By Lawrence G. McMillan

This article was originally published in The Option Strategist Newsletter Volume 15, No. 2 on January 26, 20006.

The time is nigh for us to once again consider one of our most reliable seasonal trades – the January Seasonal. Simply stated, the system is this: buy “the market” at the close of trading at the close of the 18th trading day of January, and sell your position at the close five days later.

When we first began writing about this system – and for several years afterwards – its track record was impeccable. However, in the last few years, the system has had some problems. With a slight adjustment, which we detailed at some length in last year’s article, we were able to fix those problems.

Essentially, the fix was a simple one: exit at the close of trading on the 4th day, not the 5th. For some reason, since 1999, there were four years in which a profitable trade turned into an unprofitable one – all because of major losses on that fifth trading day.

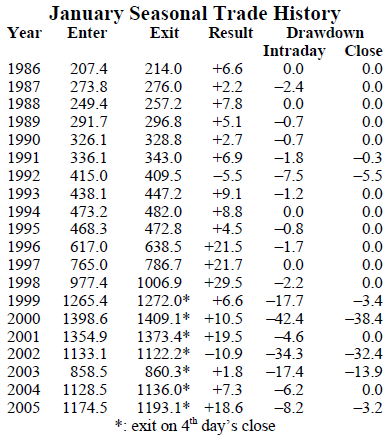

The combined track record is shown below. Through 1998, the system exited on the fifth trading day. Since then, on the fourth trading day.

Overall, the system has registered a profit in 18 of the past 20 years. Although, to be fair, we didn’t switch our exit point to the fourth day until 2004. Hence, there were four other years with losing trades if one stayed all the way to the close of trading on the fifth day. It should also be noted that we normally don’t just trade the system without thought – we use contingent stops and take partial profits.

Last year was an excellent year once again, with the exit on the fourth day being better by about 3.30 $SPX points than exiting on the fifth day. Since the exit on the fourth day has been superior every year since 1999 (except 2000), we have permanently modified the system to exit on the fourth day. We will continue to track both, but at this point, there is no reason to go back to the “old” way.

One of the more remarkable things about the system is that in most years there is very little drawdown. In 13 of the 20 years shown in the table, there was no closing drawdown at all. That is, $SPX never closed lower during the 4- or 5- day period than the entry point. More amazing perhaps, is the fact that in four of the years there wasn’t even an intraday drawdown; that is, $SPX went straight up on the first day and never looked back. That hasn’t been the case in recent years, but the last two have shown very modest drawdowns.

Of course, drawdowns are less emotionally testing for option traders than for futures traders, since with a long option, one knows in advance what his maximum loss can be.

This system isn’t quite as good as the October Seasonal trade, but it’s close. One of the things about the October seasonal is that we know it works best if there is a strong selloff early in October. Then institutions are ready to buy at the end of the month. The same thing doesn’t quite hold true for the January Seasonal, even though the buying is coming from the same place – institutions who feel it is necessary to put money to work before the month ends, lest they embarrass themselves by showing a lot of cash on their balance sheets.

What makes some January Seasonal trades better than others? The answer to that question remains elusive. However, thanks to information provided by subscriber Dino Mirmingos, there is one more piece of information that we’ll track in the future. If one looks at both the Santa Claus rally (last 5 trading days of one year, plus the first two of the next year) and the January Seasonal trade, there has not been a year (dating back to 1978) when both have lost money. Hence, if the Santa Claus rally is a loser, we can feel quite certain that the January Seasonal will be a winner. Some years both win, some years only one wins, but in no cases did both lose.

This article was originally published in The Option Strategist Newsletter Volume 15, No. 2 on January 26, 2006.

© 2023 The Option Strategist | McMillan Analysis Corporation