By Lawrence G. McMillan

The Thanksgiving holiday in the U.S. brings about several positive seasonal patterns that are generally worth playing. A number of years ago, we used to trade these separately, but then it became apparent that one generally “morphs” into the other, and so in today’s world, these three systems are really blended into one. The three systems, in their original format, were:

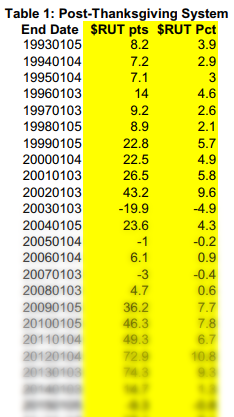

1) the Post-Thanksgiving bullish period: One buys at the close of trading on the Wednesday immediately preceding Thanksgiving and holds into mid-December.

1) the Post-Thanksgiving bullish period: One buys at the close of trading on the Wednesday immediately preceding Thanksgiving and holds into mid-December.

2) the January Effect (whereby small cap stocks outperform big-cap stocks). Thirty years ago, this Effect took place in January, but since it was successful, traders began to try to get a “jump” on the system, moving it forward in time – to the point where the January Effect now takes place in mid-December.

3) the Santa Claus Rally: so named by Yale Hirsch, encompasses the last five trading days of one year and the first two trading days of the next year. This is normally a highly bullish period. However, if it is not, then there can be negative implications for January. Or as Yale put it “If Santa Claus fails to call, Bears may come to Broad and Wall.”

After considerable study and testing, we determined that it is best to buy small-caps (i.e., the Russell 2000 Index – $RUT) on the...

Read the full article, published on 11/17/17, by subscribing to The Option Strategist Newsletter.

© 2023 The Option Strategist | McMillan Analysis Corporation