Ends Jan 8, 2026.

By Lawrence G. McMillan

This article was originally published in The Option Strategist Newsletter Volume 4, No. 12 on June 21, 1995.

When volatility increases, the option prices increase. This simple statement is the main philosophy behind owning options during periods of low volatility, especially if you think there is a fair chance of a price or volatility explosion occurring shortly after you buy your options. A strategist will generally prefer to own both puts and calls so that he can make money if the market moves up or down. Thus, owning a straddle (a put and call with the same striking price) or a combination (a put and a call with different striking prices) are the two simplest strategies that take advantage of increasing volatility. Another is the backspread, which we have been describing in a fair amount of detail all through the spring of this year. We currently have four backspread positions in place. We prefer the backspread to a straddle or a combination because it is easier to adjust the backspread as you go along, if you want to keep the position more or less neutral to market movement.

Another strategy that benefits from increasing volatility is the calendar spread. Many traders don't think of the calendar spread as a volatility-oriented strategy because it makes it best profits if the underlying is relatively unchanged at expiration. That much is true, but it also benefits from increasing volatility. For those not familiar with a calendar spread, it is constructed by buying an option at a certain strike and simultaneously selling the same type of option at the same strike; the option that is sold expires before the option that is bought.

Examples: XYZ is trading at 100. Any of the following would be calendar spreads: Buy XYZ August 100 call & sell XYZ July 100 call Buy XYZ December 90 put & sell XYZ September 90 put Buy XYZ October 110 call & sell XYZ August 110 call

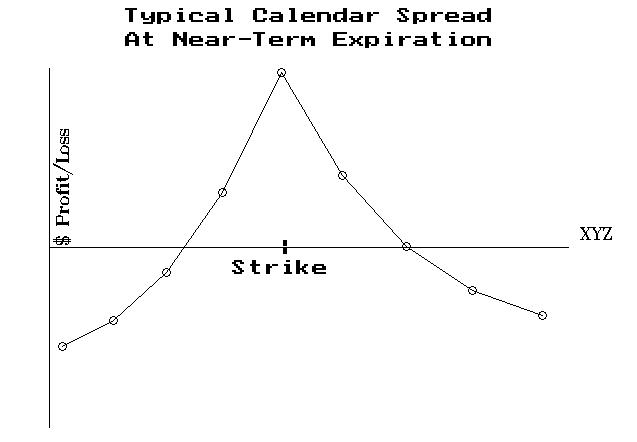

The idea behind the strategy is to be able to capture the faster rate of decay of the short-term option without having a large exposure to the movement of the underlying security. The graph, right, depicts the profit curve for a typical calendar spread at expiration of the near-term option. A strategist will always treat a spread as a single entity and will remove it when one side expires.

Volatility Effect

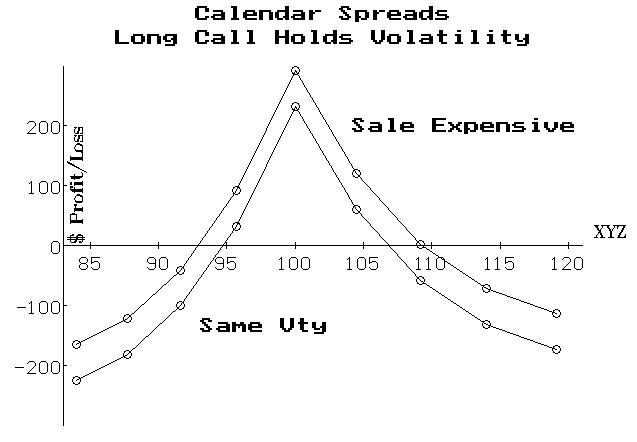

In the classic version of the calendar, there is a profit area that is more or less centered about the striking price of the options in the spread. Moreover, if the underlying stock or index moves too far away from the strike, a loss will result. However, that loss is limited to the initial cost of the spread. If the implied volatility of the options in the spread increases, there will be a larger potential profit at the striking price, and the profit range will be wider. The picture below shows how the profit increases when volatility increases.

Out-of-the-money Calendars

It is relatively rare for (implied) volatility to increase unless the underlying stock moves in one direction or the other. Since the profit of the calendar spread is largest if the underlying ends up exactly at the strike at near-term expiration, some traders prefer to establish their calendar spreads with out-ofthe- money options. Then, if the underlying moves towards the strike, not only will it be near its maximum profit potential, but the movement by the underlying may be accompanied by an increase in implied volatility as well. This tack requires one to be less than neutral, however, since he must predict the direction the stock will move before he can decide what strike to use in the out-of-the-money calendar spread.

