators and the higher it goes, the more sellers there will be. The speculative activity is likely to put a premium on the futures when they are low and perhaps produce a discount when they are high.

So, suppose that we as hedgers, pay 160 for the futures when VIX is 15.0. Yet, nothing transpires that quarter, and VIX is literally unchanged at quarter’s end. So the futures expire at 150 – a loss of $1000 per contract. Now, the hedger must buy the next futures contract, which is likely to have a premium, and the whole procedure could repeat itself. As long as VIX remains low-priced, the premium on the futures will likely persist, and the cost of the hedge will be increased by the amount of the premium.

I view this as the biggest problem with the hedging strategy. How expensive will the premium be? It’s hard to say at the current time, but since VIX can’t be arbitraged (there is no underlying or equivalent), it won’t necessarily remain at “fair value,” and therefore the premium may be larger than expected (see box, page 6). Even so, the strategy is worth consideration by any holder of stocks.

This article was originally published in The Option Strategist Newsletter Volume 13, No. 5 on March 11, 2004.

© 2023 The Option Strategist | McMillan Analysis Corporation