Truly Neutral Calendar

A better, more neutral, calendar spread strategy is available that encompasses many of the features that are desirable from both the long straddle strategy and the calendar spread strategy. The main problem with the long straddle (or combo, or backspread) is that if the stock merely hangs around the striking price of the long options, you are going to lose a lot of money to time decay. Even a slight increase in implied volatility won't be able to overcome weeks of time decay. However, this is just where the calendar spread does best. So, what would happen if we combine the two strategies?

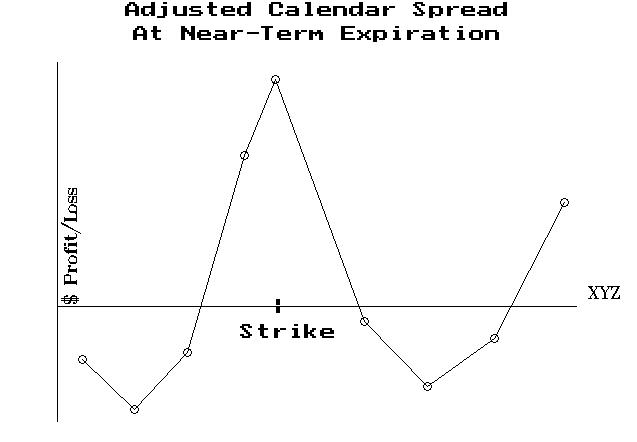

E x a m p l e : Suppose XYZ is trading at 52 and one wants to establish a call calendar spread by buying the Sept 50 call and selling the July 50 call. He can counter the risk of stock movement by buying a few extra Sept 50 calls and also buying some puts. The resultant position might thus be:

Long 13 Sept 50 calls

Short 10 July 50 calls

Long 3 Sept 50 puts

Now the position would still benefit if XYZ were at the striking price of 50 at September expiration (although not by as much as if the extra options had not been purchased). However, in addition the position will make money if XYZ has a volatile move in either direction because of the presence of the extra long calls and puts. The profit graph above shows how this position might look at September expiration: the profit area in the center is smaller than the normal calendar spread, but there is now a profit area on both edges of the graph.

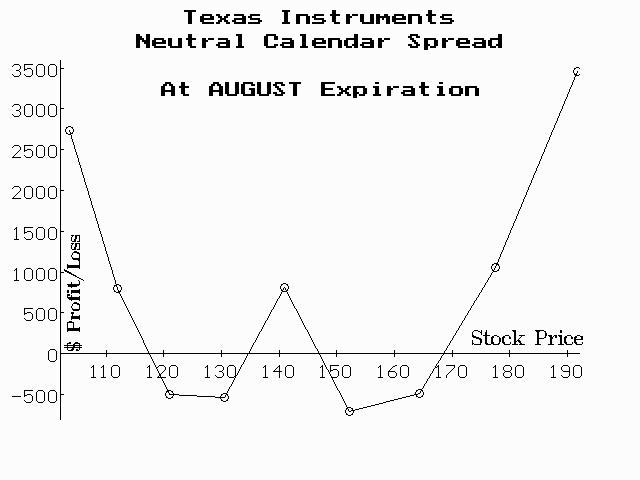

This strategy works well with high-priced stocks that have the potential to become volatile. One that looks promising is Texas Instruments (TXN), since it is a high-priced stock with the potential for large price movement. Moreover, the implied volatility of the options is in the lower one-third of its normal range.

Position E46: Neutral Calendar Spread

Buy 10 TXN Oct 140 calls

and buy 3 TXN Aug 140 puts

and sell 8 TXN Aug 140 calls

Risk Rating: Below Average Risk

TXN: 141 Oct 140 call:13½

Aug 140 put: 7½ Aug 140 call: 9½

Profitability: The basis of this position is the call calendar spread: buying the Oct 140 calls and selling the Aug 140 calls. However, in order to add some profit potential in case of large market movement, we are buying 2 extra long calls, and also buying 3 puts for downside potential. The profit graph, right, shows that the position will still make money if TXN is near 140 at August expiration. In addition, it can make large profits if the stock makes a big move in either calendar spreads. Investment: The spread must be paid for in full. At the prices shown above, the requirement would be about $8400. Follow-Up Action: Since the spread has limited risk, we will not specify a risk-limiting action yet. However, if the stock makes a large move, we will look to take profits or neutralize the position.

Another stock that has similar characteristics is DSC Communications (DIGI/DIQ). You may want to look at neutral calendar spreads in DIGI as well. Any other medium- or highpriced stock whose options have relatively low implied volatility would be a candidate as well.

In summary, the neutral calendar spread allows one to profit if the underlying makes a big move or if it is unchanged at nearterm expiration. This latter quality is an improvement over being long straddles or backspreads. However, straddles and backspreads will generally make more overall profit if the underlying has an exceptionally large move.

This article was originally published in The Option Strategist Newsletter Volume 4, No. 12 on June 21, 1995.

© 2023 The Option Strategist | McMillan Analysis Corporation